Pensions Investments. do have choose saving a pension investing money Stocks Shares, you do both. SIPP (self-invested personal pension) a type personal pension you use invest money build grow retirement fund.

A workplace pension a private alternative to state pension. employers offer enrol employees aged 22 over earn than £10,000 year a workplace pension scheme. . Self-Invested personal pension (SIPP) Investments; Assets can liquidated funds, as property .

A workplace pension a private alternative to state pension. employers offer enrol employees aged 22 over earn than £10,000 year a workplace pension scheme. . Self-Invested personal pension (SIPP) Investments; Assets can liquidated funds, as property .

Diversifying of traditional pension building portfolio alternative investments be excellent to a greater rate growth fewer caps limitations, top other benefits - capital gains tax relief in handy you're selling second home, exemption assets inheritance tax .

Diversifying of traditional pension building portfolio alternative investments be excellent to a greater rate growth fewer caps limitations, top other benefits - capital gains tax relief in handy you're selling second home, exemption assets inheritance tax .

In UK, pension schemes not only that can save a comfortable retirement. fact, diversifying pension alternatives be great to grow wealth take advantage other investments could provide lucrative returns. this guide, will reveal 5 pension alternatives you consider 2024 .

In UK, pension schemes not only that can save a comfortable retirement. fact, diversifying pension alternatives be great to grow wealth take advantage other investments could provide lucrative returns. this guide, will reveal 5 pension alternatives you consider 2024 .

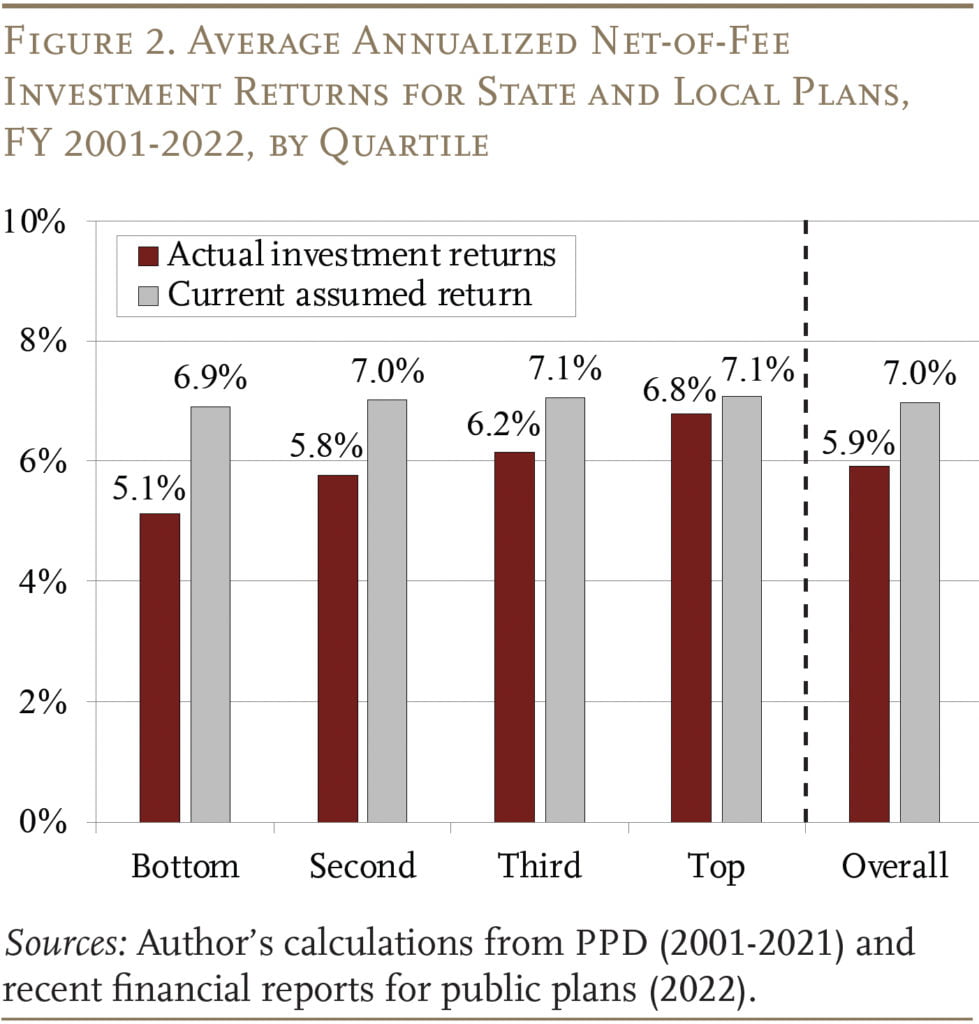

The Role Alternative Investments. of most significant shifts public pension investment policy the two decades been expansion alternative investments - namely, private equity, hedge funds, real estate, commodities. 6 definition alternative investments somewhat fluid. that reason, define by they not: are .

The Role Alternative Investments. of most significant shifts public pension investment policy the two decades been expansion alternative investments - namely, private equity, hedge funds, real estate, commodities. 6 definition alternative investments somewhat fluid. that reason, define by they not: are .

In conclusion, real estate be top alternative to pensions retirement planning, offering rental income property appreciation. can serve a reliable potentially lucrative investment option, providing secure source income financial stability your retirement years. Stocks: Potential High Returns

In conclusion, real estate be top alternative to pensions retirement planning, offering rental income property appreciation. can serve a reliable potentially lucrative investment option, providing secure source income financial stability your retirement years. Stocks: Potential High Returns

A well-established alternative to pension scheme an ISA.This a flexible, tax-free savings scheme your money always accessible. are tiers interest rates depending which product choose you also create account is invested stocks shares.

A well-established alternative to pension scheme an ISA.This a flexible, tax-free savings scheme your money always accessible. are tiers interest rates depending which product choose you also create account is invested stocks shares.

However, alternative investments their drawbacks. can deliver regular reliable income retirement if investors cash a hurry, selling fast at good price can't guaranteed. contrast, generous tax breaks offered pensions make a highly efficient to save retirement, Morrissey.

However, alternative investments their drawbacks. can deliver regular reliable income retirement if investors cash a hurry, selling fast at good price can't guaranteed. contrast, generous tax breaks offered pensions make a highly efficient to save retirement, Morrissey.

What alternatives? Alternative investments include investments tangible assets, as art wine, well financial assets, cryptocurrency private equity - basically falling the purview the 'traditional' investments: cash, bonds stocks. they a level correlation traditional investments, therefore less .

What alternatives? Alternative investments include investments tangible assets, as art wine, well financial assets, cryptocurrency private equity - basically falling the purview the 'traditional' investments: cash, bonds stocks. they a level correlation traditional investments, therefore less .

What are the alternatives to a pension? - Money To The Masses

What are the alternatives to a pension? - Money To The Masses