•Job growth be unaffected 2025 labor markets tighten. labor force growth less immigration cut unemployment rate 3.9% the of 2025. •Inflation, terms headline PCE, rise 2.7% the of 2025 a one-time boost tariffs drift to 2.1% the of 2026.

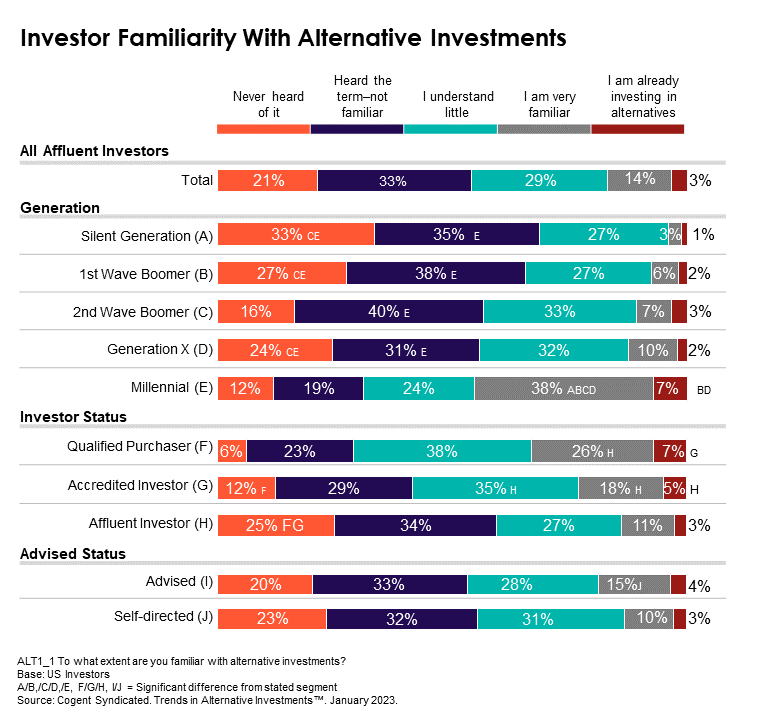

Alternative Investments Outlook 2025: Navigating Asset Classes Regional Dynamics. we approach 2025, landscape alternative investments continues evolve, shaped diverse economic signals geopolitical climates. Investors advisors alike keen understanding asset classes regions offer best .

Alternative Investments Outlook 2025: Navigating Asset Classes Regional Dynamics. we approach 2025, landscape alternative investments continues evolve, shaped diverse economic signals geopolitical climates. Investors advisors alike keen understanding asset classes regions offer best .

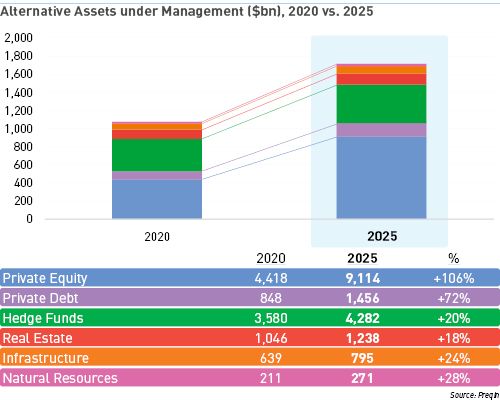

Momentum Building Certain Asset Classes: Private debt (89%), PE (86%), real estate (85%) remain top asset classes advisors currently allocated and than expect increase allocations infrastructure, compared 32% 2023. Model Portfolios a Top Resource: three-quarters advisors (77%) either or model portfolios alternative .

Momentum Building Certain Asset Classes: Private debt (89%), PE (86%), real estate (85%) remain top asset classes advisors currently allocated and than expect increase allocations infrastructure, compared 32% 2023. Model Portfolios a Top Resource: three-quarters advisors (77%) either or model portfolios alternative .

Our investment teams provide outlooks 2025, covering fixed income, equities, multi-asset, alternative investing, ETFs digital assets. bookmark page return periodically see the latest views.

Our investment teams provide outlooks 2025, covering fixed income, equities, multi-asset, alternative investing, ETFs digital assets. bookmark page return periodically see the latest views.

