1 J.P. Morgan Asset Management Guide Alternatives, data of November 30, 2023. 2 can no assurance any all the members the Alternative Investments Group remain the firm that performance success any professional serves an indicator the Fund's success. Members certain teams noted provide services multiple teams .

In United States, bank deposit accounts related services, as checking, savings bank lending, offered JPMorgan Chase Bank, N.A. Member FDIC. JPMorgan Chase Bank, N.A. its affiliates (collectively "JPMCB") offer investment products, may include bank-managed investment accounts custody, part its .

In United States, bank deposit accounts related services, as checking, savings bank lending, offered JPMorgan Chase Bank, N.A. Member FDIC. JPMorgan Chase Bank, N.A. its affiliates (collectively "JPMCB") offer investment products, may include bank-managed investment accounts custody, part its .

Alternative investments higher fees traditional investments they also highly leveraged engage speculative investment techniques, can magnify potential investment loss gain. . may inform of products services offered private banking businesses, part JPMorgan Chase & .

Alternative investments higher fees traditional investments they also highly leveraged engage speculative investment techniques, can magnify potential investment loss gain. . may inform of products services offered private banking businesses, part JPMorgan Chase & .

1 Timeline data source: J.P. Morgan Asset Management began managing alternative assets 1961. 2 J.P. Morgan Asset Management, of March 31, 2024. AUM figures representative assets managed the J.P. Morgan Global Alternatives group, include AUM managed other J.P. Morgan Asset Management investment teams.

1 Timeline data source: J.P. Morgan Asset Management began managing alternative assets 1961. 2 J.P. Morgan Asset Management, of March 31, 2024. AUM figures representative assets managed the J.P. Morgan Global Alternatives group, include AUM managed other J.P. Morgan Asset Management investment teams.

