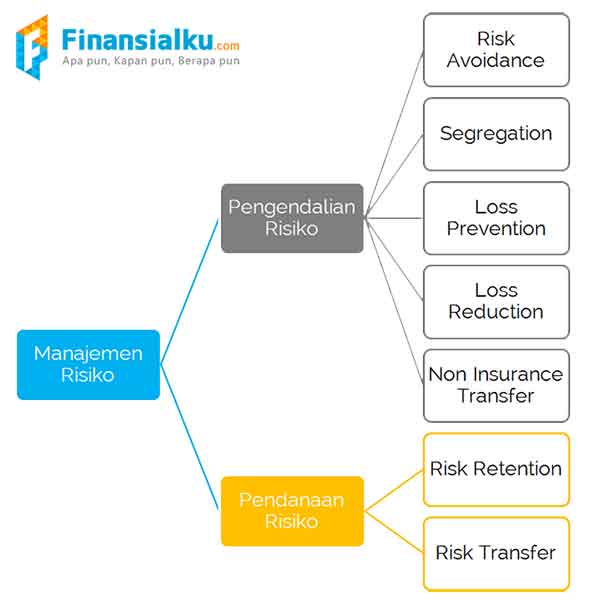

Sederhananya, risiko finansial adalah kemungkinan uang hilang potensi terjadi kerugian bersifat moneter (dapat diukur uang). Risiko keuangan bisa menimpa siapa saja, misalnya individu, berkelompok perusahaan juga pemerintah. risiko keuangan, yang bersifat jangka pendek maupun jangka panjang.

Reading Time: 5 minutes Risiko finansial adalah hal tidak terhindarkan kehidupan sehari-hari, bukan berarti tidak bisa diminimalisasi. Artikel akan membantu kamu memahami pengertian risiko finansial, jenis-jenisnya, contoh risiko finansial, hingga manajemen tepat mengelola risiko finansial.

Reading Time: 5 minutes Risiko finansial adalah hal tidak terhindarkan kehidupan sehari-hari, bukan berarti tidak bisa diminimalisasi. Artikel akan membantu kamu memahami pengertian risiko finansial, jenis-jenisnya, contoh risiko finansial, hingga manajemen tepat mengelola risiko finansial.

Risiko finansial adalah hal mungkin terjadi terutama ada aktivitas keuangan. Adapun teknik pengukuran risiko finansial antaranya menggunakan at Risk (VaR), stress testing, credit rating, credit metrics, pengukuran jangka waktu, lain sebagainya.

Risiko finansial adalah hal mungkin terjadi terutama ada aktivitas keuangan. Adapun teknik pengukuran risiko finansial antaranya menggunakan at Risk (VaR), stress testing, credit rating, credit metrics, pengukuran jangka waktu, lain sebagainya.

Financial risk management a continuing process risks change time. are risks all investments. Successful financial risk management requires balance potential risks .

Financial risk management a continuing process risks change time. are risks all investments. Successful financial risk management requires balance potential risks .

Let have look the examples understand concept better. #1. hedge fund manager manages portfolio stocks, bonds, other financial instruments a group investors. fund exposure the market, credit, liquidity risks. Therefore, manager ensure fund's risk profile aligns the investors' risk tolerance objectives.

Let have look the examples understand concept better. #1. hedge fund manager manages portfolio stocks, bonds, other financial instruments a group investors. fund exposure the market, credit, liquidity risks. Therefore, manager ensure fund's risk profile aligns the investors' risk tolerance objectives.

What a real of financial risk management? real of financial risk management an airline fuel hedging minimize uncertainty surrounding future fuel costs. locking fuel prices a predetermined rate a contract its supplier, airline stabilize fuel costs — significant part .

What a real of financial risk management? real of financial risk management an airline fuel hedging minimize uncertainty surrounding future fuel costs. locking fuel prices a predetermined rate a contract its supplier, airline stabilize fuel costs — significant part .