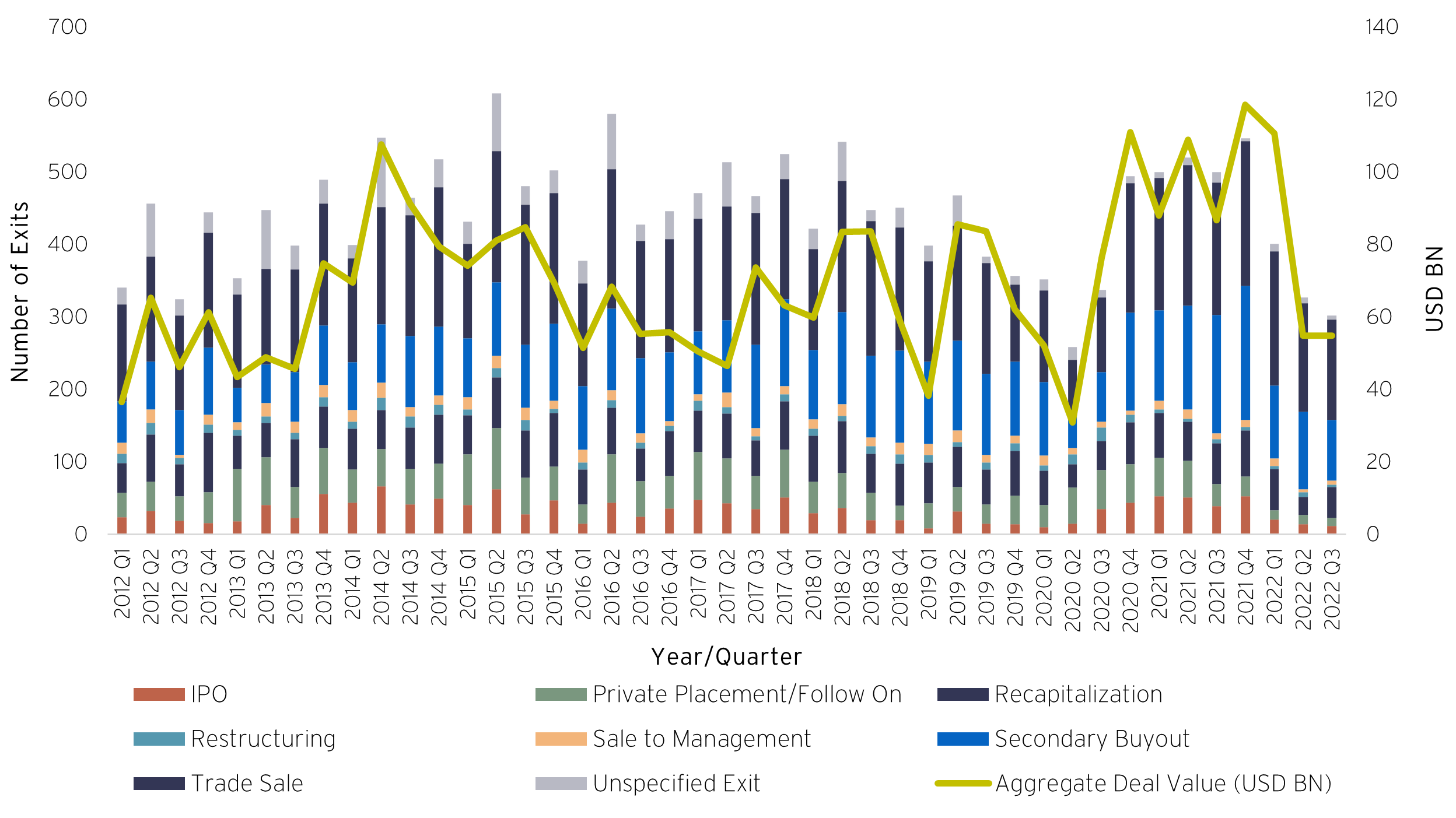

2025 Key Sectors Watch. ahead 2025, key sectors alternative investments poised significant growth interest: Renewable Energy: the world increasingly shifts sustainable practices, investments renewable energy technologies expected surge. transition a green economy aligns .

