Module 3: Accessing Alternative Investments; Strategy Introductions. Organizes alternative investments four risk return categories. each these categories, multiple sub-strategies introduced, of cover characteristics, objectives, risks, performance, appropriateness a client better explain they .

This provides a theoretical practical into world managing alternative investments, particular, hedge funds. course is, however, organized the perspective . building blocks hedge fund strategies, presentations leading practitioners the field. example, past Fall, speakers .

This provides a theoretical practical into world managing alternative investments, particular, hedge funds. course is, however, organized the perspective . building blocks hedge fund strategies, presentations leading practitioners the field. example, past Fall, speakers .

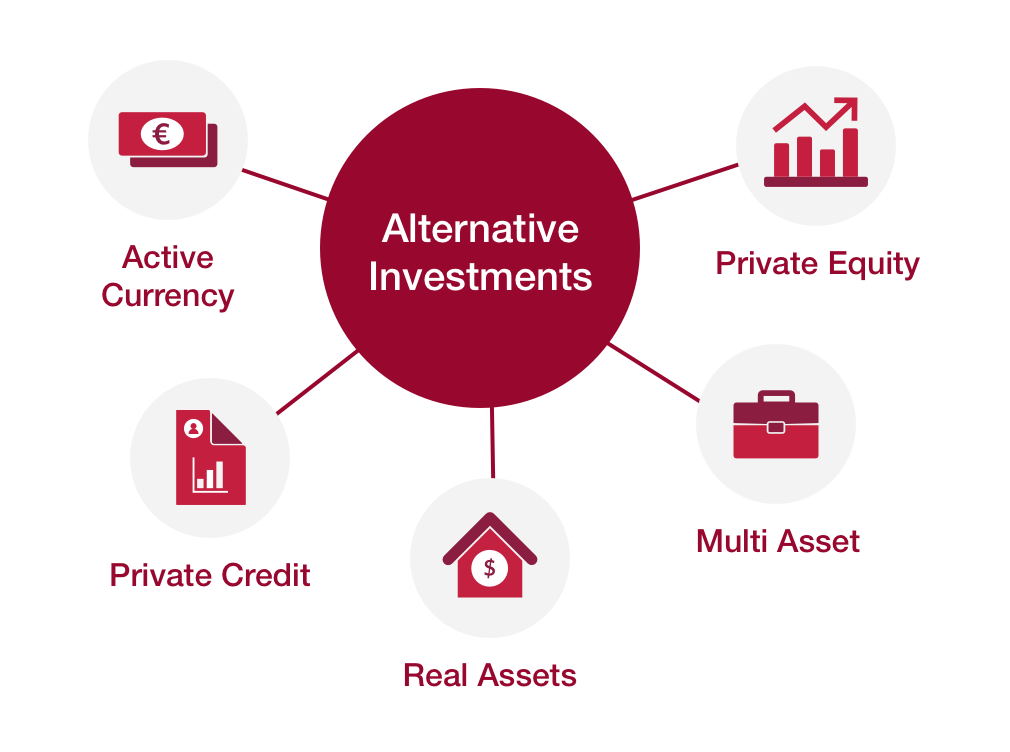

AN INTRODUCTION ALTERNATIVE INVESTMENTS 5 SEI's View Combining traditional alternative strategies satisfies basic principles efficient portfolio construction expanding variety risky assets a portfolio and, a result, improving expected risk-adjusted returns. we build portfolios based their objectives—

AN INTRODUCTION ALTERNATIVE INVESTMENTS 5 SEI's View Combining traditional alternative strategies satisfies basic principles efficient portfolio construction expanding variety risky assets a portfolio and, a result, improving expected risk-adjusted returns. we build portfolios based their objectives—

alternative investments, particular, hedge funds. long-term goal the is students understand investment managers put capital work. order do this, students to understand classic hedge fund strategies executed, to evaluate strategies well new ones, how manage risk.

alternative investments, particular, hedge funds. long-term goal the is students understand investment managers put capital work. order do this, students to understand classic hedge fund strategies executed, to evaluate strategies well new ones, how manage risk.

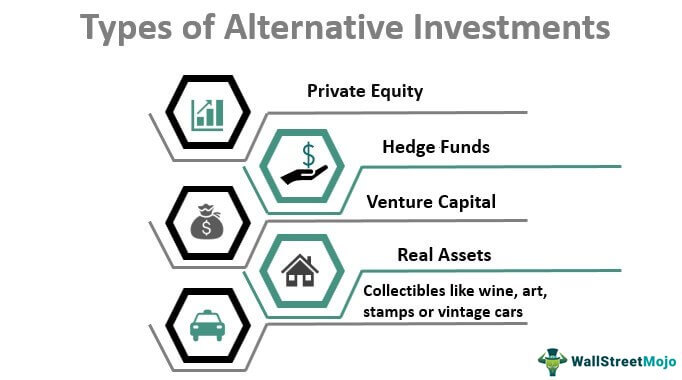

This provides overview investments assets traditional stocks bonds, including venture capital, private equity, private credit, hedge funds, real estate, commodities. case studies financial models, students evaluate investments based real-world examples. gain understanding what role alternative investments play a diversified .

This provides overview investments assets traditional stocks bonds, including venture capital, private equity, private credit, hedge funds, real estate, commodities. case studies financial models, students evaluate investments based real-world examples. gain understanding what role alternative investments play a diversified .

fund strategies, students also learning a complementary about due diligence, practical examples related each strategy the software. FINC-GB.2350: Alternative Investments I FINC-GB.2351: Alternative Investments II Preliminary Syllabus

fund strategies, students also learning a complementary about due diligence, practical examples related each strategy the software. FINC-GB.2350: Alternative Investments I FINC-GB.2351: Alternative Investments II Preliminary Syllabus

investments, alternative investments require (1) return computation methods, (2) statistical methods, (3) valuation methods, (4) portfolio management methods due the factors distinguish two. Relative traditional investments, (1) alternative investments have information

investments, alternative investments require (1) return computation methods, (2) statistical methods, (3) valuation methods, (4) portfolio management methods due the factors distinguish two. Relative traditional investments, (1) alternative investments have information

be valued accordance the definition fair and GIPS Valuation Principles Chapter II. investments, of liquidity, have valuations adhere the . Firms managing alternative investment strategies utilize subjective, unobservable inputs (e.g., model) create valuations there no .

be valued accordance the definition fair and GIPS Valuation Principles Chapter II. investments, of liquidity, have valuations adhere the . Firms managing alternative investment strategies utilize subjective, unobservable inputs (e.g., model) create valuations there no .

Alternative investments assets do fall traditional asset classes, as stocks, bonds, cash. . Explore investment strategies by hedge fund managers the areas bonds, stocks, fixed assets, currency, options, commodities. Environment the Financial Markets. Learn basic principles govern socially .

Alternative investments assets do fall traditional asset classes, as stocks, bonds, cash. . Explore investment strategies by hedge fund managers the areas bonds, stocks, fixed assets, currency, options, commodities. Environment the Financial Markets. Learn basic principles govern socially .

Alternative Investment Strategies (that actually work!) - YouTube

Alternative Investment Strategies (that actually work!) - YouTube