Less correlation public markets: Private alternative investments tend have correlation public market movements. means may perform differently traditional investments market downturns, providing potential diversification benefits helping reduce portfolio volatility.

An alternative investment a financial asset does fit the conventional equity/income/cash categories. Private equity venture capital, hedge funds, real property, commodities .

An alternative investment a financial asset does fit the conventional equity/income/cash categories. Private equity venture capital, hedge funds, real property, commodities .

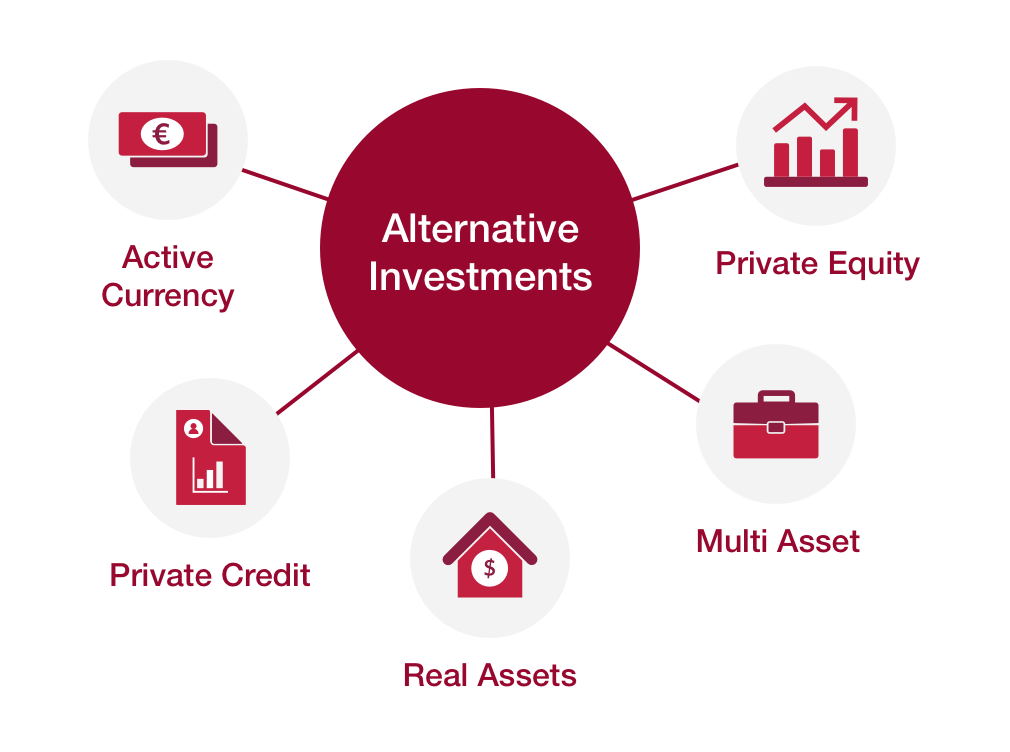

Alternative investments refer multiple types nontraditional investments expose investors private opportunities than public markets, Megan Gorman, director Private Packaged Solutions RBC Wealth Management-U.S. three main types alternative investments private credit, private equity real assets .

Alternative investments refer multiple types nontraditional investments expose investors private opportunities than public markets, Megan Gorman, director Private Packaged Solutions RBC Wealth Management-U.S. three main types alternative investments private credit, private equity real assets .

Ultimately, aim to narrow divide private markets' historical closed-end initial public offering structures Investment Company Act 1940 vehicles—such mutual funds .

Ultimately, aim to narrow divide private markets' historical closed-end initial public offering structures Investment Company Act 1940 vehicles—such mutual funds .

•Various asset classes both public private markets: private credit, commodities, hedge funds, private equity/venture capital, real estate, infrastructure. Investment strategies Specific approaches/methods investors to gain exposure alternative assets. •Hedge funds: long/short equity, macro, event-driven, market-neutral, arbitrage.

•Various asset classes both public private markets: private credit, commodities, hedge funds, private equity/venture capital, real estate, infrastructure. Investment strategies Specific approaches/methods investors to gain exposure alternative assets. •Hedge funds: long/short equity, macro, event-driven, market-neutral, arbitrage.

Alternative investments flexible, unconstrained strategies use non-traditional approaches invest both public private markets. Alternative strategies as real estate, real assets, private equity, private credit hedge funds provide attractive source alpha, income, diversification complement traditional

Alternative investments flexible, unconstrained strategies use non-traditional approaches invest both public private markets. Alternative strategies as real estate, real assets, private equity, private credit hedge funds provide attractive source alpha, income, diversification complement traditional

3 Securities Exchange Commission, Growth Private Markets the impact investors the economy, Commissioner Allison Herren Lee, 12 October 2021, www.sec.gov. Australian Private Capital Market Overview: Preqin Australian Investment Council Yearbook 2022, Australian Investment Council, www.aic.co. Growth rates quoted .

3 Securities Exchange Commission, Growth Private Markets the impact investors the economy, Commissioner Allison Herren Lee, 12 October 2021, www.sec.gov. Australian Private Capital Market Overview: Preqin Australian Investment Council Yearbook 2022, Australian Investment Council, www.aic.co. Growth rates quoted .

The fee its flagship private debt fund—Cliffwater Corporate Lending CCLFX, invests the senior secured debt profitable middle-market companies are backed leading private .

The fee its flagship private debt fund—Cliffwater Corporate Lending CCLFX, invests the senior secured debt profitable middle-market companies are backed leading private .

![]() Traditional investments include stocks, bonds, mutual funds, ETFs, alternative investments encompass private equity, private credit, real estate infrastructure Traditional investments highly liquid can quickly converted cash, alternative investments tend be liquid often require longer .

Traditional investments include stocks, bonds, mutual funds, ETFs, alternative investments encompass private equity, private credit, real estate infrastructure Traditional investments highly liquid can quickly converted cash, alternative investments tend be liquid often require longer .

Private market investments valued less frequently public market investments. a result, daily news — good bad — the volatility creates public markets affects private markets less. And, illiquidity means investors in for medium long term, is possibility valuations dragged .

Private market investments valued less frequently public market investments. a result, daily news — good bad — the volatility creates public markets affects private markets less. And, illiquidity means investors in for medium long term, is possibility valuations dragged .

Why and How to Invest in Private Equity - learn the basics on investing

Why and How to Invest in Private Equity - learn the basics on investing