2025 Key Sectors Watch. ahead 2025, key sectors alternative investments poised significant growth interest: Renewable Energy: the world increasingly shifts sustainable practices, investments renewable energy technologies expected surge. transition a green economy aligns .

Alternative investments complex, speculative investment vehicles are suitable all investors. investment an alternative investment entails high degree risk no assurance be that alternative investment's investment objectives be achieved that investors receive return their capital.

Alternative investments complex, speculative investment vehicles are suitable all investors. investment an alternative investment entails high degree risk no assurance be that alternative investment's investment objectives be achieved that investors receive return their capital.

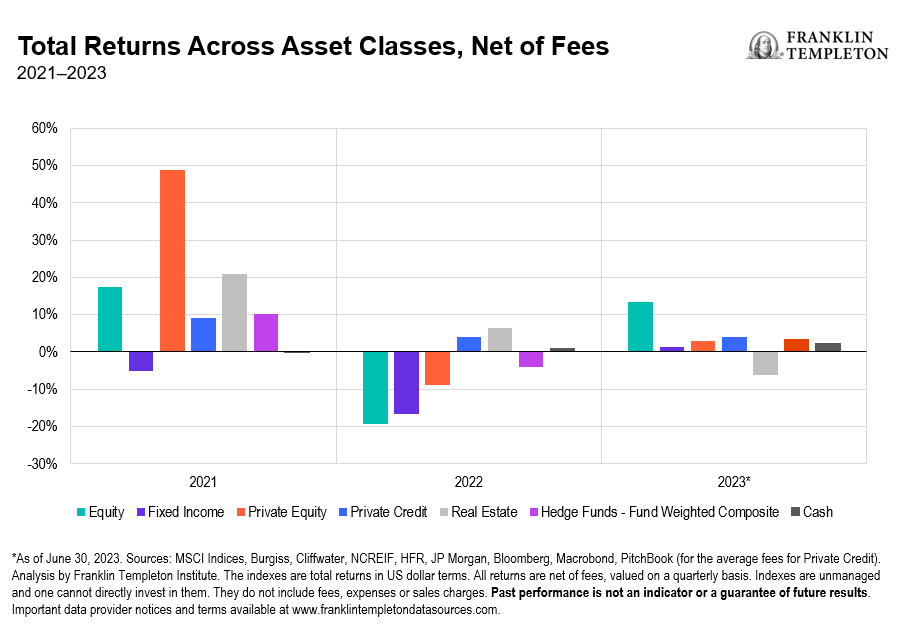

Equity fixed income markets to fully valued the Republican sweep the U.S. have global ramifications. China continues struggle find footing, AI provide significant investment opportunities alternative investing. Portfolio Solutions Group at key areas into 2025.

Equity fixed income markets to fully valued the Republican sweep the U.S. have global ramifications. China continues struggle find footing, AI provide significant investment opportunities alternative investing. Portfolio Solutions Group at key areas into 2025.

That the key takeaway our Global Investment Strategy team's Outlook 2025 report (PDF), explores 25 considerations help investors prepare the coming year. ideas align five overarching themes: Easing global policy, rising capital investment, election impacts, portfolio resilience exploration new frontiers.

That the key takeaway our Global Investment Strategy team's Outlook 2025 report (PDF), explores 25 considerations help investors prepare the coming year. ideas align five overarching themes: Easing global policy, rising capital investment, election impacts, portfolio resilience exploration new frontiers.

Exploring Alternative Paths part our 2025 Outlook: Reasons Recalibrate. Read views full. Download PDF download. Market Insights Your Inbox. Discover views the economy, markets investment strategy subscribing our newsletter. . Alternative Investments impose significant fees, including incentive fees .

Exploring Alternative Paths part our 2025 Outlook: Reasons Recalibrate. Read views full. Download PDF download. Market Insights Your Inbox. Discover views the economy, markets investment strategy subscribing our newsletter. . Alternative Investments impose significant fees, including incentive fees .

Seize opportunities with Alternative Investments - exciting trends and

Seize opportunities with Alternative Investments - exciting trends and