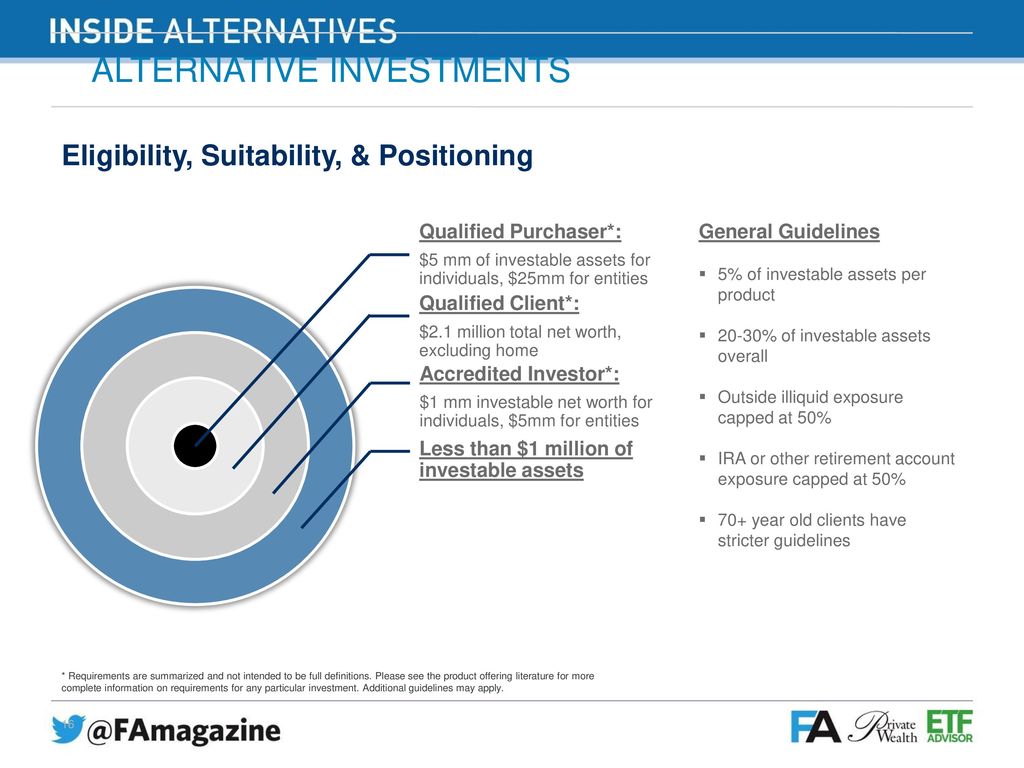

Per Investment Advisers Act 1940, advisor only charge performance-based fee a "qualified client." So, is qualified client defined? qualified client. $2.2 million investable assets (increased $2 million 2016 $2.1 million 2021) OR; $1.1 million invested that advisor (increased .

Alternative Investments eligibility Alternative investments offered to qualified investors. Client eligibility purchase alternative investments typically based the client's net worth shown the chart below. 1 Net Worth: individual's entity's (e.g., trust's) net worth determined by

Alternative Investments eligibility Alternative investments offered to qualified investors. Client eligibility purchase alternative investments typically based the client's net worth shown the chart below. 1 Net Worth: individual's entity's (e.g., trust's) net worth determined by

