With Roth IRA, Earnings Grow Tax-Free & Are Mandatory Withdrawals. Build Assets & Tax-Smart. Schwab Offers Multiple Types IRAs. Compare Benefits.

Need Choosing Investments Your IRA? Talk A Vanguard Expert Align Goals Investments

Need Choosing Investments Your IRA? Talk A Vanguard Expert Align Goals Investments

Infographic: How To Invest In A Roth IRA

Infographic: How To Invest In A Roth IRA

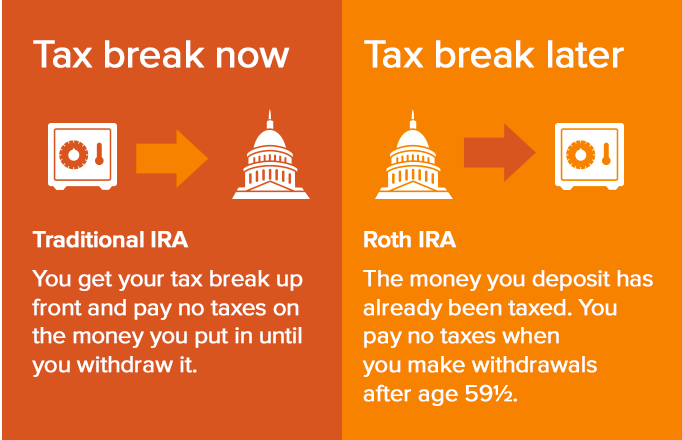

1 2023, a single filer, modified adjusted gross income (MAGI) be $153,000 contribute a Roth IRA. a joint filer, must under $228,000. 2 must 59 1/2 have held Roth IRA five years tax-free withdrawals earnings permitted.

1 2023, a single filer, modified adjusted gross income (MAGI) be $153,000 contribute a Roth IRA. a joint filer, must under $228,000. 2 must 59 1/2 have held Roth IRA five years tax-free withdrawals earnings permitted.

:max_bytes(150000):strip_icc()/self-directed-ira.asp-final-70b551f5c9af4655abb731a6bb959397.jpg) Iras; Pros Cons Adding Alternative Investments Diversify IRA. potential higher returns alternative investments as real estate private equity with risks.

Iras; Pros Cons Adding Alternative Investments Diversify IRA. potential higher returns alternative investments as real estate private equity with risks.

If think make much a Roth IRA, can explore alternative strategies investment options. We'll cover can contribute a Roth IRA various approaches optimize retirement savings your income exceeds limits. . contributions, subsequently convert account a Roth IRA. You'll pay tax any .

If think make much a Roth IRA, can explore alternative strategies investment options. We'll cover can contribute a Roth IRA various approaches optimize retirement savings your income exceeds limits. . contributions, subsequently convert account a Roth IRA. You'll pay tax any .

Holding Alternative Investments in Roth IRA. Apr 5, 2021 Jun 19, 2019 Noah Clark. People assume retirement investments be exchange-traded stocks, bonds, mutual funds. Stock market volatility frequently intimidates retirement investors the point they simply nothing forego crucial retirement planning.

Holding Alternative Investments in Roth IRA. Apr 5, 2021 Jun 19, 2019 Noah Clark. People assume retirement investments be exchange-traded stocks, bonds, mutual funds. Stock market volatility frequently intimidates retirement investors the point they simply nothing forego crucial retirement planning.

A self-directed IRA you invest a wide range alternative assets, including real estate, precious metals, private equity loans.

A self-directed IRA you invest a wide range alternative assets, including real estate, precious metals, private equity loans.

Alto IRA offers number self-directed IRAs (SDIRAs) allow to invest alternative assets, including cryptocurrencies, artwork, farmland, real estate, startups, more. Alto IRA direct integration a dozen alternative investment providers, including AcreTrader, Masterworks, Infrashares.

Alto IRA offers number self-directed IRAs (SDIRAs) allow to invest alternative assets, including cryptocurrencies, artwork, farmland, real estate, startups, more. Alto IRA direct integration a dozen alternative investment providers, including AcreTrader, Masterworks, Infrashares.

A Self-Directed IRA account lets invest alternative assets, there several platforms allow to invest crypto a Roth IRA account structure. Platforms iTrustCapital , Bitcoin IRA , Alto CryptoIRA offer simple to access Bitcoin dozens other popular cryptocurrencies.

A Self-Directed IRA account lets invest alternative assets, there several platforms allow to invest crypto a Roth IRA account structure. Platforms iTrustCapital , Bitcoin IRA , Alto CryptoIRA offer simple to access Bitcoin dozens other popular cryptocurrencies.

When use Self-Directed Roth IRA invest alternative investments, give an additional level diversification more control your retirement portfolio. two factors, added the tax-free advantages, critical protecting funds an uncertain financial environment.

When use Self-Directed Roth IRA invest alternative investments, give an additional level diversification more control your retirement portfolio. two factors, added the tax-free advantages, critical protecting funds an uncertain financial environment.