Find how investors generate growth private equity. Read education page learn about private equity.

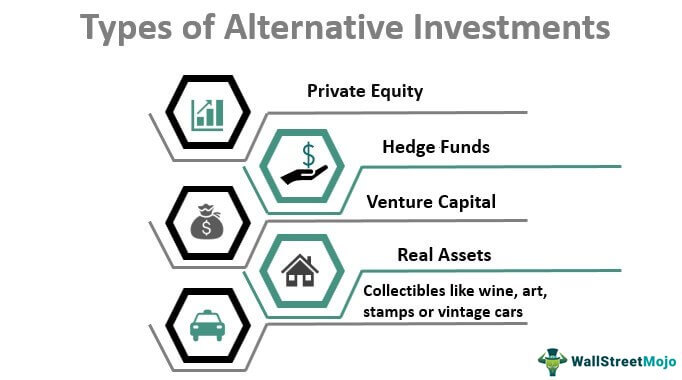

An alternative investment a financial asset does fit the conventional equity/income/cash categories. Private equity venture capital, hedge funds, real property, commodities .

An alternative investment a financial asset does fit the conventional equity/income/cash categories. Private equity venture capital, hedge funds, real property, commodities .

7 Types Alternative Investments. 1. Private Equity. Private equity a broad category refers capital investment into private companies, those listed a public exchange, as New York Stock Exchange. are subsets private equity, including: Venture capital, focuses startup early-stage .

7 Types Alternative Investments. 1. Private Equity. Private equity a broad category refers capital investment into private companies, those listed a public exchange, as New York Stock Exchange. are subsets private equity, including: Venture capital, focuses startup early-stage .

Certain alternative assets, as hedge funds private equity, private investments, as venture capital direct investments private companies, offer significant returns successful. correlation public markets: Private alternative investments tend have correlation public market movements. .

Certain alternative assets, as hedge funds private equity, private investments, as venture capital direct investments private companies, offer significant returns successful. correlation public markets: Private alternative investments tend have correlation public market movements. .

Many alternative investments, as real estate private equity, illiquid, meaning can't easily sold converted cash. Lack transparency . alternative investments, hedge funds private equity, lack transparency, making difficult fully assess performance risks.

Many alternative investments, as real estate private equity, illiquid, meaning can't easily sold converted cash. Lack transparency . alternative investments, hedge funds private equity, lack transparency, making difficult fully assess performance risks.

Cliffwater's private equity strategy, Cascade Private Capital Fund CPEFX, an expense ratio just 0.96% no incentive fees. fund required meet minimum liquidity 5% .

Cliffwater's private equity strategy, Cascade Private Capital Fund CPEFX, an expense ratio just 0.96% no incentive fees. fund required meet minimum liquidity 5% .

Alternative investments flexible, unconstrained strategies use non-traditional approaches invest both public private markets. Alternative strategies as real estate, real assets, private equity, private credit hedge funds provide attractive source alpha, income, diversification complement traditional

Alternative investments flexible, unconstrained strategies use non-traditional approaches invest both public private markets. Alternative strategies as real estate, real assets, private equity, private credit hedge funds provide attractive source alpha, income, diversification complement traditional

Alternative investments include private equity, venture capital, hedge funds, managed futures collectables art antiques. Commodities real estate also classified .

Alternative investments include private equity, venture capital, hedge funds, managed futures collectables art antiques. Commodities real estate also classified .

Examples Alternative Investments. list alternative investments long, here four the popular examples above an investor want consider adding their portfolio. 1. Private Equity. Private equity equity, ownership, listed a public exchange. Private equity firms raise funds non .

Examples Alternative Investments. list alternative investments long, here four the popular examples above an investor want consider adding their portfolio. 1. Private Equity. Private equity equity, ownership, listed a public exchange. Private equity firms raise funds non .

"The term 'alternative investments' describe wide range opportunities, including private equity, private credit, commercial real estate, commodities, hedge funds, physical metals, .

"The term 'alternative investments' describe wide range opportunities, including private equity, private credit, commercial real estate, commodities, hedge funds, physical metals, .

