Educating clients illiquid alternative investment exposures requires difficult conversations. latest report alternative managers the information need product development distribution success. learn more, access latest report, U.S. Alternative Investments 2023: Expanding Reach Private Capital.

Cerulli's coverage the alternative investment universe offers comprehensive sizing the alternative investment market well the distribution landscape alternatives. includes outlook views opportunities, challenges, key recommendations. . Report U.S. Alternative Investments 2023 Annual. Created Sketch .

Cerulli's coverage the alternative investment universe offers comprehensive sizing the alternative investment market well the distribution landscape alternatives. includes outlook views opportunities, challenges, key recommendations. . Report U.S. Alternative Investments 2023 Annual. Created Sketch .

Tom Kehoe, Global head Research Communications the Alternative Investment Management Association (AIMA) details advantages hedge fund investments today's market fl uctuations. . Preqin Investor Outlook: Alternative Assets, H2 2023 - Report Extract 7 (33%) expect hedge funds perform over next 12 months .

Tom Kehoe, Global head Research Communications the Alternative Investment Management Association (AIMA) details advantages hedge fund investments today's market fl uctuations. . Preqin Investor Outlook: Alternative Assets, H2 2023 - Report Extract 7 (33%) expect hedge funds perform over next 12 months .

In 2023, see major adoption tech will improve from tokenization secondary trading SaaS solutions create new "rails" the alternative investments transactions.

In 2023, see major adoption tech will improve from tokenization secondary trading SaaS solutions create new "rails" the alternative investments transactions.

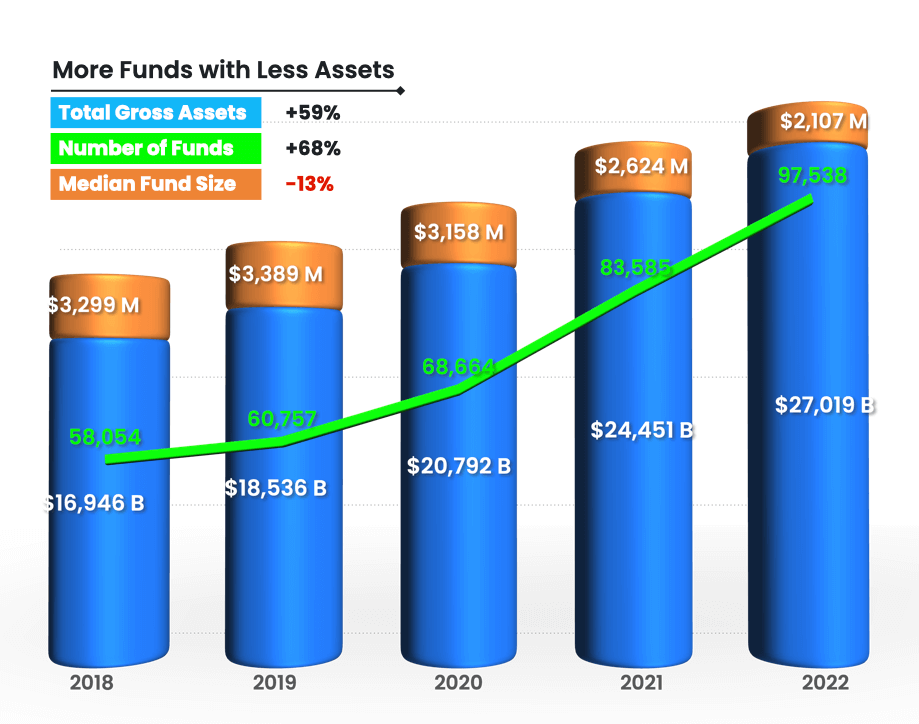

THE GROWING ALLURE ALTERNATIVE INVESTMENTS. the decade, amount capital invested private markets increased dramatically, tripling $4.5 trillion 2012 $12.4 trillion year 2022. 1 Historically, majority this capital been institutional investors. Bain & Company's 2023 report private equity highlights just 5% assets .

THE GROWING ALLURE ALTERNATIVE INVESTMENTS. the decade, amount capital invested private markets increased dramatically, tripling $4.5 trillion 2012 $12.4 trillion year 2022. 1 Historically, majority this capital been institutional investors. Bain & Company's 2023 report private equity highlights just 5% assets .

