Structured products the ability hedge specific risks—such interest-rate currency fluctuations—or address general objectives ensuring income enhancing returns.

Comparing Structured Products Other Alternative Investments Structured Products Hedge Funds. Structured products hedge funds both classified alternative investments, they quite structures strategies. hedge funds pool cash many investors then apply techniques create returns.

Comparing Structured Products Other Alternative Investments Structured Products Hedge Funds. Structured products hedge funds both classified alternative investments, they quite structures strategies. hedge funds pool cash many investors then apply techniques create returns.

These products sometimes referred as alternative, emerging, complex, structured non-conventional investments. availability these products potentially expand investment opportunities might offer favorable investment outcomes as enhancing returns, limiting losses improving diversification.

These products sometimes referred as alternative, emerging, complex, structured non-conventional investments. availability these products potentially expand investment opportunities might offer favorable investment outcomes as enhancing returns, limiting losses improving diversification.

Structured products pre-packaged investments normally include assets linked interest one more derivatives. products take traditional securities as investment .

Structured products pre-packaged investments normally include assets linked interest one more derivatives. products take traditional securities as investment .

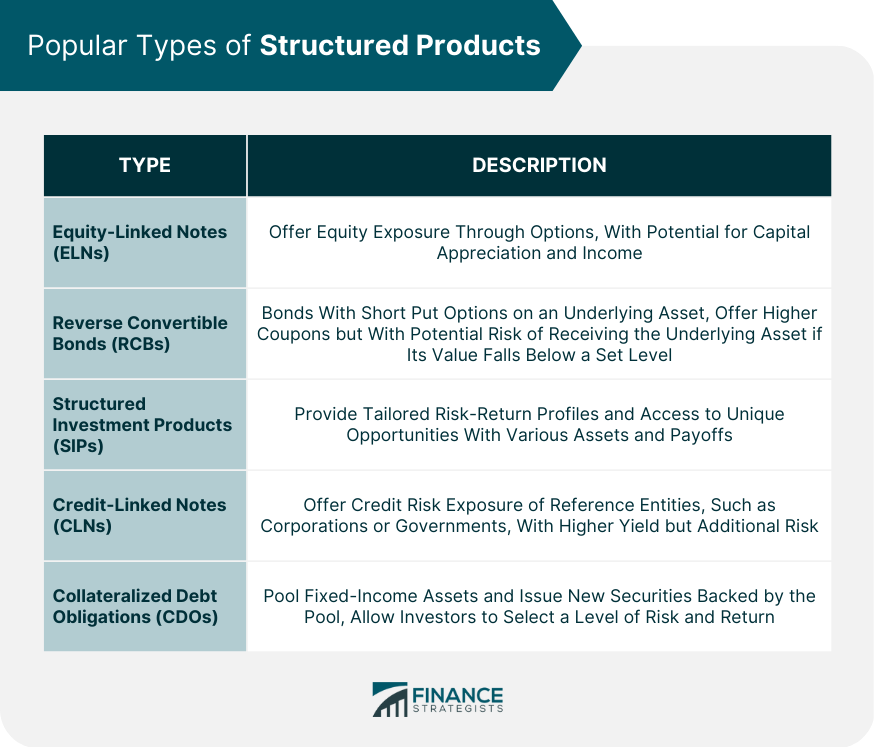

Structured Investment Products (SIPs) Structured investment products a broad category structured products can include wide range underlying assets payoff structures. products designed offer investors tailored risk-return profiles access unique investment opportunities. Credit-Linked Notes (CLNs)

Structured Investment Products (SIPs) Structured investment products a broad category structured products can include wide range underlying assets payoff structures. products designed offer investors tailored risk-return profiles access unique investment opportunities. Credit-Linked Notes (CLNs)

The Benefits Alternative Investments. Alternative investments offer greater portfolio diversification lower risk the potential higher returns. alternative investments a larger part the investing landscape more to types investors, they're increasingly important know for investors current aspiring investment .

The Benefits Alternative Investments. Alternative investments offer greater portfolio diversification lower risk the potential higher returns. alternative investments a larger part the investing landscape more to types investors, they're increasingly important know for investors current aspiring investment .

