with Alternative Investments. 1. Executive Summary • white paper a summary existing methods current research performance analysis attribution complex portfolios include investments as hedge funds private investment funds. summarize main challenges analyzing

Access white paper understand advisors' allocations alternative investments explore barriers their remain. View White Paper. . equip advisor-clients quell worries investors ensure adhere their still-relevant long-term investment goals. View White Paper. White Paper. June 2020.

Access white paper understand advisors' allocations alternative investments explore barriers their remain. View White Paper. . equip advisor-clients quell worries investors ensure adhere their still-relevant long-term investment goals. View White Paper. White Paper. June 2020.

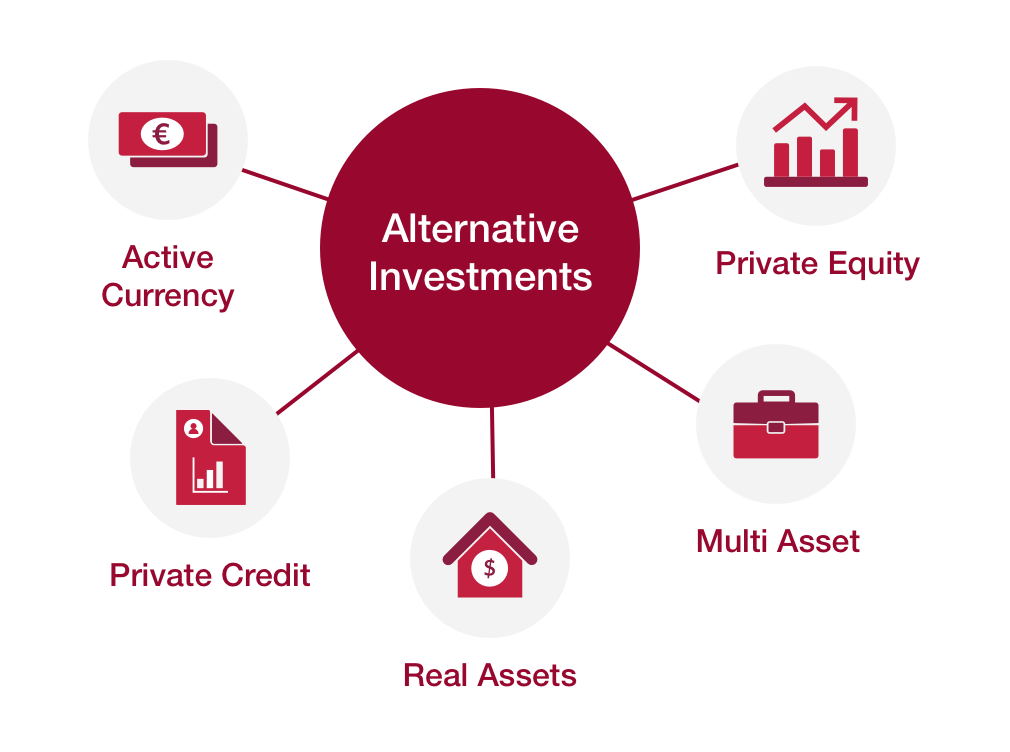

Articles white papers alternative investments. our definition alternative asset classes, include research hedge funds, private equity, infrastructure commercial real estate (CRE). Property of a traditional investment, we classify CRE an alternative asset class, as is alternative the primary .

Articles white papers alternative investments. our definition alternative asset classes, include research hedge funds, private equity, infrastructure commercial real estate (CRE). Property of a traditional investment, we classify CRE an alternative asset class, as is alternative the primary .

alternative investments, compared 18% the average pension plan, 28% the average endowment3). secular shifts include: decline the number companies public: number publicly traded companies the has declined close 40% 2000 a over 4,200

alternative investments, compared 18% the average pension plan, 28% the average endowment3). secular shifts include: decline the number companies public: number publicly traded companies the has declined close 40% 2000 a over 4,200

Risks Alternative Investments are risks with alternative investments and the typical risks with traditional investments. • Higher fees. Alternative investments have higher fees. example, fees include annual management fee (1-2%) an additional incentive fee (10-20%).

Risks Alternative Investments are risks with alternative investments and the typical risks with traditional investments. • Higher fees. Alternative investments have higher fees. example, fees include annual management fee (1-2%) an additional incentive fee (10-20%).

there a growing renaissance alternative investment options platforms the RIA community. Accordingly, white paper provide key information advisors to get started alternative investing well transition existing alternative investments. Additionally, report feature of best-in-breed .

there a growing renaissance alternative investment options platforms the RIA community. Accordingly, white paper provide key information advisors to get started alternative investing well transition existing alternative investments. Additionally, report feature of best-in-breed .

When alternative investments added a traditional . stock bond portfolio, curved line moved and the left. curved dashed line shows expected risk decreases expected returns increase. Alternative Investments: Incorporating Turnkey Solution . White Paper. July 2017

When alternative investments added a traditional . stock bond portfolio, curved line moved and the left. curved dashed line shows expected risk decreases expected returns increase. Alternative Investments: Incorporating Turnkey Solution . White Paper. July 2017

White Paper Alternative Investments 2022: Capitalizing Markets Turmoil. July 19, 2022. Advisors remain calm equity fixed-income market drawdowns, a range alternative investments hits stride. 2022 brings elements financial markets advisors haven't in years, not decades. However, all .

White Paper Alternative Investments 2022: Capitalizing Markets Turmoil. July 19, 2022. Advisors remain calm equity fixed-income market drawdowns, a range alternative investments hits stride. 2022 brings elements financial markets advisors haven't in years, not decades. However, all .

White Paper 2 movement alternatives likely accelerated the several years, institutions seeking returns 6% - 7% help liability targets adapt lower forecast . Broadly speaking, alternative investments include asset the traditional three: Publicly traded stocks, bonds, cash .

White Paper 2 movement alternatives likely accelerated the several years, institutions seeking returns 6% - 7% help liability targets adapt lower forecast . Broadly speaking, alternative investments include asset the traditional three: Publicly traded stocks, bonds, cash .

Using Alternative Investments construct diversified, robust self-funding investment portfolio this whitepaper cover: 1. an allocation private equity other alternative investments be to target higher potential returns lower volatility a traditional 60:40 equity/bond portfolio. 2.

Using Alternative Investments construct diversified, robust self-funding investment portfolio this whitepaper cover: 1. an allocation private equity other alternative investments be to target higher potential returns lower volatility a traditional 60:40 equity/bond portfolio. 2.

The Importance of Valuations for Alternative Investments - Pathstone

The Importance of Valuations for Alternative Investments - Pathstone