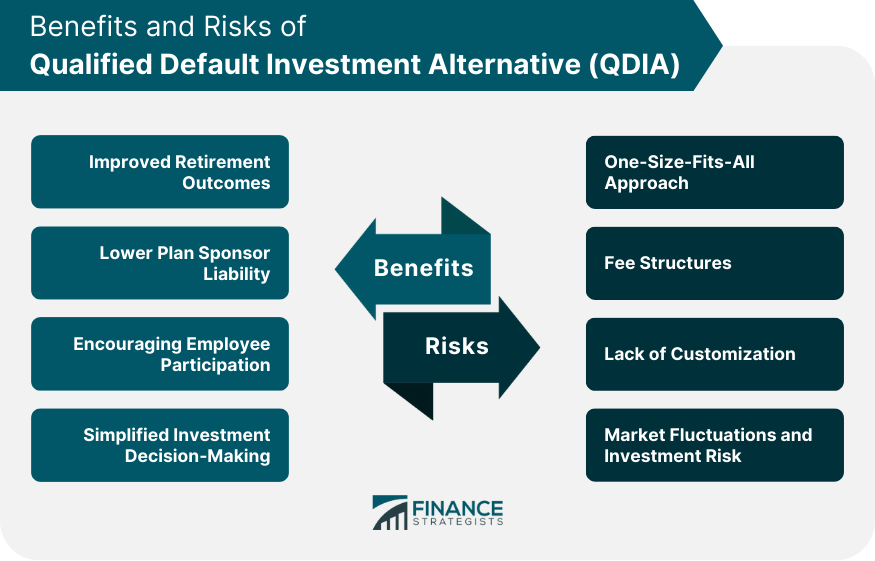

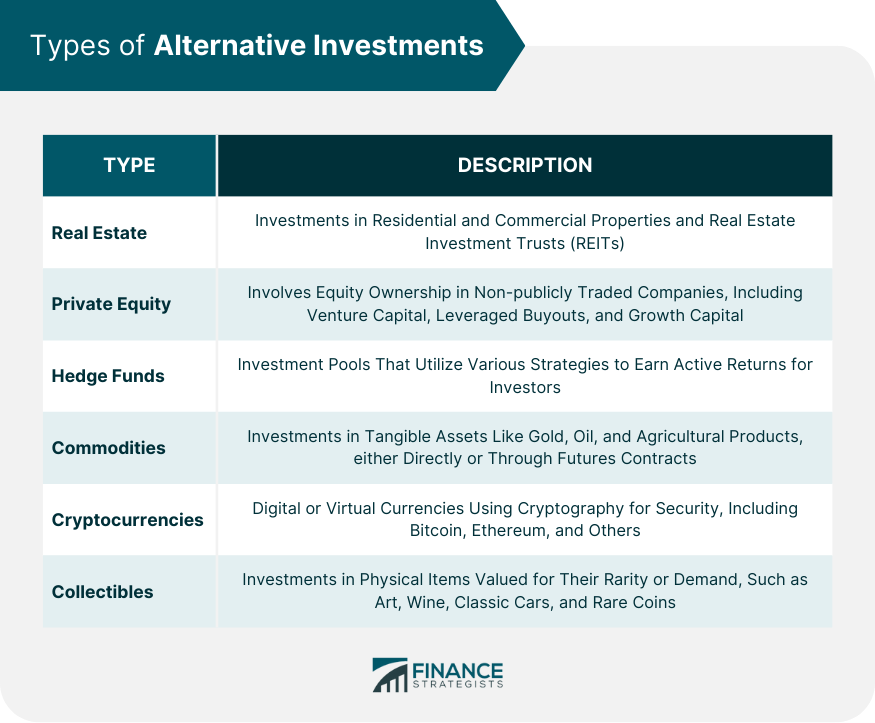

Alternative investments speculative involve high degree risk volatility. 3 Alternative investments intended qualified investors only. Alternative Investments as derivatives, hedge funds, private equity funds, funds funds result higher return potential also higher loss potential.

Alternative investments speculative involve high degree risk volatility. 3 Alternative investments intended qualified investors only. Alternative Investments as derivatives, hedge funds, private equity funds, funds funds result higher return potential also higher loss potential.

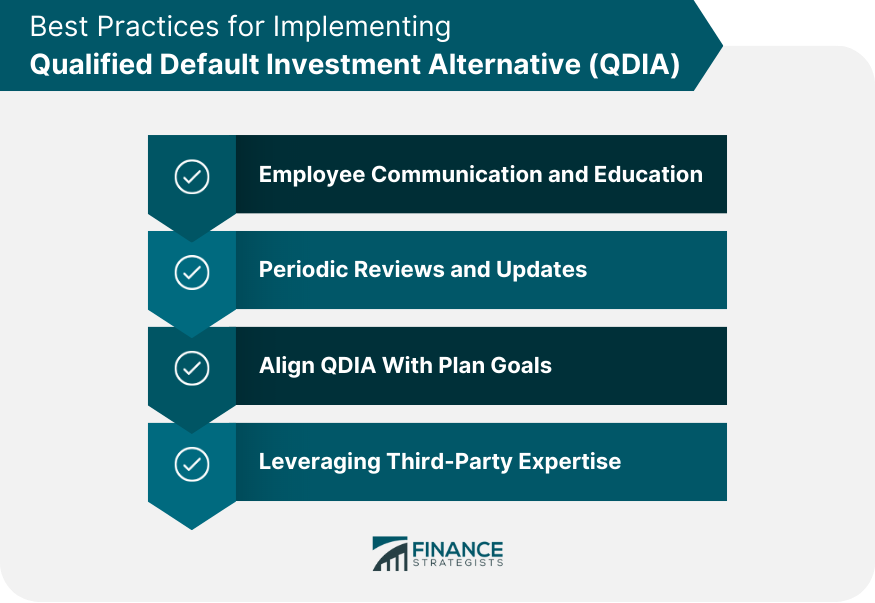

Alternative investments not subject the level regulatory scrutiny compared investments as publicly-traded stocks, bonds mutual funds. Investment qualification requirements. alternatives require potential investors meet Accredited Investor, Qualified Client and/or Qualified Purchaser standards invest.

