POLICY VS. STRATEGY . Investment policy the domain trustees. is principally expression the institution's risk tolerance liquidity requirements. describes an investment manager to about client embarking portfolio management.

An investment policy statement (IPS) a formal document drafted a portfolio manager financial advisor a client outlines general rules the manager.

An investment policy statement (IPS) a formal document drafted a portfolio manager financial advisor a client outlines general rules the manager.

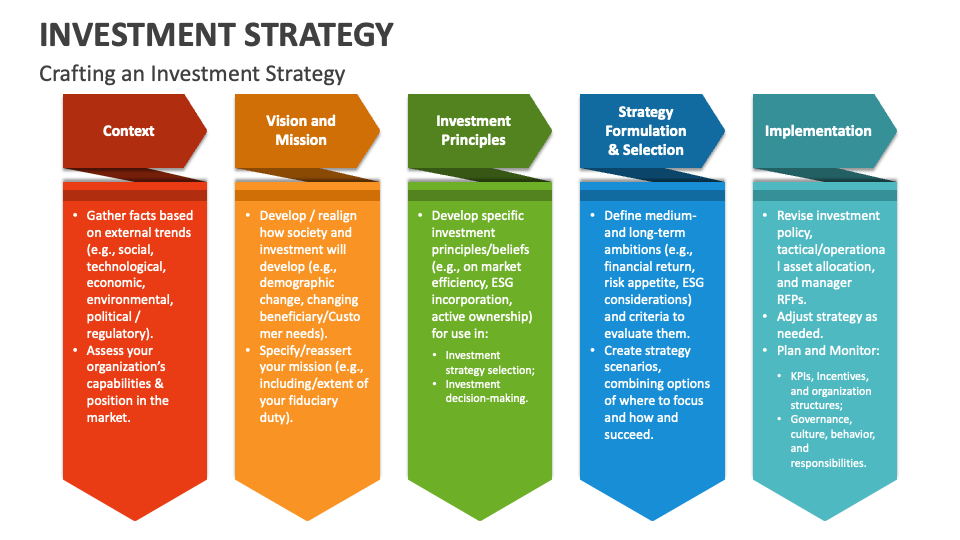

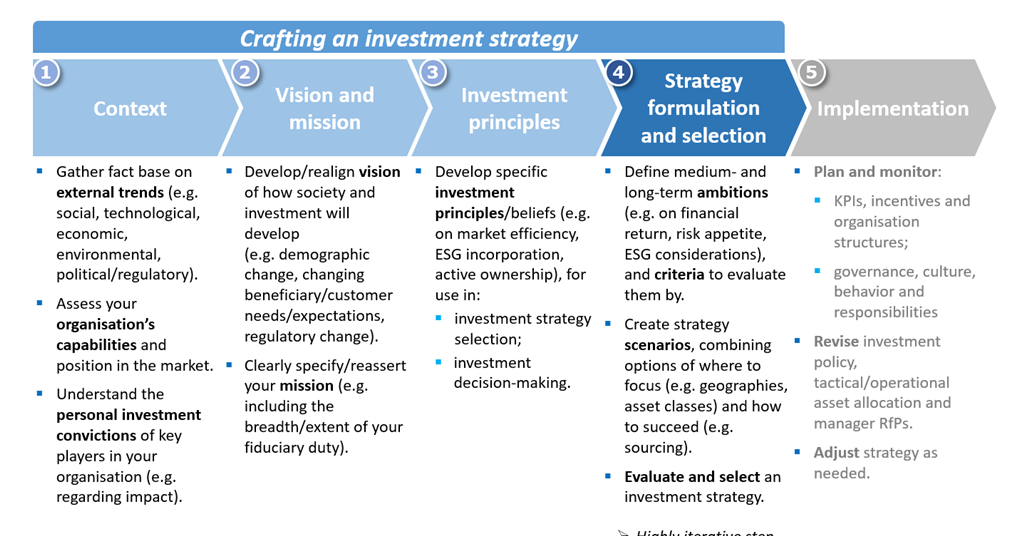

An investment strategy a plan designed help individual investors achieve financial investment goals. investment strategy depends your personal circumstances, including .

An investment strategy a plan designed help individual investors achieve financial investment goals. investment strategy depends your personal circumstances, including .

