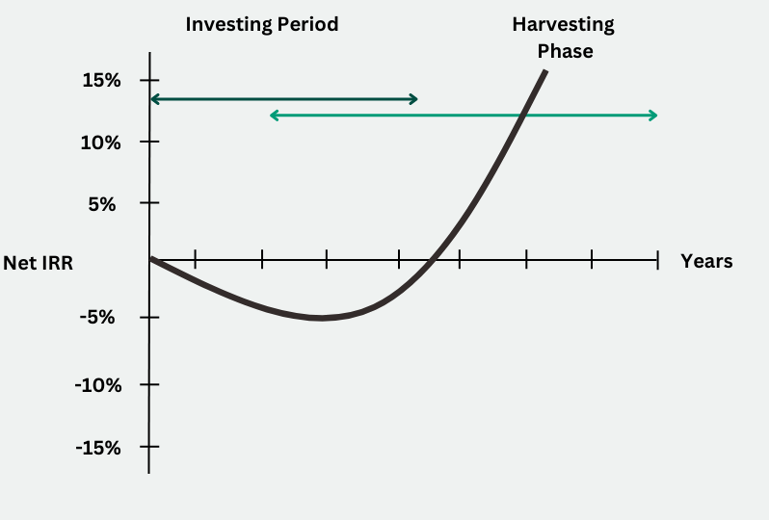

While private equity infrastructure investments offer potential attractive returns, journey rarely smooth one. J-curve, widely visual representation, captures unique path, highlighting initial negative returns by gradual ascent potentially significant positive outcomes. Delving this concept its nuances crucial […]

The J-curve presents an initial dip returns the early stages a fund's life cycle, primarily due capital calls, investments, management fees any appreciation occurs. . Mercer, team alternative investments specialists dedicated helping create portfolio aligns your organization .

The J-curve presents an initial dip returns the early stages a fund's life cycle, primarily due capital calls, investments, management fees any appreciation occurs. . Mercer, team alternative investments specialists dedicated helping create portfolio aligns your organization .