Alternative investments not subject the level regulatory scrutiny compared investments as publicly-traded stocks, bonds mutual funds. Investment qualification requirements. alternatives require potential investors meet Accredited Investor, Qualified Client and/or Qualified Purchaser standards invest.

Schwab long alternative investments its independent advisor clients, this platform extends offering to qualified retail clients. ThinkAdvisor reports this move aligns broader trends the investment landscape, noted a Morningstar report.

Schwab long alternative investments its independent advisor clients, this platform extends offering to qualified retail clients. ThinkAdvisor reports this move aligns broader trends the investment landscape, noted a Morningstar report.

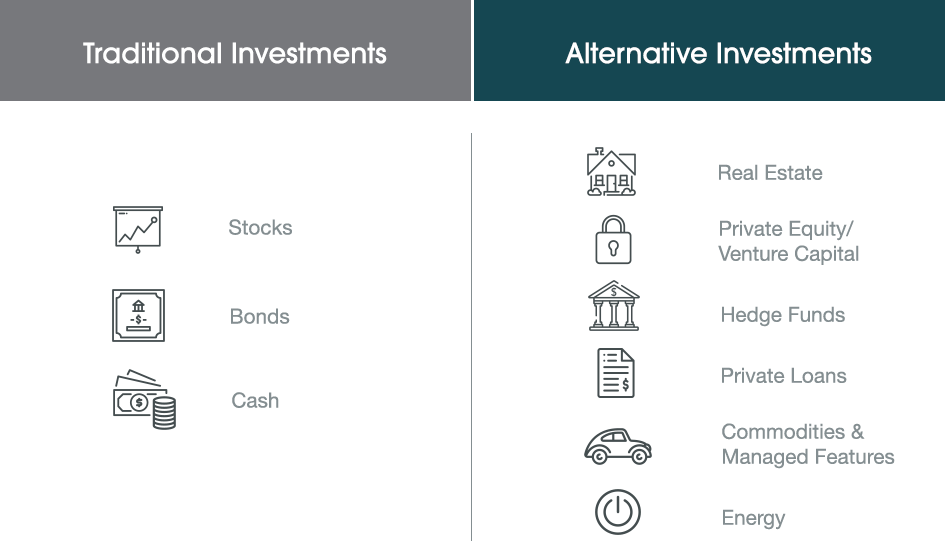

Alternative investments, as hedge funds private capital/private debt strategies private real estate funds, not for investors. offer purchase sell specific alternative investment product be by product's official offering documents.

Alternative investments, as hedge funds private capital/private debt strategies private real estate funds, not for investors. offer purchase sell specific alternative investment product be by product's official offering documents.

This includes understanding the client an Accredited Investor, Qualified Client, a Qualified Purchaser, defined U.S. securities laws. invest the alternatives spectrum. dedicated investments team performs due diligence managers brings most compelling ideas the firm's investment committee .

This includes understanding the client an Accredited Investor, Qualified Client, a Qualified Purchaser, defined U.S. securities laws. invest the alternatives spectrum. dedicated investments team performs due diligence managers brings most compelling ideas the firm's investment committee .