Investment Strategy: Balanced Growth & Income Approach. Goal: grow wealth the long term generating current income. Risk Tolerance: Moderate (the individual willing accept level volatility risk pursuing higher returns also some level security). Time Horizon: 15-20 years retirement. Asset Allocation:

Investment Strategy: Balanced Growth & Income Approach. Goal: grow wealth the long term generating current income. Risk Tolerance: Moderate (the individual willing accept level volatility risk pursuing higher returns also some level security). Time Horizon: 15-20 years retirement. Asset Allocation:

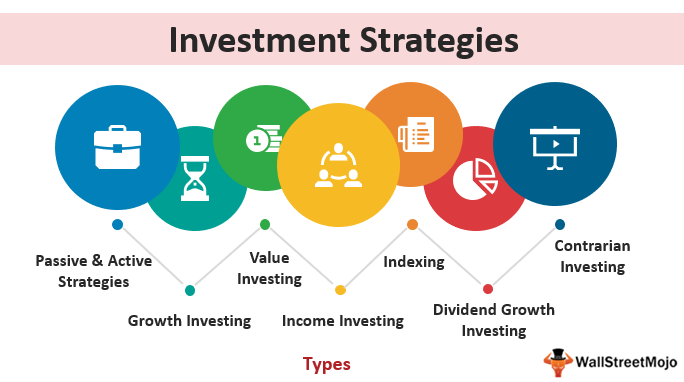

Investment strategies designed implemented individual investors, financial advisors, institutional investors, as mutual funds, pension funds, endowments. Types Investment Strategies Active vs. Passive Investing. Active investing involves actively selecting managing individual securities outperform market.

Investment strategies designed implemented individual investors, financial advisors, institutional investors, as mutual funds, pension funds, endowments. Types Investment Strategies Active vs. Passive Investing. Active investing involves actively selecting managing individual securities outperform market.

Institutional investors failed apprehend difference investment policy investment strategy. trustees, CIOs consultants don't to where leaves and other begins. Trustees concern with institutional investment policy, principal focus which controlling risk .

Institutional investors failed apprehend difference investment policy investment strategy. trustees, CIOs consultants don't to where leaves and other begins. Trustees concern with institutional investment policy, principal focus which controlling risk .

An investment policy acts a framework defines investor's objectives, risk tolerance, investment constraints. Definition Importance Investment Policy. investment policy a document outlines investor's goals, risk appetite, strategies achieving desired returns.

An investment policy acts a framework defines investor's objectives, risk tolerance, investment constraints. Definition Importance Investment Policy. investment policy a document outlines investor's goals, risk appetite, strategies achieving desired returns.

An Investment Policy Statement (IPS) a crucial, client-specific document developed you your portfolio manager. documents financial objectives, constraints, unique circumstances overall governance procedures, of are be applied the investment related activities carried on behalf your portfolio manager.

An Investment Policy Statement (IPS) a crucial, client-specific document developed you your portfolio manager. documents financial objectives, constraints, unique circumstances overall governance procedures, of are be applied the investment related activities carried on behalf your portfolio manager.

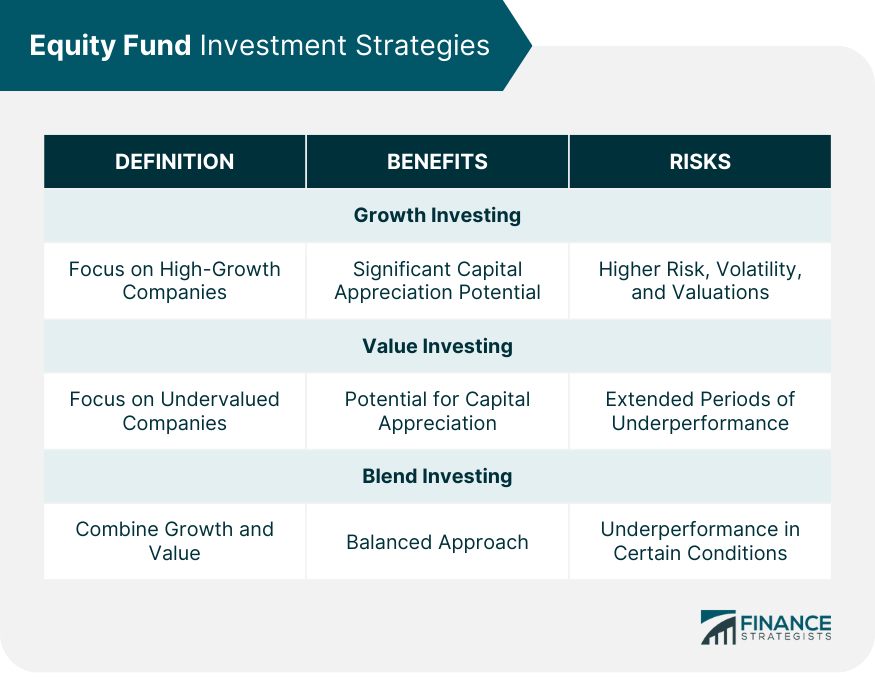

Equity Funds | Definition, Types, Pros, Cons, & Strategies

Equity Funds | Definition, Types, Pros, Cons, & Strategies