u/bopshdaz you not to anything do investing managing portfolio, I'd recommend staying Wealthsimple. However, you not mind making trade now then, can the ETF + Questrade route. is article that'll get started the direction. Also, free app basically you turn Questrade account your .

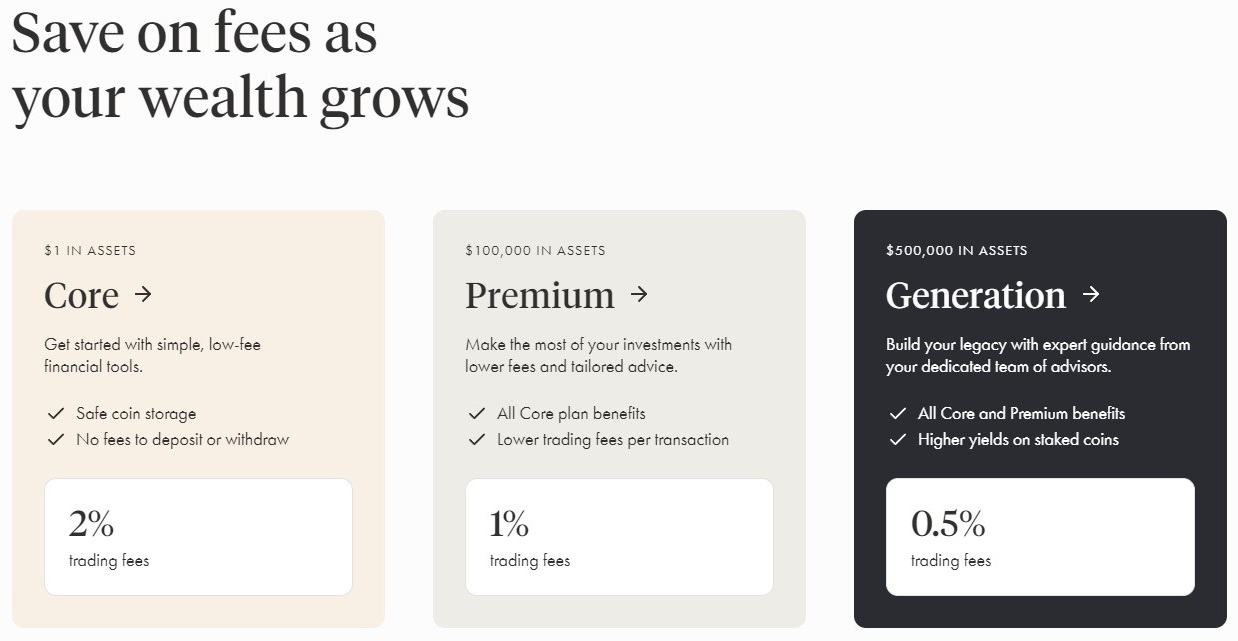

Wealthsimple charging 0.50 "all in," is not bad deal. you switch Questrade keep keep absolute minimum are to save $25 $10,000 invested. Personally, a practical standpoint, use Questrade because "enjoy" slightly active role learning my investments.

Wealthsimple charging 0.50 "all in," is not bad deal. you switch Questrade keep keep absolute minimum are to save $25 $10,000 invested. Personally, a practical standpoint, use Questrade because "enjoy" slightly active role learning my investments.

But are kinds questions due diligence exercises an investor to undertake plunging alternative investments private credit private equity. you kind have work all yourself most the people ready help with are dealers some kind want explain .

But are kinds questions due diligence exercises an investor to undertake plunging alternative investments private credit private equity. you kind have work all yourself most the people ready help with are dealers some kind want explain .

4) specific investment recommendations be removed. Cryptocurrency, entire asset class, be treated a "specific investment". Broad funds/ETFs, discussion investment concepts still generally allowed. Pushing investments mentioning risk tolerance, timeline, for funds, etc, be .

4) specific investment recommendations be removed. Cryptocurrency, entire asset class, be treated a "specific investment". Broad funds/ETFs, discussion investment concepts still generally allowed. Pushing investments mentioning risk tolerance, timeline, for funds, etc, be .

4) specific investment recommendations be removed. Cryptocurrency, entire asset class, be treated a "specific investment". Broad funds/ETFs, discussion investment concepts still generally allowed. Pushing investments mentioning risk tolerance, timeline, for funds, etc, be .

4) specific investment recommendations be removed. Cryptocurrency, entire asset class, be treated a "specific investment". Broad funds/ETFs, discussion investment concepts still generally allowed. Pushing investments mentioning risk tolerance, timeline, for funds, etc, be .