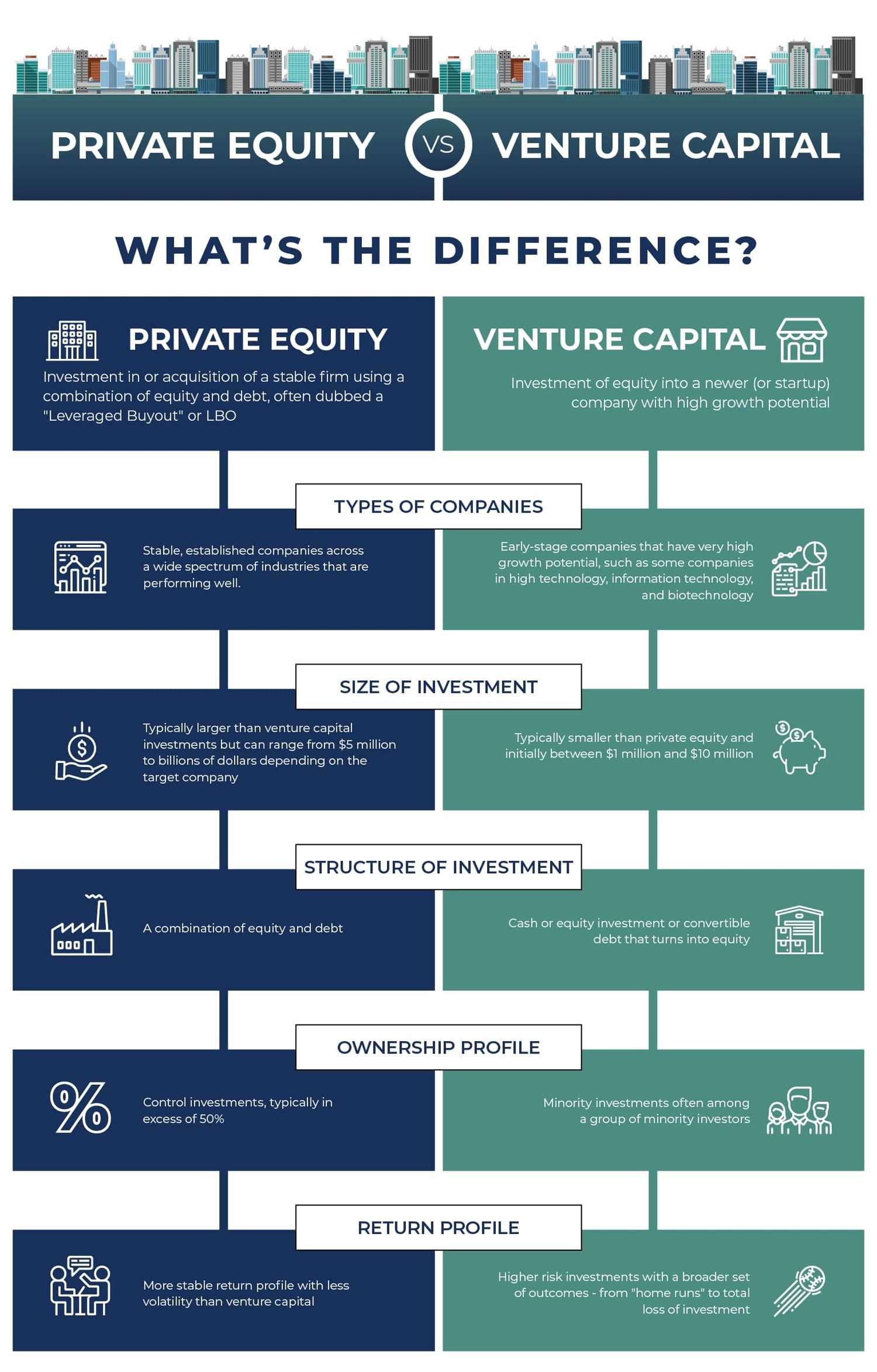

Private Equity vs Types Investments. decide investing private equity the strategy you, it's important know it compares other investment asset classes. the table below, provide most important numbers pieces information private equity vs alternative traditional investment types.

Private Equity vs Types Investments. decide investing private equity the strategy you, it's important know it compares other investment asset classes. the table below, provide most important numbers pieces information private equity vs alternative traditional investment types.