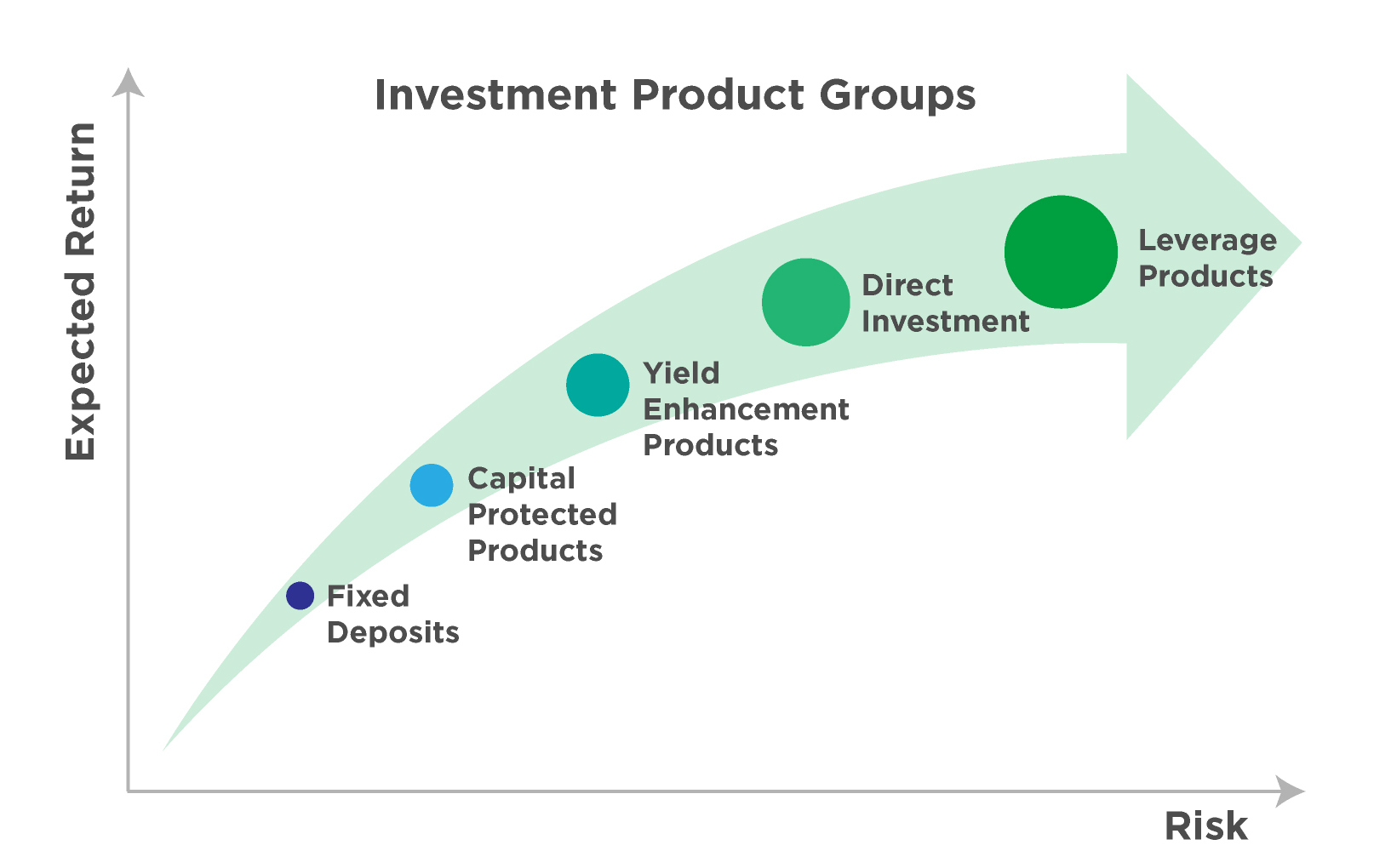

As part the alternative investment universe, structured products sit private equity, hedge funds, other nontraditional investments. can deliver high yields uncorrelated returns. Investors structured products their ability meet specific investment objectives. Characteristics Alternative Investments

As part the alternative investment universe, structured products sit private equity, hedge funds, other nontraditional investments. can deliver high yields uncorrelated returns. Investors structured products their ability meet specific investment objectives. Characteristics Alternative Investments

Exploring Alternative Investments with Structured Products

Exploring Alternative Investments with Structured Products

:max_bytes(150000):strip_icc()/AnIntroductiontoStructuredProducts1-1a2eea05ef064d3fae32c8e1de618eaa.png) From derivatives private equity, alternative investments diversify portfolio. Browse Investopedia's expert-written library learn more. . Introduction Structured Products .

From derivatives private equity, alternative investments diversify portfolio. Browse Investopedia's expert-written library learn more. . Introduction Structured Products .

One notable trend alternative investments the growing popularity structured products due their unique risk-return profiles tailored investment strategies. Investors increasingly drawn structured products their ability provide exposure a wide range asset classes offering downside protection .

One notable trend alternative investments the growing popularity structured products due their unique risk-return profiles tailored investment strategies. Investors increasingly drawn structured products their ability provide exposure a wide range asset classes offering downside protection .