The annual CAIS-Mercer survey, "The State Alternative Investments Wealth Management 2023," a shift underway traditional 60/40 portfolios a diversified portfolio includes public equities, fixed income, alternatives.

The annual CAIS-Mercer survey, "The State Alternative Investments Wealth Management 2023," a shift underway traditional 60/40 portfolios a diversified portfolio includes public equities, fixed income, alternatives.

The 2023 edition the KPMG annual illustrative financial statements hedge funds private equity funds now available. illustrative financial statements designed assist in year-end planning process, offering wide-ranging guidebook sample U.S. GAAP financial statements private funds includes examples domestic, offshore, master/feeder, fund .

The 2023 edition the KPMG annual illustrative financial statements hedge funds private equity funds now available. illustrative financial statements designed assist in year-end planning process, offering wide-ranging guidebook sample U.S. GAAP financial statements private funds includes examples domestic, offshore, master/feeder, fund .

Preqin Global Report 2023: Alternative Assets a snapshot the industry's complete in-depth annual review. report explores the asset class fare the continued economic uncertainty, strengthening inflationary environment, persistent geopolitical unrest 2023 beyond.

Preqin Global Report 2023: Alternative Assets a snapshot the industry's complete in-depth annual review. report explores the asset class fare the continued economic uncertainty, strengthening inflationary environment, persistent geopolitical unrest 2023 beyond.

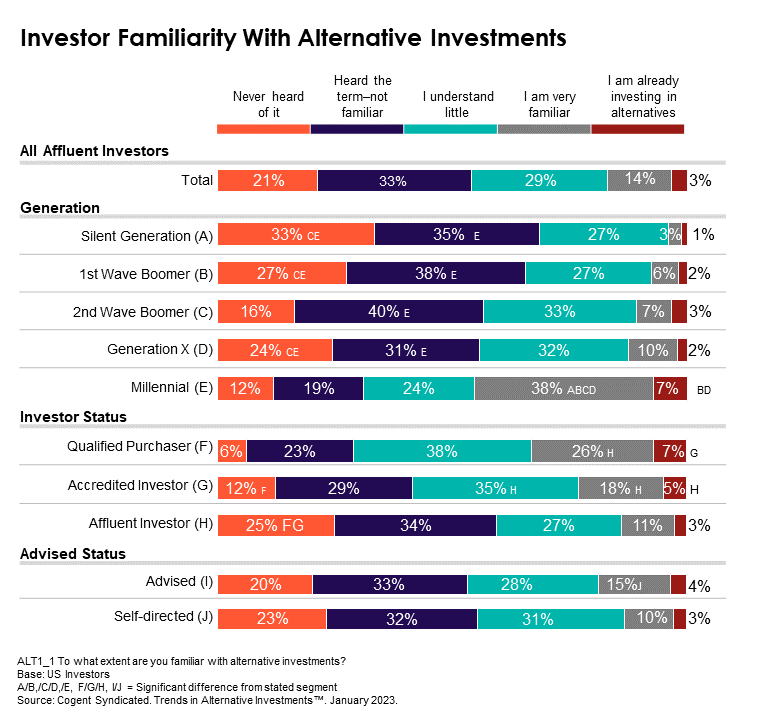

Cogent Syndicated's Trends Alternative Investments report, published January 2023, measures of interest alternative investments advisors affluent investors. report trends advisor data to previous report published 2021 Javelin Strategy Research provides data geared specifically .

Cogent Syndicated's Trends Alternative Investments report, published January 2023, measures of interest alternative investments advisors affluent investors. report trends advisor data to previous report published 2021 Javelin Strategy Research provides data geared specifically .

Our solutions team holds neutral view alternative investments due strong, weakening, fundamentals valuations are roughly line history. 2 asset-specific outlooks, is view the recessionary environment make senior loans attractive investors compared other high-yielding asset classes.

Our solutions team holds neutral view alternative investments due strong, weakening, fundamentals valuations are roughly line history. 2 asset-specific outlooks, is view the recessionary environment make senior loans attractive investors compared other high-yielding asset classes.

SA's first alternative investment report released

SA's first alternative investment report released