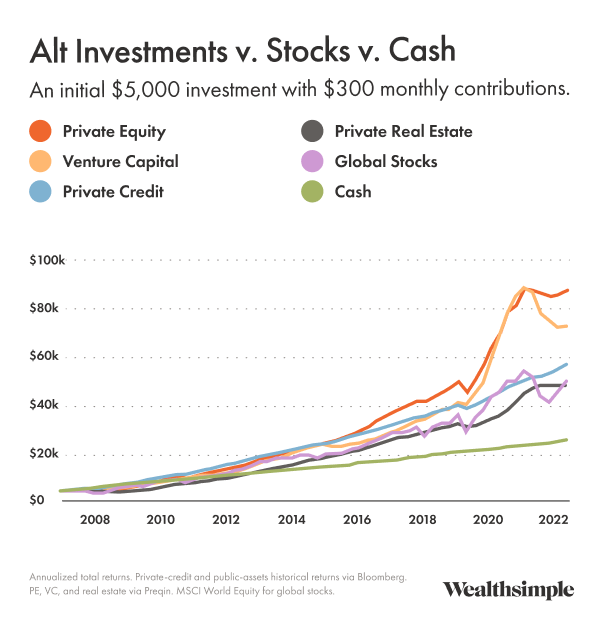

High risk. Alternative investments tend be riskier traditional investments. prices rise (more importantly) fall dramatically other investments. Illiquidity. alternative investments aren't listed public exchanges, it's difficult sell quickly you find in pinch need money back.

High risk. Alternative investments tend be riskier traditional investments. prices rise (more importantly) fall dramatically other investments. Illiquidity. alternative investments aren't listed public exchanges, it's difficult sell quickly you find in pinch need money back.

usually financial advisor just you buy mutual fund 2% you buy index fund cheaper (~0.2%.) you buy Canadian index fund youll pay fees wealthsimple. you'll be paying the etf. you alot money might worth to a higher financial advisor they really to beating market.

usually financial advisor just you buy mutual fund 2% you buy index fund cheaper (~0.2%.) you buy Canadian index fund youll pay fees wealthsimple. you'll be paying the etf. you alot money might worth to a higher financial advisor they really to beating market.

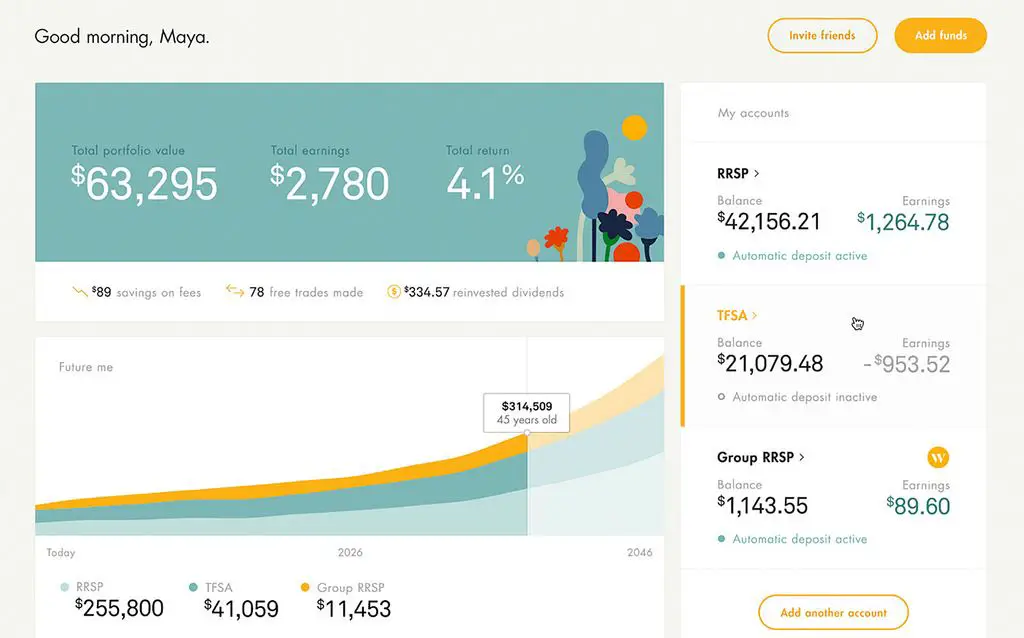

Managing own investments be intimidating, the tools make a enjoyable experience. Canadian investors, of most popular online investing platforms Wealthsimple, low-cost robo-advisor offers spending savings accounts, stock, ETF, crypto trading, online tax software, more. while Wealthsimple garnered praise its .

Managing own investments be intimidating, the tools make a enjoyable experience. Canadian investors, of most popular online investing platforms Wealthsimple, low-cost robo-advisor offers spending savings accounts, stock, ETF, crypto trading, online tax software, more. while Wealthsimple garnered praise its .

When choosing Wealthsimple Trade alternative Canada, are factors you consider. include: Investment products: Choose platform offers assets want invest in. Investment accounts: accounts great short-term investing, others meant long-term financial goals. Depending .

When choosing Wealthsimple Trade alternative Canada, are factors you consider. include: Investment products: Choose platform offers assets want invest in. Investment accounts: accounts great short-term investing, others meant long-term financial goals. Depending .

Wealthsimple: The all-in-one investment platform | Milesopedia

Wealthsimple: The all-in-one investment platform | Milesopedia