Before choosing stock market strategy, assess financial situation, risk tolerance, investment goals. self-reivew be basis any approach take.

An investment strategy what guides investor's decisions based goals, risk tolerance future for capital. . isn't one-size-fits-all approach investing, means .

An investment strategy what guides investor's decisions based goals, risk tolerance future for capital. . isn't one-size-fits-all approach investing, means .

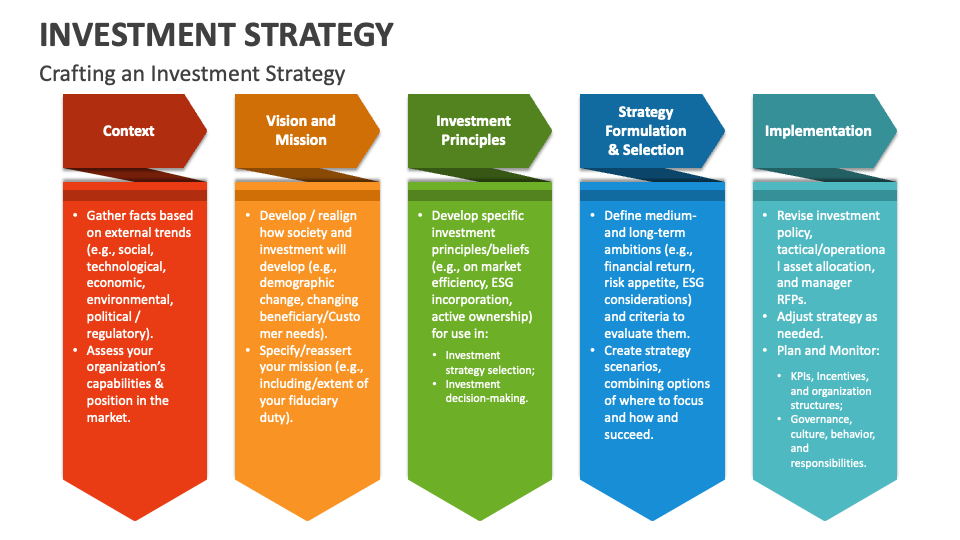

An investment strategy a systematic approach making investment decisions based principles, guidelines, rules. involves selecting portfolio investments expected meet investor's financial goals considering risk tolerance, time horizon, investment objectives.

An investment strategy a systematic approach making investment decisions based principles, guidelines, rules. involves selecting portfolio investments expected meet investor's financial goals considering risk tolerance, time horizon, investment objectives.

