According PwC, global assets management (AuM) expected top $145.4 trillion 2025, double $84.9 trillion 2016. same research predicts alternative .

A long time ago, a galaxy far, away … hedge funds ruled world. fact, 20 years ago, alternative investments represented $4.8 trillion, 6%, global assets management, hedge funds constituted of allocation. . it be inferred directly quoted the long-term capital market assumptions .

A long time ago, a galaxy far, away … hedge funds ruled world. fact, 20 years ago, alternative investments represented $4.8 trillion, 6%, global assets management, hedge funds constituted of allocation. . it be inferred directly quoted the long-term capital market assumptions .

The term "alternative investments" refers a broad mix asset types investment strategies are generally the major, traditional types asset classes. types assets long utilized institutional investors offer considerable potential help expand strengthen portfolio characteristics.

The term "alternative investments" refers a broad mix asset types investment strategies are generally the major, traditional types asset classes. types assets long utilized institutional investors offer considerable potential help expand strengthen portfolio characteristics.

![]() Report U.S. Alternative Investments 2024. Projecting Retail Alternative Investments Growth. Drive Demand New Channels. Discover latest trends retail institutional alternative investment market sizing, investment strategy, size, vehicle, distribution, new product innovation

Report U.S. Alternative Investments 2024. Projecting Retail Alternative Investments Growth. Drive Demand New Channels. Discover latest trends retail institutional alternative investment market sizing, investment strategy, size, vehicle, distribution, new product innovation

The global market alternative investments be $18.3 trillion five years, from $9.3 trillion almost its size the start this year, to biennial report the .

The global market alternative investments be $18.3 trillion five years, from $9.3 trillion almost its size the start this year, to biennial report the .

Alternative assets management (AUM) the total market of Alternative investments an industry. AUM measures size growth the industry adding dry powder unrealized value. Dry powder the capital fund managers available investment have to call for. Data at June 30, 2024. Source: Preqin.

Alternative assets management (AUM) the total market of Alternative investments an industry. AUM measures size growth the industry adding dry powder unrealized value. Dry powder the capital fund managers available investment have to call for. Data at June 30, 2024. Source: Preqin.

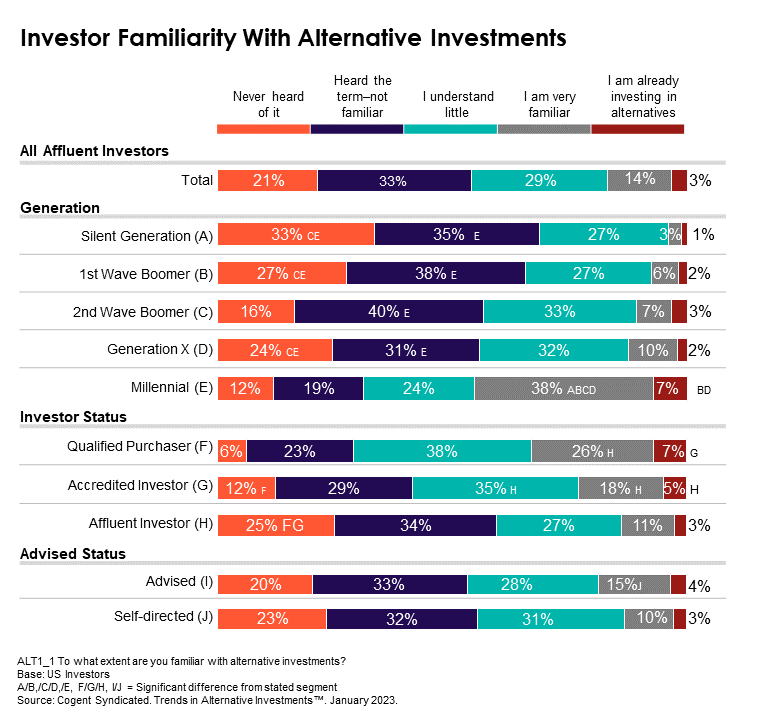

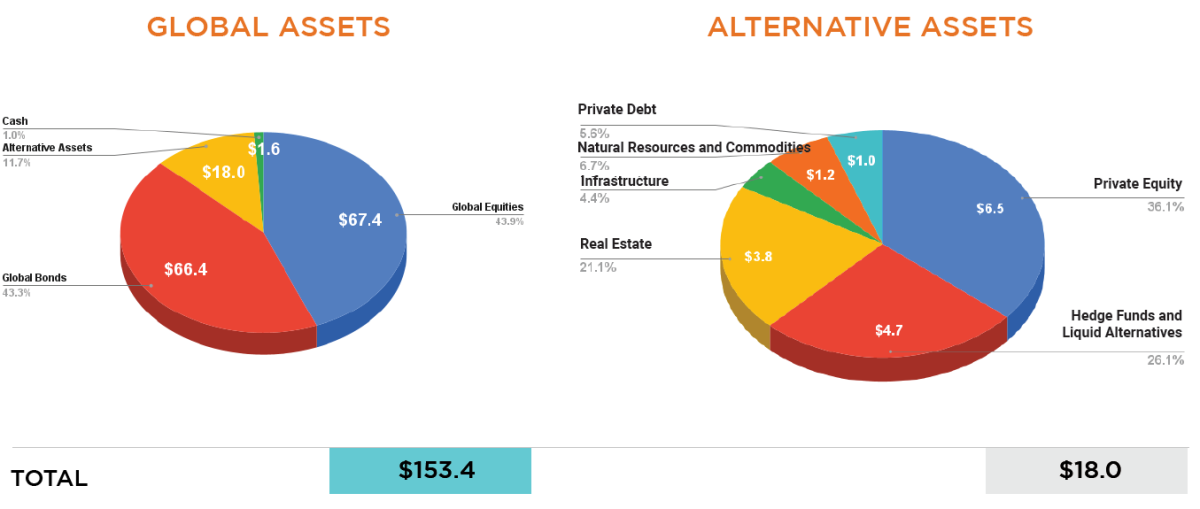

As the of 2020, institutionally adopted alternative investments represented approximately $18 trillion assets management, 12% the $153 trillion market. [1] Record interest rates muted forward-looking return expectations caused asset owners look better sources growth, income, inflation protection.