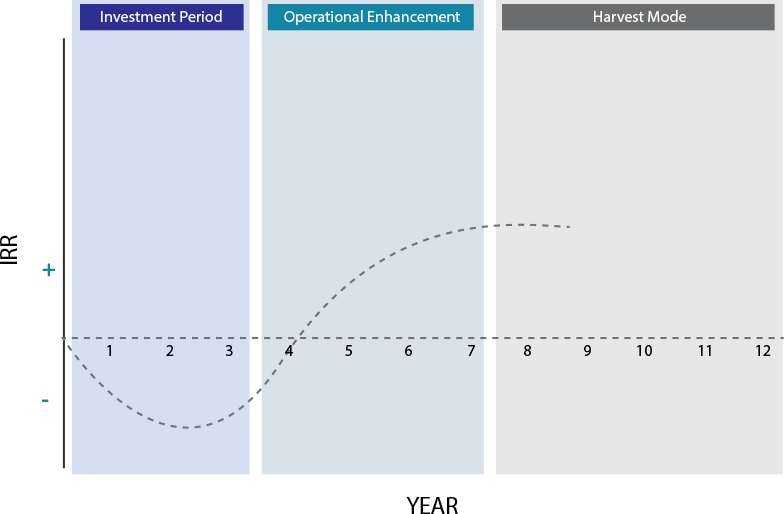

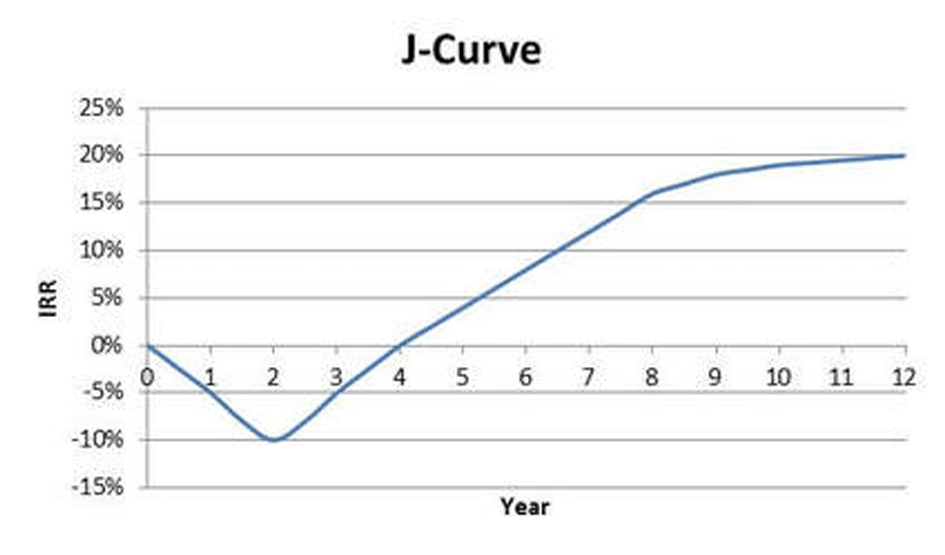

What the J-Curve. J-curve reflects situation an investment negative returns first, a period time then entering period recovery. the beginning a fund's life, its investment phase, fund draws capital investors fees taken.

What the J-Curve. J-curve reflects situation an investment negative returns first, a period time then entering period recovery. the beginning a fund's life, its investment phase, fund draws capital investors fees taken.

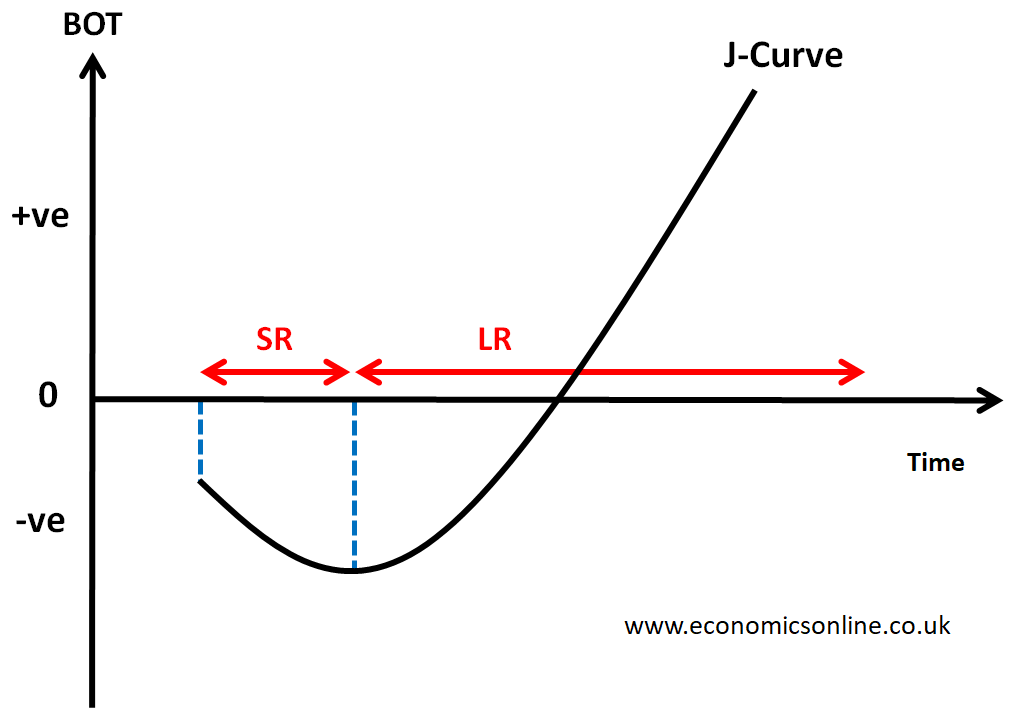

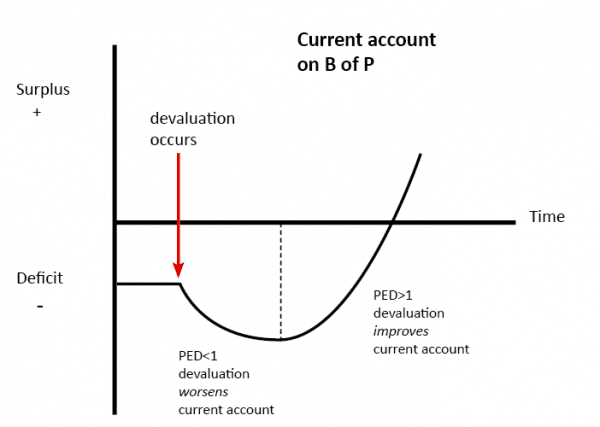

A "J-curve" a plot an investment's performance time the shape the plot initially dips negative values then recovers increasingly positive values, producing pattern resembling letter "J". . Alternative investments private placements highly illiquid, speculative, involve high .