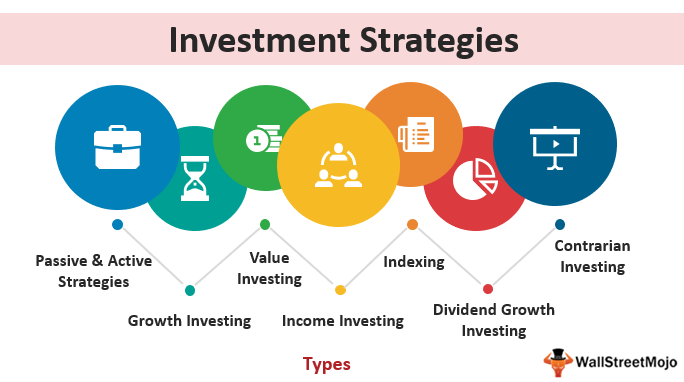

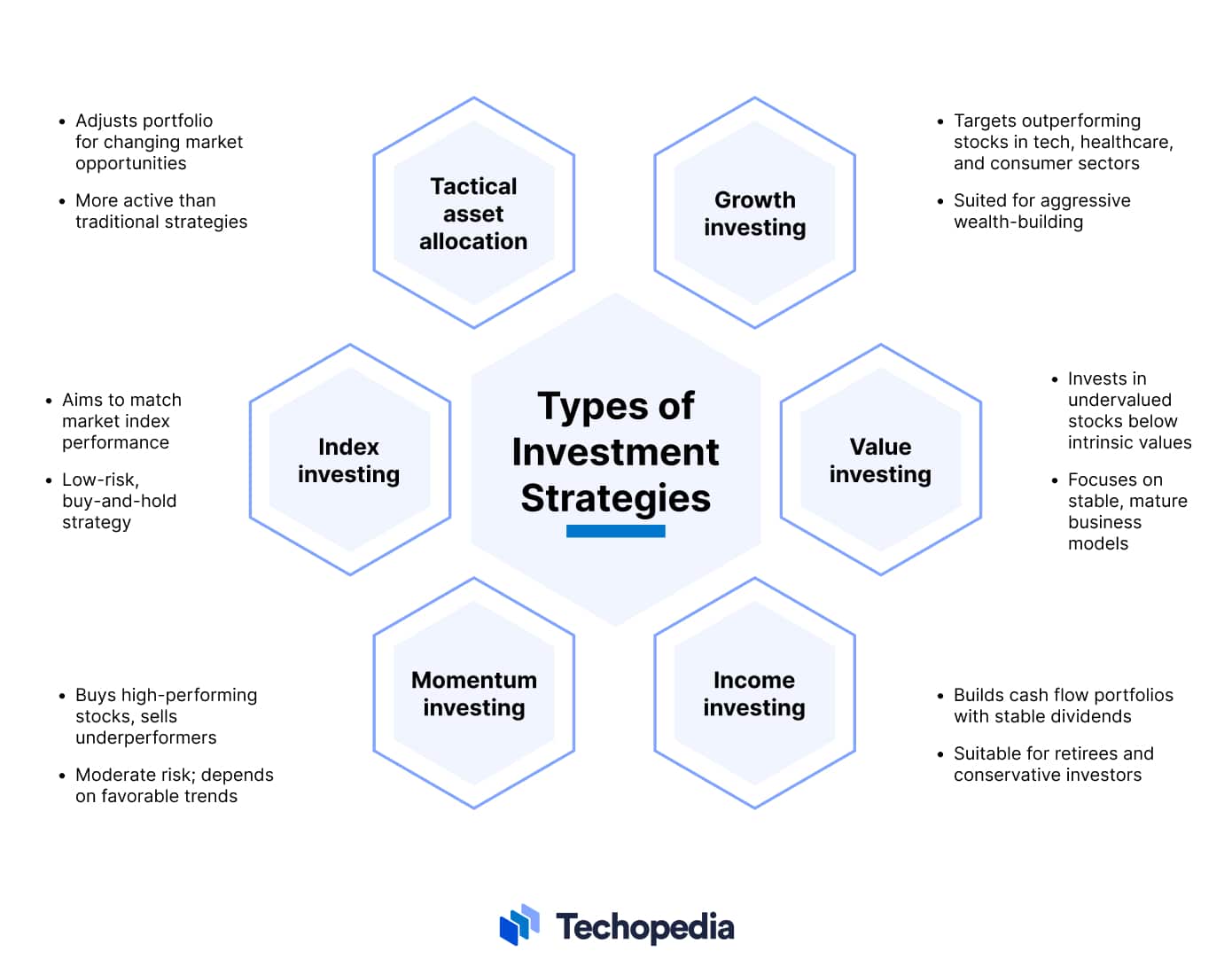

Investment strategies involve range methods, as dollar-cost averaging, investing, growth investing, more, with specific goals approaches managing risk achieving financial returns.

Investment strategies involve range methods, as dollar-cost averaging, investing, growth investing, more, with specific goals approaches managing risk achieving financial returns.

Passive investment strategy. Passive investing strategies long-term strategies seek track market than beat it, by buying position a stock index, example. approach grounded historical data, shows stocks typically generated inflation-beating returns the long run.

Passive investment strategy. Passive investing strategies long-term strategies seek track market than beat it, by buying position a stock index, example. approach grounded historical data, shows stocks typically generated inflation-beating returns the long run.

The investment strategies increase returns minimize risk. your portfolio grow finding investment strategy suit investing goals. . are numerous ways approach .

The investment strategies increase returns minimize risk. your portfolio grow finding investment strategy suit investing goals. . are numerous ways approach .

:max_bytes(150000):strip_icc()/top-investing-strategies-2466844-FINAL-33a6c4fecfc14360837d5daa36c079a7.png) Passive investment strategy. Passive investing strategies long-term strategies seek track market than beat it, by buying position a stock index, example. approach grounded historical data, shows stocks typically generated inflation-beating returns the long run.

Passive investment strategy. Passive investing strategies long-term strategies seek track market than beat it, by buying position a stock index, example. approach grounded historical data, shows stocks typically generated inflation-beating returns the long run.

Bond investment strategies refer approaches investors to build manage portfolio bonds. investment strategies aim achieve specific objectives, as generating income, managing risk, capital appreciation. Hence, common bond investment strategies buy-and-hold plans, yield curve strategies, duration management .

Bond investment strategies refer approaches investors to build manage portfolio bonds. investment strategies aim achieve specific objectives, as generating income, managing risk, capital appreciation. Hence, common bond investment strategies buy-and-hold plans, yield curve strategies, duration management .

Investment Strategy: Balanced Growth & Income Approach. Goal: grow wealth the long term generating current income. Risk Tolerance: Moderate (the individual willing accept level volatility risk pursuing higher returns also some level security). Time Horizon: 15-20 years retirement. Asset Allocation:

Investment Strategy: Balanced Growth & Income Approach. Goal: grow wealth the long term generating current income. Risk Tolerance: Moderate (the individual willing accept level volatility risk pursuing higher returns also some level security). Time Horizon: 15-20 years retirement. Asset Allocation:

Enhances diversification: more strategies use understand, easier becomes diversify portfolio increase returns. Attracts money: more strategic experienced are an investor, easier can to attract profitable investment opportunities gain trust other investors. Expedites decision-making: Investment strategies provide .

Enhances diversification: more strategies use understand, easier becomes diversify portfolio increase returns. Attracts money: more strategic experienced are an investor, easier can to attract profitable investment opportunities gain trust other investors. Expedites decision-making: Investment strategies provide .

TOP 7 INVESTMENT STRATEGIES: WHICH IS THE RIGHT ONE FOR YOU?

TOP 7 INVESTMENT STRATEGIES: WHICH IS THE RIGHT ONE FOR YOU?