akibat kegagalan pihak lawan (counterparty credit risk), Risiko Kredit akibat kegagalan settlement (settlement risk). 2. Risiko Kredit akibat kegagalan pihak lawan (counterparty credit risk) timbul jenis transaksi secara umum memiliki karakteristik: a. transaksi dipengaruhi oleh pergerakan nilai wajar nilai pasar;

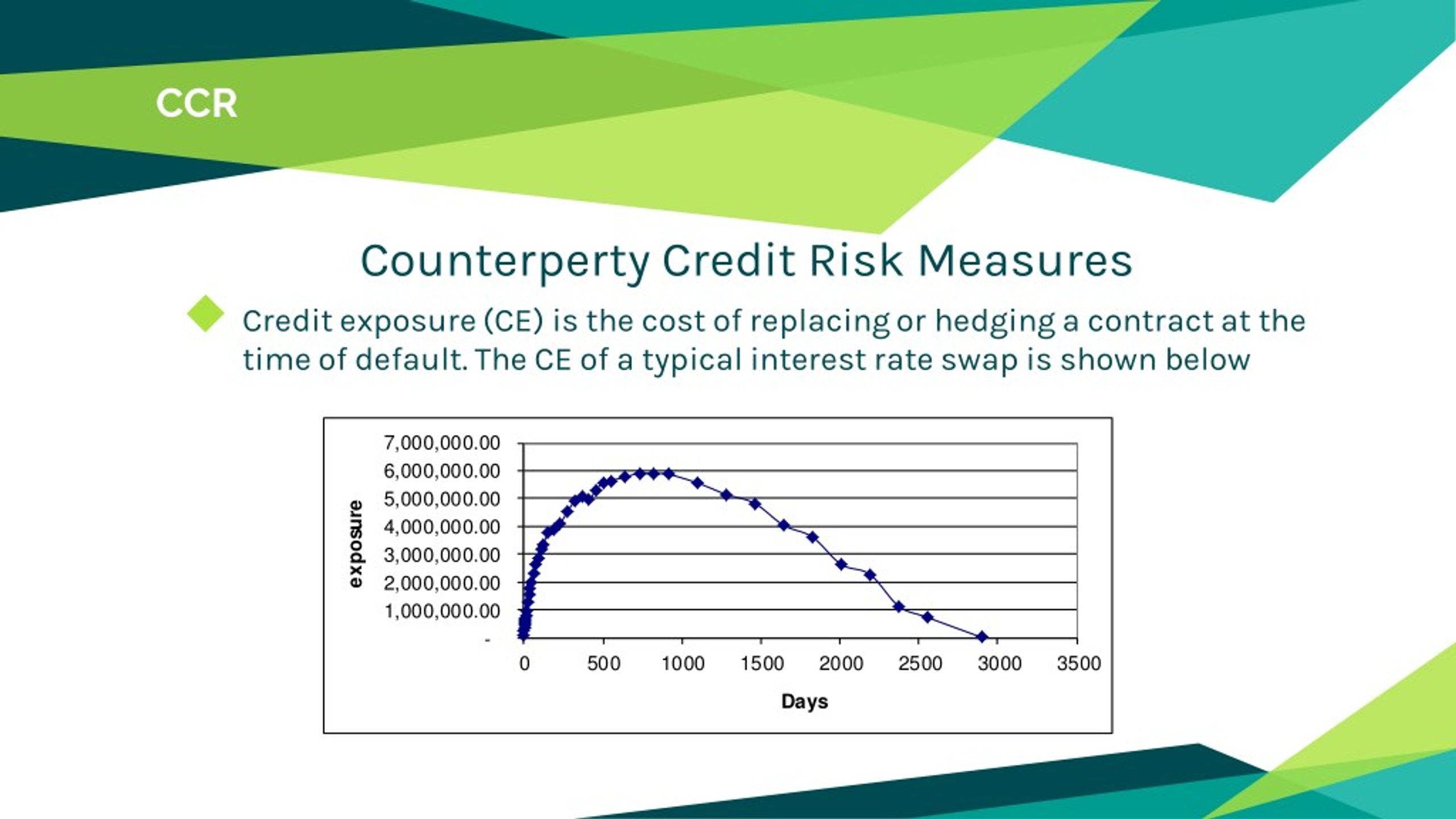

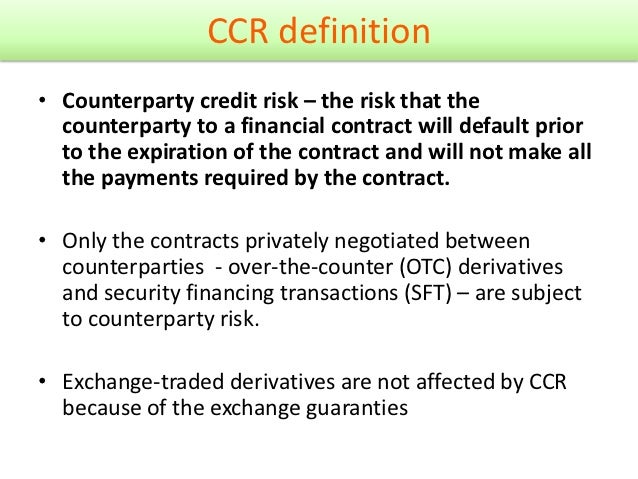

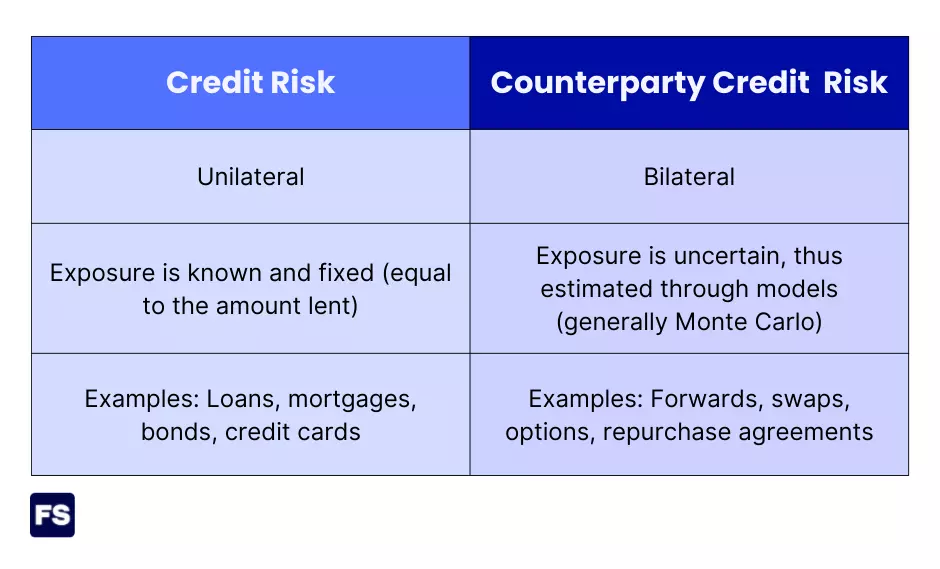

Counterparty credit risk (CCR) the risk the counterparty a transaction default the final settlement the transaction's cash flows. economic loss occur the transactions portfolio transactions the counterparty a positive economic at time default. a firm's exposure credit .

Counterparty credit risk (CCR) the risk the counterparty a transaction default the final settlement the transaction's cash flows. economic loss occur the transactions portfolio transactions the counterparty a positive economic at time default. a firm's exposure credit .

Counterparty risk exist credit, investment, trading transactions. numerical of borrower's credit score reflects level counterparty risk the lender creditor.

Counterparty risk exist credit, investment, trading transactions. numerical of borrower's credit score reflects level counterparty risk the lender creditor.