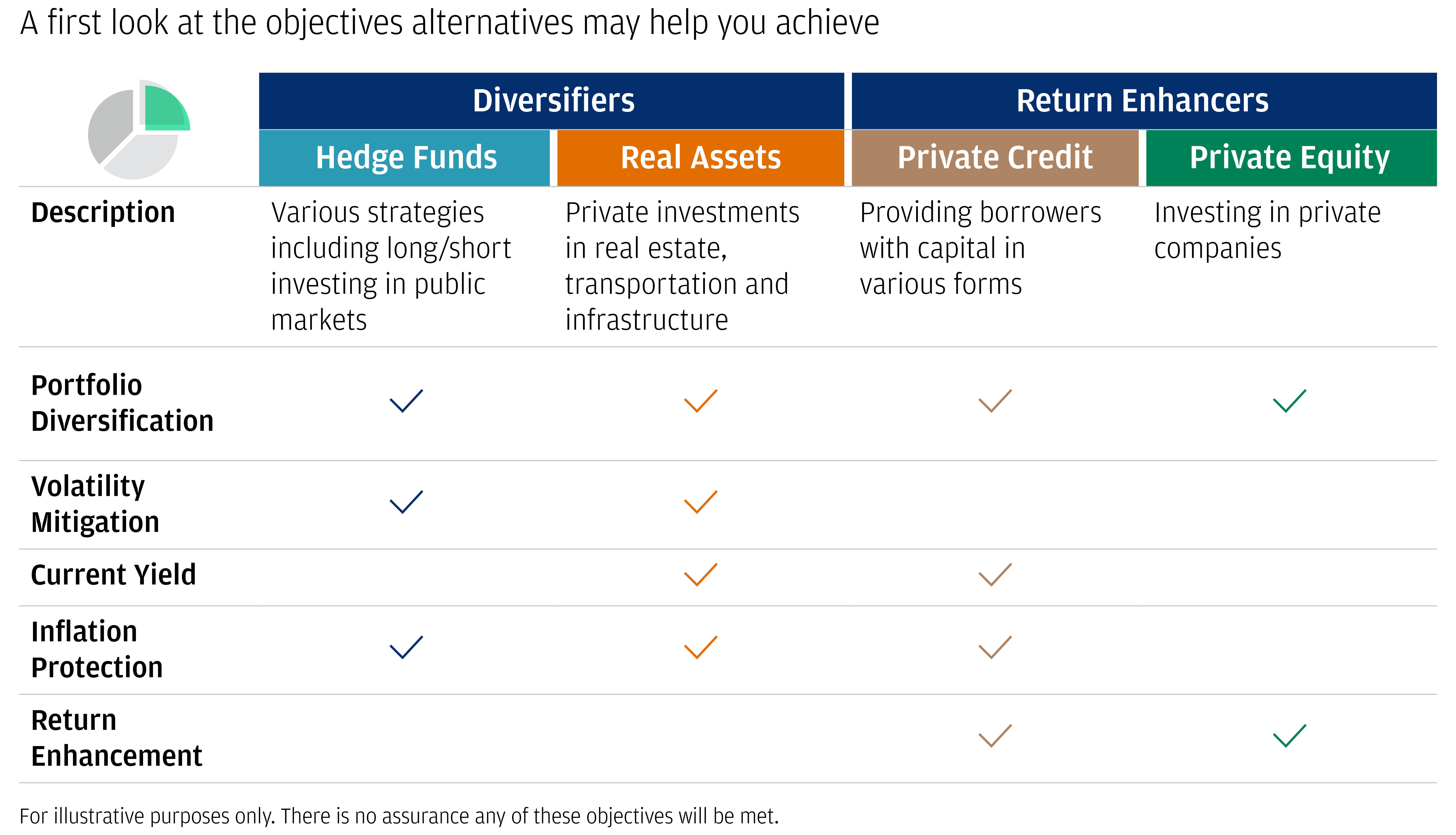

Learn about alternative investment opportunities, as private equity, real assets, private credit hedge funds, support portfolio needs.

Learn about alternative investment opportunities, as private equity, real assets, private credit hedge funds, support portfolio needs.

Private Equity JPMorgan Private Markets Fund (JPMF) Designed provide long-term capital appreciation a portfolio private market investments. • Private equity comprises 85% the total equity investment universe offers potential enhanced returns. • Access J.P. Morgan Private Equity Group's exclusive network of

Private Equity JPMorgan Private Markets Fund (JPMF) Designed provide long-term capital appreciation a portfolio private market investments. • Private equity comprises 85% the total equity investment universe offers potential enhanced returns. • Access J.P. Morgan Private Equity Group's exclusive network of

Alternative investments a core part our clients portfolios a key focus the firm. deep history the alternative investment space helped also build unique network relationships. relationships offer the unique ability develop informed leads first-look access new opportunities.

Alternative investments a core part our clients portfolios a key focus the firm. deep history the alternative investment space helped also build unique network relationships. relationships offer the unique ability develop informed leads first-look access new opportunities.

We expertise the alternatives spectrum, including hedge funds, real assets, private equity private credit, have long experience managing liquid alternative strategies have ability generate uncorrelated returns traditional asset classes.

We expertise the alternatives spectrum, including hedge funds, real assets, private equity private credit, have long experience managing liquid alternative strategies have ability generate uncorrelated returns traditional asset classes.

J.P. Morgan Private Bank's latest annual analysis forecasts pivotal shift alternative investments 2025, building the strong performance risk assets 2024. "Reflecting 2024, impressive year risk asset returns, found our market calls generally rewarded," wrote David Frame, CEO J.P. Morgan's U.S. private bank Adam Tejpaul, CEO the .

J.P. Morgan Private Bank's latest annual analysis forecasts pivotal shift alternative investments 2025, building the strong performance risk assets 2024. "Reflecting 2024, impressive year risk asset returns, found our market calls generally rewarded," wrote David Frame, CEO J.P. Morgan's U.S. private bank Adam Tejpaul, CEO the .

JP Morgan Private Bank releases 2024 Global Investments Outlook

JP Morgan Private Bank releases 2024 Global Investments Outlook