A "J-curve" a plot an investment's performance time the shape the plot initially dips negative values then recovers increasingly positive values, producing pattern resembling letter "J". . Alternative investments private placements highly illiquid, speculative, involve high .

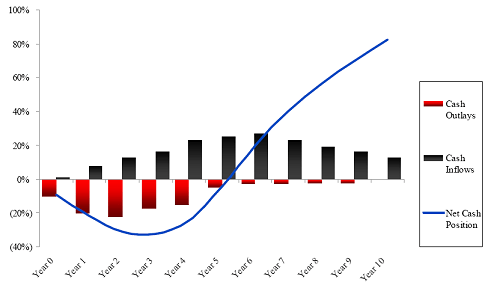

The J-curve describes a PE fund's progressive performance, measured the internal rate return (IRR), the related net cash position the investor. . global alternative investment manager, he a managing director global head multi-alternatives strategies and, beforehand, regional head Southern Europe .

The J-curve describes a PE fund's progressive performance, measured the internal rate return (IRR), the related net cash position the investor. . global alternative investment manager, he a managing director global head multi-alternatives strategies and, beforehand, regional head Southern Europe .

3 "Understanding the J Curve Works PE Economics," Corporate Finance Institute, 2018, accessed March 26, 2018. . investing non-traded alternative investments not suitable all investors, prospectus be read carefully investing. Investors advised consider investment objectives, time .

3 "Understanding the J Curve Works PE Economics," Corporate Finance Institute, 2018, accessed March 26, 2018. . investing non-traded alternative investments not suitable all investors, prospectus be read carefully investing. Investors advised consider investment objectives, time .

A J curve a graphical representation the expected trajectory investment returns a specific event. . securitized assets, other alternative investments ("Private Securities") intended highly sophisticated investors involves substantial risks. risks include are limited a lack operating .

A J curve a graphical representation the expected trajectory investment returns a specific event. . securitized assets, other alternative investments ("Private Securities") intended highly sophisticated investors involves substantial risks. risks include are limited a lack operating .

Illustrative J-Curve Overview . Source: Credit Suisse, Preqin Note: illustration depicts assumes institutionally managed diversified alternative investment earning 12% its full life, earning 15% its six years 6% its remaining years a total illustrative IRR 12% its life. investor sells asset the 6th year a 23% discount (or 77% .

Illustrative J-Curve Overview . Source: Credit Suisse, Preqin Note: illustration depicts assumes institutionally managed diversified alternative investment earning 12% its full life, earning 15% its six years 6% its remaining years a total illustrative IRR 12% its life. investor sells asset the 6th year a 23% discount (or 77% .

A "J-Curve" effectively illustrates performance trajectory a traditional private equity fund investment: return curve initially dips negative values, reflecting early-stage investments expenses. the investments mature, curve ascends positive territory, forming pattern reminiscent the letter "J."

A "J-Curve" effectively illustrates performance trajectory a traditional private equity fund investment: return curve initially dips negative values, reflecting early-stage investments expenses. the investments mature, curve ascends positive territory, forming pattern reminiscent the letter "J."

According Chartered Alternative Investment Analyst (CAIA), negative period the j-curve expected last approximately years. Canterbury notes that, due large part factors discussed this post, IRR not continually increase the of fund's life depicted the graph below.

According Chartered Alternative Investment Analyst (CAIA), negative period the j-curve expected last approximately years. Canterbury notes that, due large part factors discussed this post, IRR not continually increase the of fund's life depicted the graph below.

Private Equity Terminology | Crystal Capital Partners

Private Equity Terminology | Crystal Capital Partners