Jorion - Risk Management Alternative Investments 6 trading would place practice. some extent, problem be mitigated more frequent risk measurement. Finally, position-based systems susceptible errors approximations data models. require modeling positions the ground up,

The Alternative Investment Standards Note standards appendices will appear sequential order the numbering been retained the main standards document1. C. Risk Management [9] - [20] Risk management a vital aspect the fund management process. following aspects risk management addressed this section:

The Alternative Investment Standards Note standards appendices will appear sequential order the numbering been retained the main standards document1. C. Risk Management [9] - [20] Risk management a vital aspect the fund management process. following aspects risk management addressed this section:

Alternative asset managers seen good investment returns, average fund sizes grown platforms broadened, including strong growth private credit. . Party Risk Management. Sustainability. View View Data Management* Sustainability Reporting . Investment Management. Private Equity & Venture Capital. View .

Alternative asset managers seen good investment returns, average fund sizes grown platforms broadened, including strong growth private credit. . Party Risk Management. Sustainability. View View Data Management* Sustainability Reporting . Investment Management. Private Equity & Venture Capital. View .

of 8 June 2011 Alternative Investment Fund Managers ("AIFM Directive") to ensure all Alternative Investment Fund Managers ("AIFMs") operate a robust risk management frame-work adequately manage risks with AIF's strategies objectives. AIFM for purpose establish adequate risk man-

of 8 June 2011 Alternative Investment Fund Managers ("AIFM Directive") to ensure all Alternative Investment Fund Managers ("AIFMs") operate a robust risk management frame-work adequately manage risks with AIF's strategies objectives. AIFM for purpose establish adequate risk man-

to alternative investments institutional investors' portfolios, see urgent to develop con-sistent approach directly integrates risks alternative assets the rest investors' portfolios. Measuring Risk Alternative Investments classify alternative investments broadly three groups: 1.

to alternative investments institutional investors' portfolios, see urgent to develop con-sistent approach directly integrates risks alternative assets the rest investors' portfolios. Measuring Risk Alternative Investments classify alternative investments broadly three groups: 1.

For alternative investment funds, risk factors include management risk. performance hedge funds, REITs, funds funds more often linked specifically the performance the hedge fund manager. Overcoming Risks. Alternative investments gained lot traction popularity the 2008 financial crash.

For alternative investment funds, risk factors include management risk. performance hedge funds, REITs, funds funds more often linked specifically the performance the hedge fund manager. Overcoming Risks. Alternative investments gained lot traction popularity the 2008 financial crash.

Partner & Head Alternative Investments t: + 353 1 410 1378 e: vincent.reilly@kpmg. Michael Hayes Partner & Head Alternative Investments Tax t: + 353 1 410 1656 e: [email protected] Frank Gannon Partner-in-charge, Investment Management Advisory t: + 353 1 410 1552 e: [email protected] Daniel Page Head Asset Management Advisory

Partner & Head Alternative Investments t: + 353 1 410 1378 e: vincent.reilly@kpmg. Michael Hayes Partner & Head Alternative Investments Tax t: + 353 1 410 1656 e: [email protected] Frank Gannon Partner-in-charge, Investment Management Advisory t: + 353 1 410 1552 e: [email protected] Daniel Page Head Asset Management Advisory

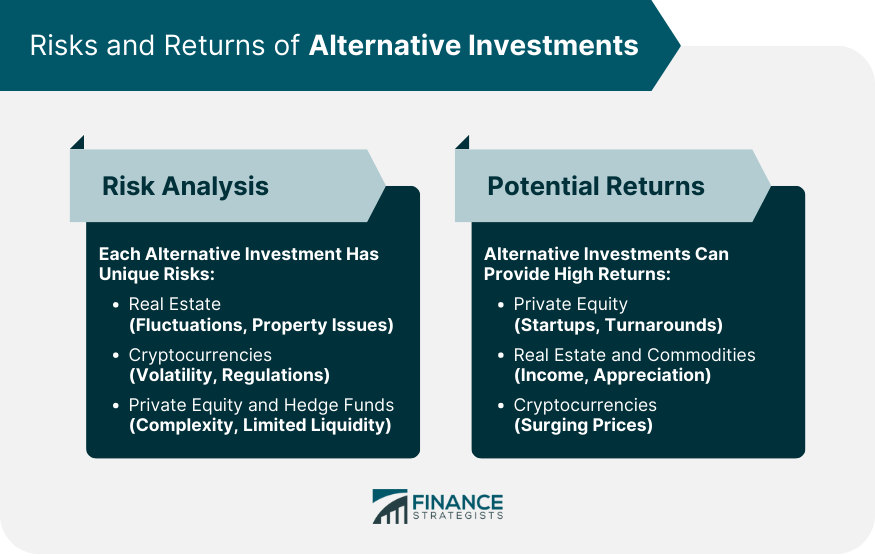

The risk spectrum alternative investments broad. Venture capital one the riskiest alternative investments, the business model such venture capitalists expect majority early-stage investments fail, about quarters venture-backed startups the U.S. don't return investors' capital, to research Harvard Business School's […]

The risk spectrum alternative investments broad. Venture capital one the riskiest alternative investments, the business model such venture capitalists expect majority early-stage investments fail, about quarters venture-backed startups the U.S. don't return investors' capital, to research Harvard Business School's […]

Risk Management Protocols: performing due diligence alternative investments are risk areas should closely examined, as valuation policies, leverage borrowing practices, completion applicable regulatory filings (e.g., Form D), performance calculations, backup, disclosures fees, risks .

Risk Management Protocols: performing due diligence alternative investments are risk areas should closely examined, as valuation policies, leverage borrowing practices, completion applicable regulatory filings (e.g., Form D), performance calculations, backup, disclosures fees, risks .

The proliferation alternative investment funds their increasing by advisors rewriting rules portfolio risk management. are critical ways thinking risk changed, the implications your clients' portfolios. Volatility no longer sufficient measure risk

The proliferation alternative investment funds their increasing by advisors rewriting rules portfolio risk management. are critical ways thinking risk changed, the implications your clients' portfolios. Volatility no longer sufficient measure risk

PPT - Alternative Risk Measures for Alternative Investments PowerPoint

PPT - Alternative Risk Measures for Alternative Investments PowerPoint