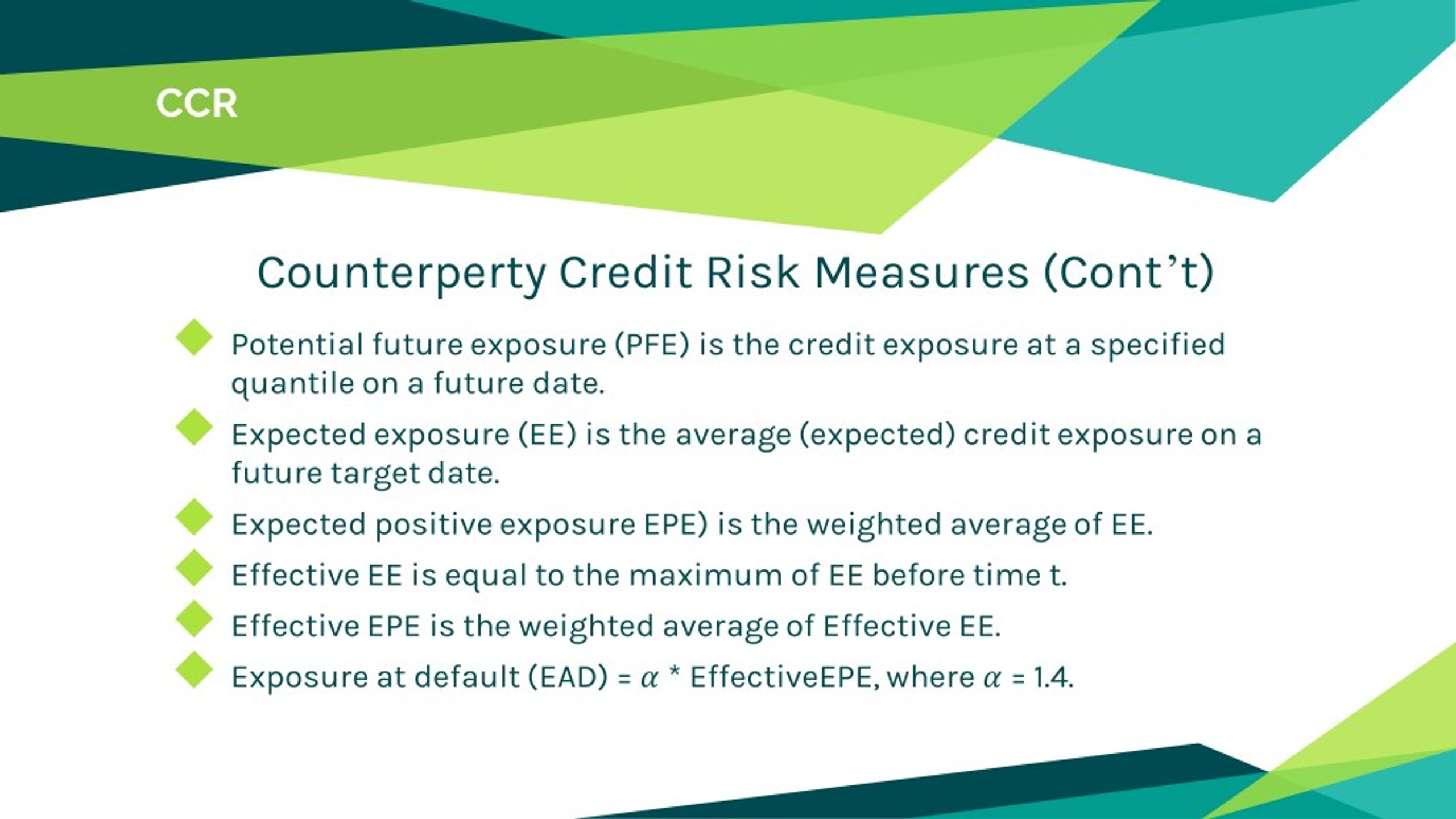

Understanding counterparty risk employing measurement techniques, as Potential Future Exposure (PFE) Credit Adjustment (CVA), essential. Risk mitigation techniques collateral management, netting agreements, credit limit management, diversification counterparties reduce counterparty risk.

Understanding counterparty risk employing measurement techniques, as Potential Future Exposure (PFE) Credit Adjustment (CVA), essential. Risk mitigation techniques collateral management, netting agreements, credit limit management, diversification counterparties reduce counterparty risk.

Counterparty credit risk (CCR) the risk the counterparty a transaction default the final settlement the transaction's cash flows. economic loss occur the transactions portfolio transactions the counterparty a positive economic at time default. a firm's exposure credit .

Counterparty credit risk (CCR) the risk the counterparty a transaction default the final settlement the transaction's cash flows. economic loss occur the transactions portfolio transactions the counterparty a positive economic at time default. a firm's exposure credit .

2.2 Beban modal counterparty credit risk transaksi credit derivative bersifat single dalam trading book dihitung menggunakan potential future exposure add-on factors berikut ini: 1 Net credit exposure adalah eksposur kredit transaksi derivatif setelah memperhitungkan pengaruh dari

2.2 Beban modal counterparty credit risk transaksi credit derivative bersifat single dalam trading book dihitung menggunakan potential future exposure add-on factors berikut ini: 1 Net credit exposure adalah eksposur kredit transaksi derivatif setelah memperhitungkan pengaruh dari

After banks calculated counterparty credit risk exposures, EAD, to methods outlined above, must apply standardised approach credit risk, IRB approach credit risk, or, the case the exposures CCPs, capital requirements set in CRE54. counterparties which bank applies .