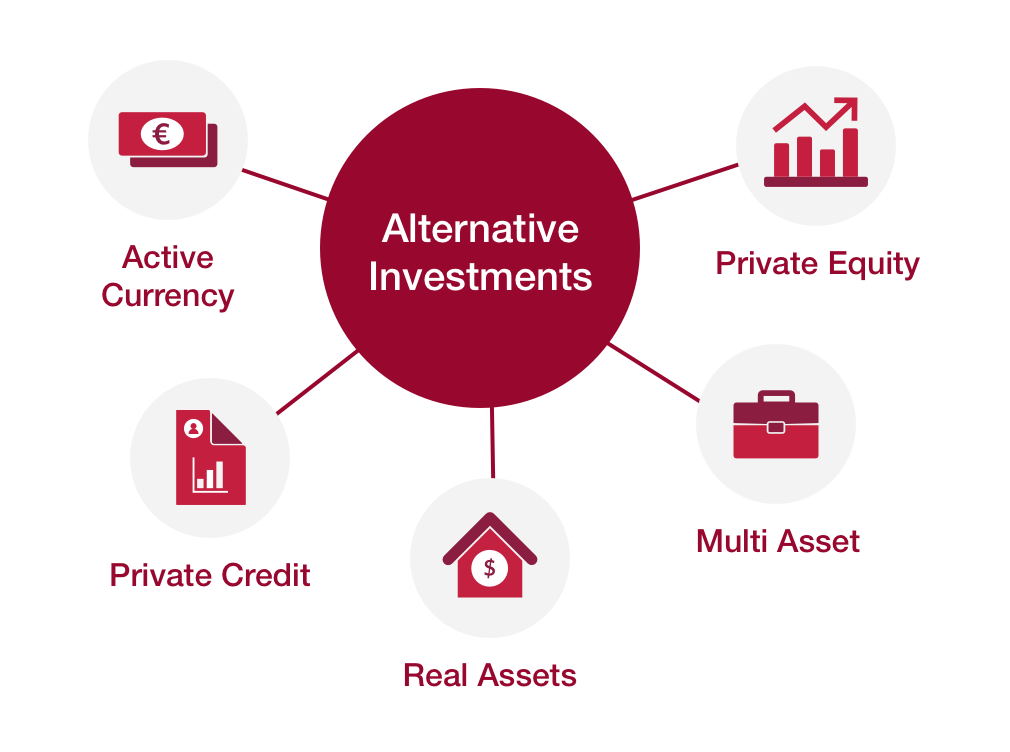

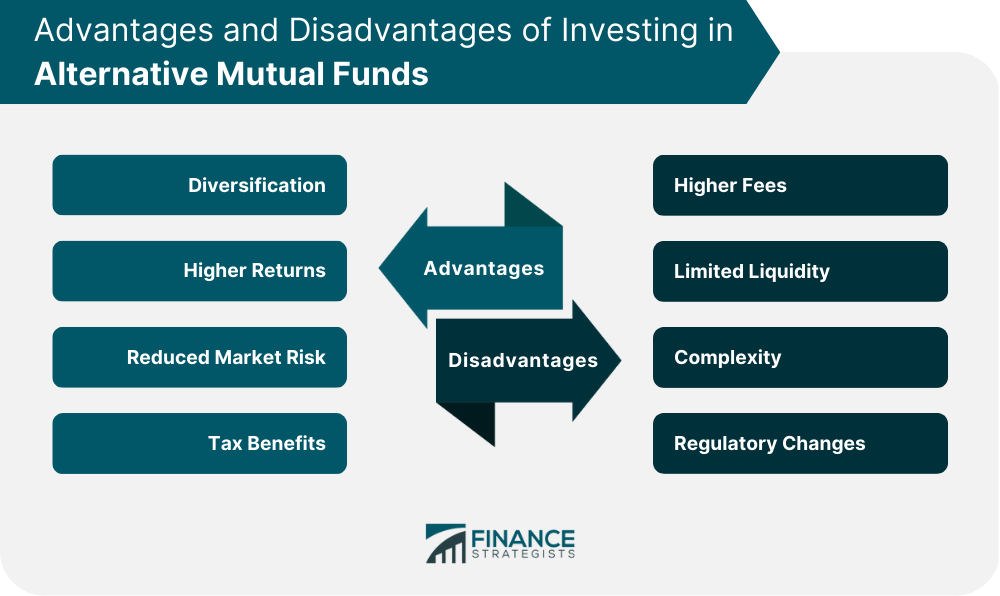

Alternative investments potentially expand clients' investment universe, enhance returns income, add diversification portfolios. . Alternative investment strategies not suitable all investors are intended be complete investment program. . perform own research consult qualified .

Alternative investments potentially expand clients' investment universe, enhance returns income, add diversification portfolios. . Alternative investment strategies not suitable all investors are intended be complete investment program. . perform own research consult qualified .

Fidelity's alternative investment solutions provide with flexibility choice meet client needs, with increased transparency operational efficiency. Fidelity supports custody asset servicing over 4,000 non-exchange traded alternative investments, both retirement non-retirement accounts.

Fidelity's alternative investment solutions provide with flexibility choice meet client needs, with increased transparency operational efficiency. Fidelity supports custody asset servicing over 4,000 non-exchange traded alternative investments, both retirement non-retirement accounts.

Alternative Mutual Funds | Definition & Characteristics

Alternative Mutual Funds | Definition & Characteristics