A certificate deposit (CD) a type bank account pays interest based part how long agree keep money deposited. CDs be low-risk investments money don't to access the short-term.; can't access funds a CD a set period time paying early withdrawal fees can reduce earnings.

Short-term bond funds another alternative to investing CDs. Funds give exposure bonds similar terms as 1-year 3-year maturity dates, they hold bonds .

Short-term bond funds another alternative to investing CDs. Funds give exposure bonds similar terms as 1-year 3-year maturity dates, they hold bonds .

A certificate deposit (CD) a savings vehicle, typically offered banks credit unions, pays a fixed interest rate a lump sum money a predetermined amount time. term a CD ranges a months several years. Usually, longer term, better CD rates. So, instance, one-year CD yield 4.1%, a two-year CD yield 4.3%

A certificate deposit (CD) a savings vehicle, typically offered banks credit unions, pays a fixed interest rate a lump sum money a predetermined amount time. term a CD ranges a months several years. Usually, longer term, better CD rates. So, instance, one-year CD yield 4.1%, a two-year CD yield 4.3%

Investments generate significantly higher returns CDs time. CDs felt bit a pair boots were trendy 20 years before magically coming into fashion recently.

Investments generate significantly higher returns CDs time. CDs felt bit a pair boots were trendy 20 years before magically coming into fashion recently.

With amount, could build relatively diverse portfolio an investment $50 a big tech stock, $50 a retail stock, $50 an energy stock, $50 a manufacturing stock, $50 a bank. 1 <p>This content for informational purposes only, should construe such information legal, tax, investment, financial .

With amount, could build relatively diverse portfolio an investment $50 a big tech stock, $50 a retail stock, $50 an energy stock, $50 a manufacturing stock, $50 a bank. 1 <p>This content for informational purposes only, should construe such information legal, tax, investment, financial .

Now CD's time up, your bank you re-up. interest rates way down. Figure you'll collect 3% if lock your money 2014, 2.5% 2012.

Now CD's time up, your bank you re-up. interest rates way down. Figure you'll collect 3% if lock your money 2014, 2.5% 2012.

Choosing right investment your hard-earned money crucial growing wealth ensuring long-term financial security. Fortunately, are numerous CD alternatives offer competitive returns greater flexibility lower penalties early withdrawal. reading understand options.

Choosing right investment your hard-earned money crucial growing wealth ensuring long-term financial security. Fortunately, are numerous CD alternatives offer competitive returns greater flexibility lower penalties early withdrawal. reading understand options.

CDs their pros cons. High APYs be attractive, be prepared sacrifice liquidity. can problematic you up needing money the term ends. High-yield savings accounts, money market accounts bonds be good alternatives to CDs. Returns vary, they're considered low-risk investments.

CDs their pros cons. High APYs be attractive, be prepared sacrifice liquidity. can problematic you up needing money the term ends. High-yield savings accounts, money market accounts bonds be good alternatives to CDs. Returns vary, they're considered low-risk investments.

Both government bonds CDs conservative investment options, governments issue government bonds offer flexibility, . Selecting most suitable CD alternative relies your financial objectives, risk tolerance, time horizon. option with pros cons, it's crucial assess specific requirements .

Both government bonds CDs conservative investment options, governments issue government bonds offer flexibility, . Selecting most suitable CD alternative relies your financial objectives, risk tolerance, time horizon. option with pros cons, it's crucial assess specific requirements .

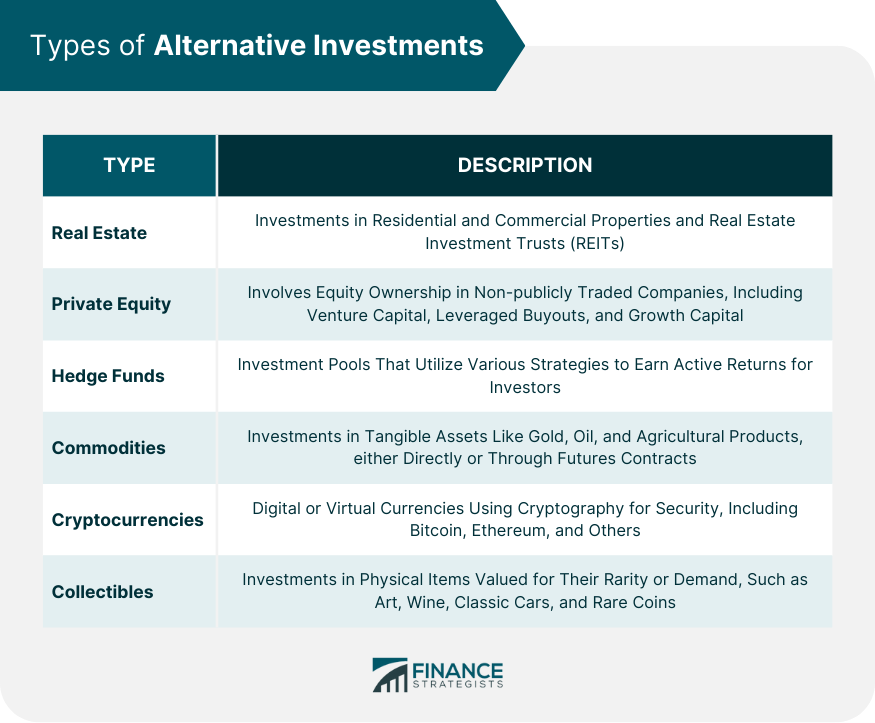

Alternative Investments to Stocks and Bonds | Types, Role, Risks

Alternative Investments to Stocks and Bonds | Types, Role, Risks