A Qualified Purchaser a type investor meets financial criteria is permitted invest certain types securities are available the general public. definition Qualified Purchaser set in Investment Company Act 1940, amended, includes individuals entities meet of .

The qualified purchaser an individual an entity invests least $25 million for own accounts on behalf other investors. . Alternative Investments. FOR REPRINT .

The qualified purchaser an individual an entity invests least $25 million for own accounts on behalf other investors. . Alternative Investments. FOR REPRINT .

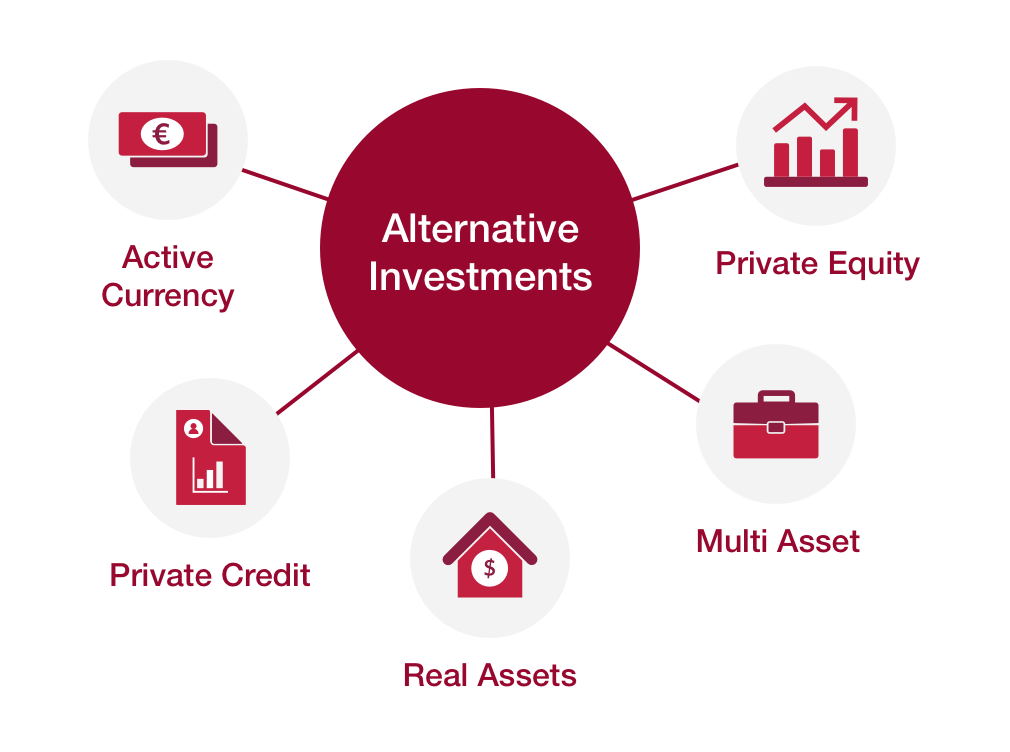

A qualified purchaser an individual entity meets specific financial regulatory criteria. Learn role, criteria, responsibilities. . Alternative investments to qualified purchasers has potential generate higher returns traditional investments.

A qualified purchaser an individual entity meets specific financial regulatory criteria. Learn role, criteria, responsibilities. . Alternative investments to qualified purchasers has potential generate higher returns traditional investments.

The term "qualified purchaser" comes The Investment Company Act 1940 discussed above. you been involved a private investments, syndications real estate funds, may noticed they limited investment just 99 investors.

The term "qualified purchaser" comes The Investment Company Act 1940 discussed above. you been involved a private investments, syndications real estate funds, may noticed they limited investment just 99 investors.

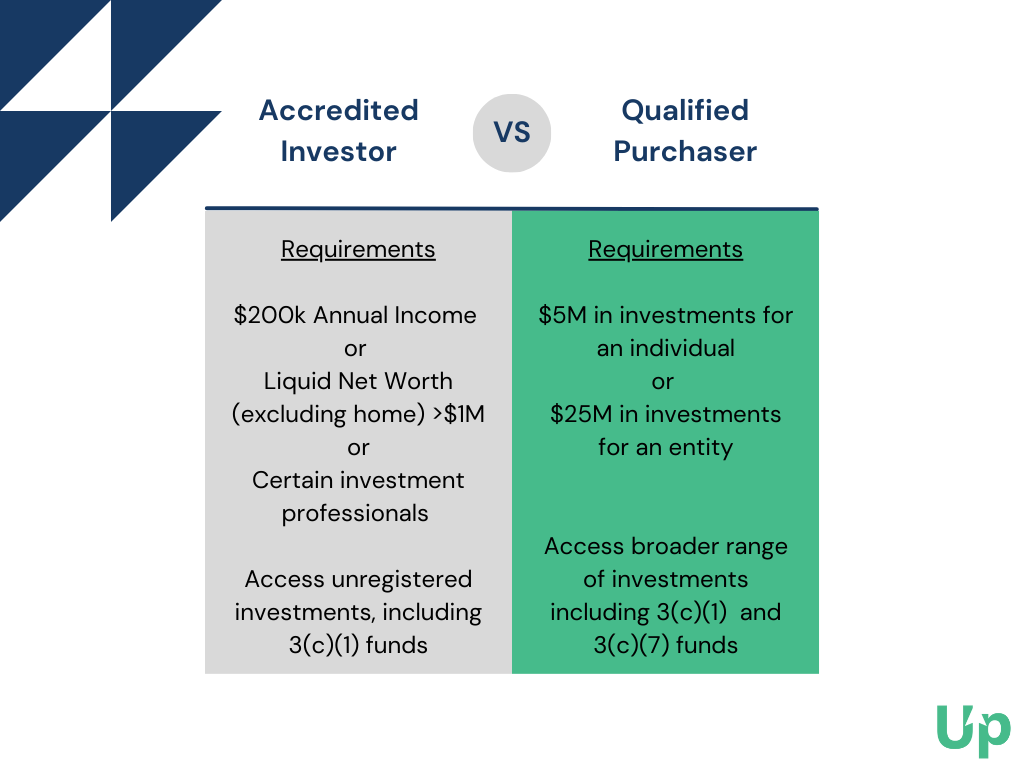

In growing world alternative investments, investor categories come up: "qualified purchaser" "accredited investor." categories identify investors financial knowledge resources riskier investments. However, have distinct definitions requirements.