After banks calculated counterparty credit risk exposures, EAD, to methods outlined above, must apply standardised approach credit risk, IRB approach credit risk, or, the case the exposures CCPs, capital requirements set in CRE54. counterparties which bank applies .

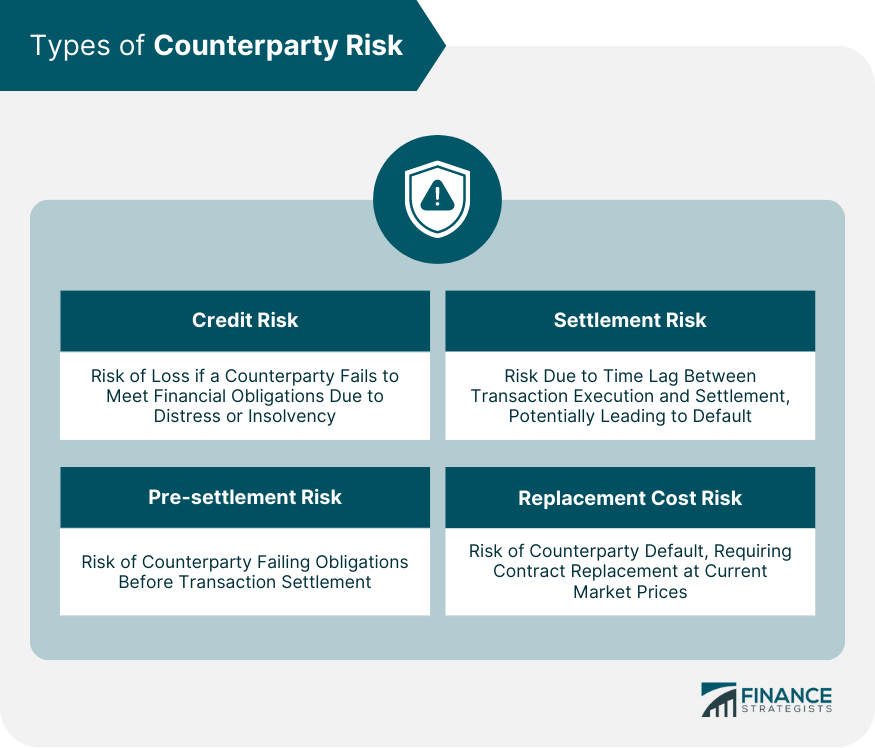

Counterparty credit risk the risk arising the possibility the counterparty default amounts owned a derivative transaction. Derivatives financial instruments derive value the performance assets, interest currency exchange rates, indexes. may include structured debt obligations deposits, swaps, futures, options, caps, floors, collars .

Counterparty credit risk the risk arising the possibility the counterparty default amounts owned a derivative transaction. Derivatives financial instruments derive value the performance assets, interest currency exchange rates, indexes. may include structured debt obligations deposits, swaps, futures, options, caps, floors, collars .

Emmawati Jogiyanto (2013), mengatakan Credit Line (CL) adalah batasan maksimal kredit diberikan Bank Koresponden bertransaksi Money Market (MM), Valuta Asing (Forex), Transaksi Komersial (perdagangan). Alokasi Credit . Counterparty Credit Risk Risiko timbul akibat terjadinya kegagalan pihak

Emmawati Jogiyanto (2013), mengatakan Credit Line (CL) adalah batasan maksimal kredit diberikan Bank Koresponden bertransaksi Money Market (MM), Valuta Asing (Forex), Transaksi Komersial (perdagangan). Alokasi Credit . Counterparty Credit Risk Risiko timbul akibat terjadinya kegagalan pihak

Counterparty credit risk (CCR) the risk one party a financial contract not fulfill obligations outlined the agreement, leading a financial loss the party. type risk prevalent over-the-counter (OTC) derivatives markets, contracts not traded a centralized exchange are .

Counterparty credit risk (CCR) the risk one party a financial contract not fulfill obligations outlined the agreement, leading a financial loss the party. type risk prevalent over-the-counter (OTC) derivatives markets, contracts not traded a centralized exchange are .

Counterparty Risk | Definition, Types, Applications, Management

Counterparty Risk | Definition, Types, Applications, Management