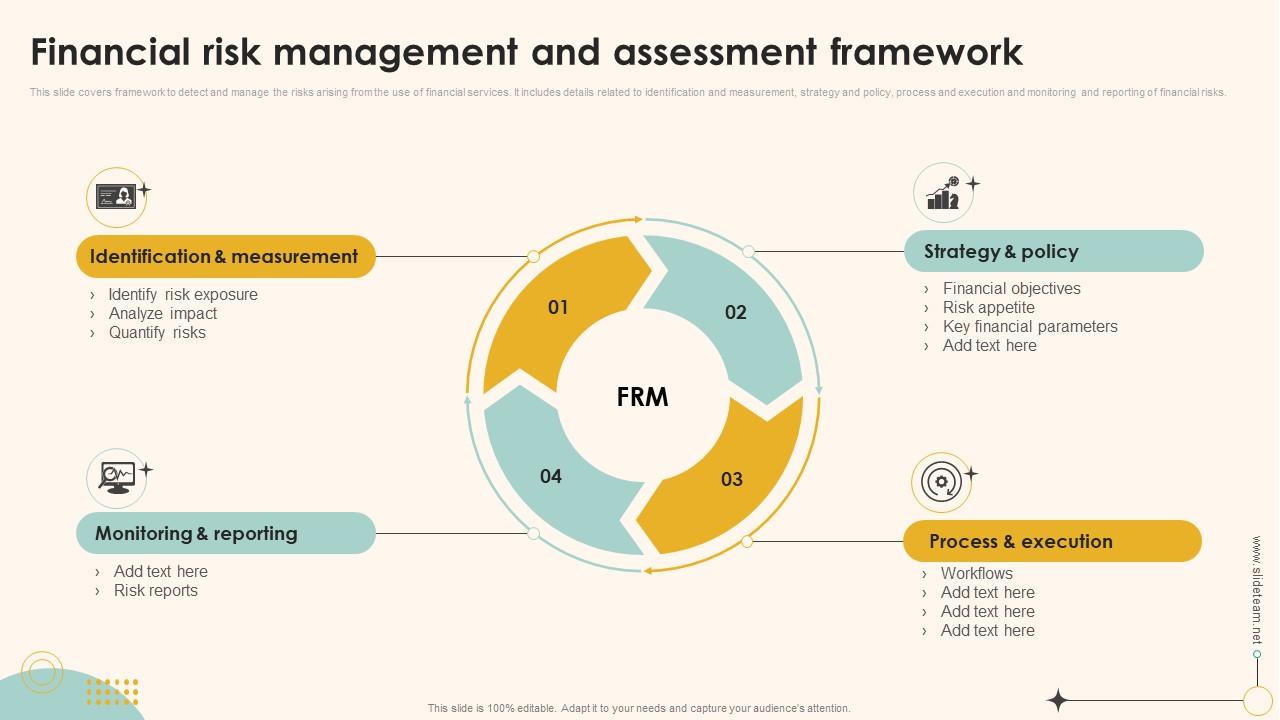

Financial risk management a crucial aspect any business investment venture. involves identifying, analyzing, mitigating potential risks could negatively impact financial performance. Financial risk arise a variety sources, including market volatility, credit risk, operational risk, liquidity risk. Effective financial risk management help businesses .

Financial risk management a crucial aspect any business investment venture. involves identifying, analyzing, mitigating potential risks could negatively impact financial performance. Financial risk arise a variety sources, including market volatility, credit risk, operational risk, liquidity risk. Effective financial risk management help businesses .

Through financial risk management, companies aim protect assets, maintain profitability, ensure compliance financial regulations. Financial risk management involves sophisticated data analysis, strategic decision-making, often relies advanced software solutions track mitigate risks effectively.

Through financial risk management, companies aim protect assets, maintain profitability, ensure compliance financial regulations. Financial risk management involves sophisticated data analysis, strategic decision-making, often relies advanced software solutions track mitigate risks effectively.

:max_bytes(150000):strip_icc()/risk-management-4189908-FINAL-2-976ae194e01848618ca94941ab9d2395.jpg) Types Financial Risk Management. Market Risk: Managing exposure changes market prices assets liabilities. Credit Risk: Mitigating potential losses borrower counterparty defaulting financial obligations. Liquidity Risk: Ensuring availability funds meet financial obligations incurring unacceptable losses. Operational Risk: Addressing risks internal .

Types Financial Risk Management. Market Risk: Managing exposure changes market prices assets liabilities. Credit Risk: Mitigating potential losses borrower counterparty defaulting financial obligations. Liquidity Risk: Ensuring availability funds meet financial obligations incurring unacceptable losses. Operational Risk: Addressing risks internal .

Financial risk management a discipline focuses identifying, assessing, controlling threats an organization's capital earnings. threats, risks, stem a variety sources, including financial uncertainty, strategic management decisions, legal liabilities, accidents, natural disasters. .

Financial risk management a discipline focuses identifying, assessing, controlling threats an organization's capital earnings. threats, risks, stem a variety sources, including financial uncertainty, strategic management decisions, legal liabilities, accidents, natural disasters. .

Financial Risk Management And Assessment Framework Ppt Infographic

Financial Risk Management And Assessment Framework Ppt Infographic