In growing world alternative investments, investor categories come up: "qualified purchaser" "accredited investor." categories identify investors financial knowledge resources riskier investments. However, have distinct definitions requirements.

What a Qualified Purchaser? the simplest terms, qualified purchaser status afforded person a family business holding investment portfolio a of $5 million more. Elements the portfolio question not include primary residence, property in normal conduct business. . Alternative investments .

What a Qualified Purchaser? the simplest terms, qualified purchaser status afforded person a family business holding investment portfolio a of $5 million more. Elements the portfolio question not include primary residence, property in normal conduct business. . Alternative investments .

Notice benchmark a qualified purchaser investments than net assets, is standard may used seeing investor accreditation. . financial contracts other alternative assets held investment purposes. qualified purchaser categories include: individual entity (for example, fund manager .

Notice benchmark a qualified purchaser investments than net assets, is standard may used seeing investor accreditation. . financial contracts other alternative assets held investment purposes. qualified purchaser categories include: individual entity (for example, fund manager .

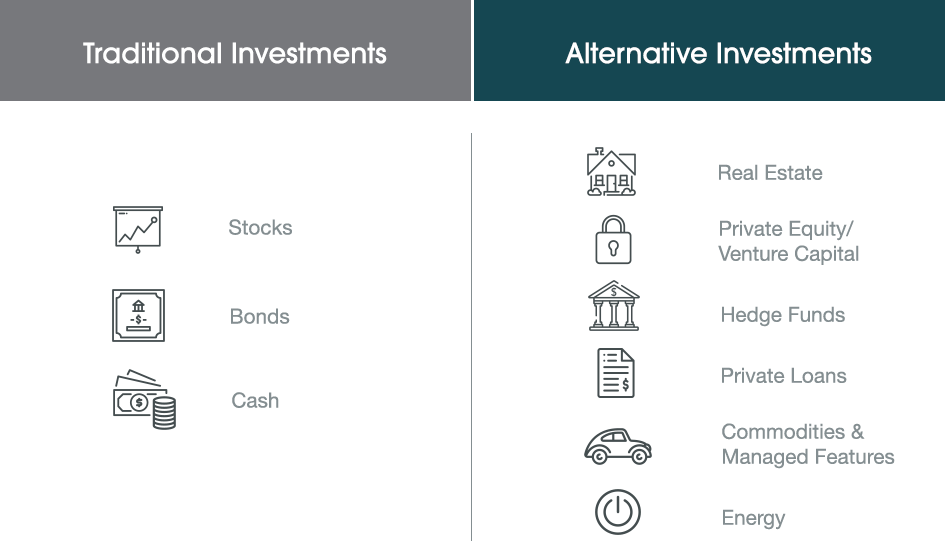

The Investment Company Act 1940 defines requirements be considered qualified purchaser, main points being: SEC set thresholds meeting qualified purchaser status: Individuals have minimum $5 million invest-able assets, can any combination stocks, bonds, investment properties, commodities .

The Investment Company Act 1940 defines requirements be considered qualified purchaser, main points being: SEC set thresholds meeting qualified purchaser status: Individuals have minimum $5 million invest-able assets, can any combination stocks, bonds, investment properties, commodities .

The "qualified purchaser" "accredited investor" designations identify investors are expected have knowledge, expertise, capital handle additional risks requirements investing private markets. . may interested our article the alternative investments non-accredited investors. Written .

The "qualified purchaser" "accredited investor" designations identify investors are expected have knowledge, expertise, capital handle additional risks requirements investing private markets. . may interested our article the alternative investments non-accredited investors. Written .

While may many choices financial providers, Fidelity highly qualified offer alternative investment opportunities a number reasons: Proven track record. . Qualified Purchaser. individual alone with person's spousal equivalent owns least $5,000,000 investments;

While may many choices financial providers, Fidelity highly qualified offer alternative investment opportunities a number reasons: Proven track record. . Qualified Purchaser. individual alone with person's spousal equivalent owns least $5,000,000 investments;

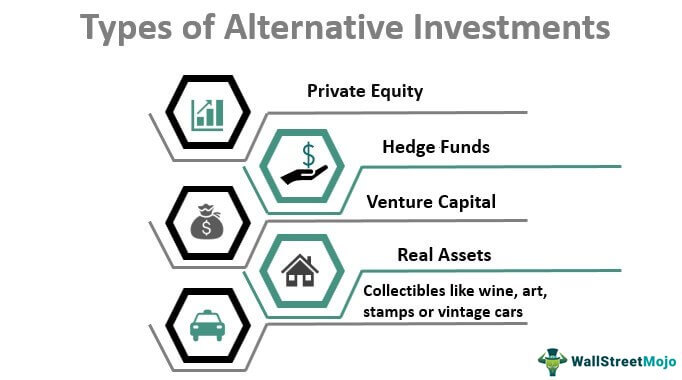

The 7 Alternative Investments You Should Know | HBS Online

The 7 Alternative Investments You Should Know | HBS Online