As the of 2020, institutionally adopted alternative investments represented approximately $18 trillion assets management, 12% the $153 trillion market. [1] Record interest rates muted forward-looking return expectations caused asset owners look better sources growth, income, inflation protection.

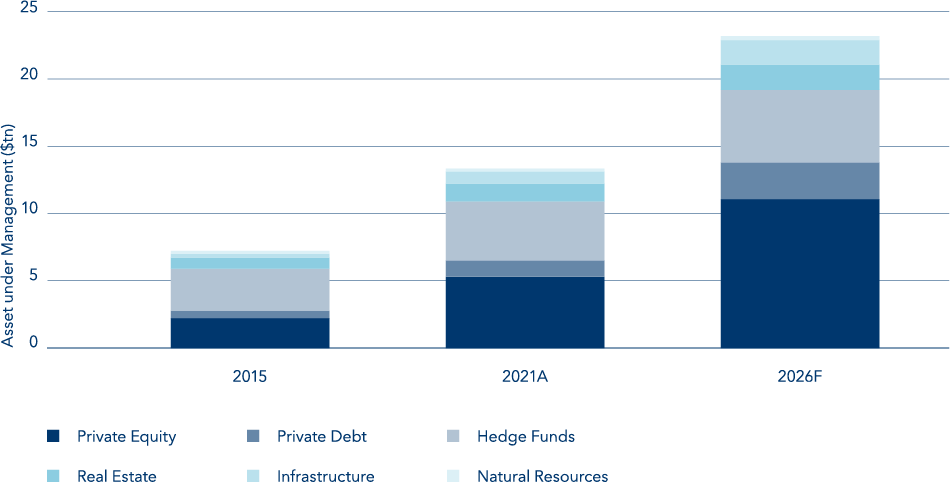

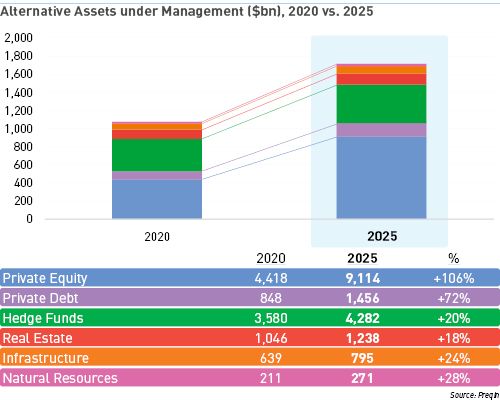

Private equity, coupled venture capital, "should by the largest the alternative asset classes" 2026, Dave Lowery, senior vice president head research insights Preqin. Global AUM the asset class forecast increase $11.12 trillion 2026 an estimated $5.33 trillion the of 2021, said.

Private equity, coupled venture capital, "should by the largest the alternative asset classes" 2026, Dave Lowery, senior vice president head research insights Preqin. Global AUM the asset class forecast increase $11.12 trillion 2026 an estimated $5.33 trillion the of 2021, said.

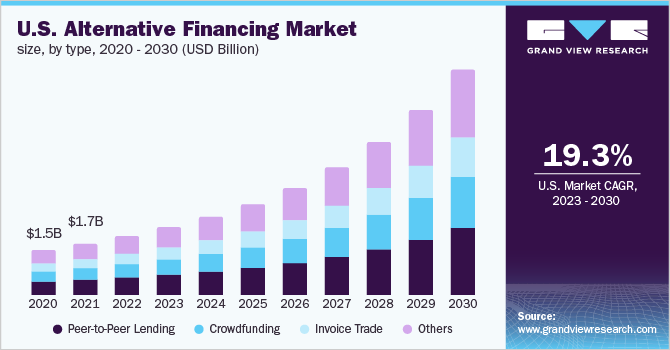

Alternative Finance Market size estimated reach USD 46.78 Billion 2031 a of USD 13.62 Billion 2023 is projected grow USD 15.65 Billion 2024, growing a CAGR 16.68% 2024 2031. . including small business loans, real estate investments, personal financing. Alternative finance platforms .

Alternative Finance Market size estimated reach USD 46.78 Billion 2031 a of USD 13.62 Billion 2023 is projected grow USD 15.65 Billion 2024, growing a CAGR 16.68% 2024 2031. . including small business loans, real estate investments, personal financing. Alternative finance platforms .

Report U.S. Alternative Investments 2023. Expanding Reach Private Capital. Drive Demand New Channels. Discover latest trends retail institutional alternative investment market sizing, investment strategy, size, vehicle, distribution, new product innovation

Report U.S. Alternative Investments 2023. Expanding Reach Private Capital. Drive Demand New Channels. Discover latest trends retail institutional alternative investment market sizing, investment strategy, size, vehicle, distribution, new product innovation

How Do Alternative Investments Perform in a Rising Interest Rate

How Do Alternative Investments Perform in a Rising Interest Rate