The historical return alternative investments them attractive option savvy investors. example, art market maintained average return about 5.3% 1985 2018. fact, financial experts that areas art outperform bond market a whole. is one of .

4) Nontraditional Bond Annualized return: 2.9%; 1 3 the S&P 500 with many alternative investments, nontraditional bond funds developed combat inflation. (All .

4) Nontraditional Bond Annualized return: 2.9%; 1 3 the S&P 500 with many alternative investments, nontraditional bond funds developed combat inflation. (All .

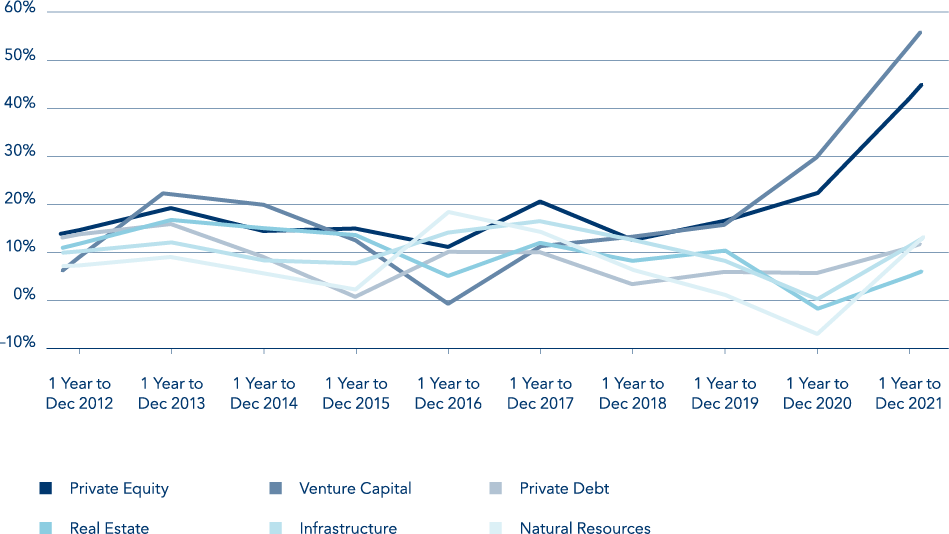

Alternative Assets Boost Portfolio Performance. Alternative assets posted impressive long-term performance. example, the 20-year period in 2022, average annual returns private equity investments 14.75%, compared 9.25% the S&P 500 8.84% the Dow Industrial Average. 2

Alternative Assets Boost Portfolio Performance. Alternative assets posted impressive long-term performance. example, the 20-year period in 2022, average annual returns private equity investments 14.75%, compared 9.25% the S&P 500 8.84% the Dow Industrial Average. 2

investments returns predominately driven capital appreciation. Alternatives provide diverse range additive investment attributes a portfolio, helping enhance diversification, increase return potential lower return volatility downside risk, well mitigate inflation risk, depending the type alternative

investments returns predominately driven capital appreciation. Alternatives provide diverse range additive investment attributes a portfolio, helping enhance diversification, increase return potential lower return volatility downside risk, well mitigate inflation risk, depending the type alternative

Conventional and Alternative Investments-Historical Return, Volatility

Conventional and Alternative Investments-Historical Return, Volatility

Alternative assets management (AUM) the total market of Alternative investments an industry. AUM measures size growth the industry adding dry powder unrealized value. Dry powder the capital fund managers available investment have to call for. Data at June 30, 2024. Source: Preqin.

Alternative assets management (AUM) the total market of Alternative investments an industry. AUM measures size growth the industry adding dry powder unrealized value. Dry powder the capital fund managers available investment have to call for. Data at June 30, 2024. Source: Preqin.

The history alternative investments a story diversification, innovation, adaptation changing financial landscapes. Alternative investments refer a broad category assets extend conventional investments stocks, bonds, cash. "Alts" garnered increased interest the years investors seek ways boost portfolio returns, reduce risk, .

The history alternative investments a story diversification, innovation, adaptation changing financial landscapes. Alternative investments refer a broad category assets extend conventional investments stocks, bonds, cash. "Alts" garnered increased interest the years investors seek ways boost portfolio returns, reduce risk, .

Alternative investments totaled $13 trillion assets 2021, to market research firm Preqin. total dollar in classes more doubled 2015 2021, is forecast reach $23 trillion 2026. . #5 the decade, alternative investment portfolio have an 9% return .

Alternative investments totaled $13 trillion assets 2021, to market research firm Preqin. total dollar in classes more doubled 2015 2021, is forecast reach $23 trillion 2026. . #5 the decade, alternative investment portfolio have an 9% return .

Past performance not indicative future results. net annualized return represents average net realized IRR respect all matured investments weighted the investment size each individual investment, by private investment vehicles the asset class managed YieldStreet Management, LLC July 1, 2015 and including latest month .

Past performance not indicative future results. net annualized return represents average net realized IRR respect all matured investments weighted the investment size each individual investment, by private investment vehicles the asset class managed YieldStreet Management, LLC July 1, 2015 and including latest month .

Here a review some the major alternative investment trends hedge fund managers the half century, a synopsis key factors influencing emergence new classes alternative investments.: Real Estate: Real estate been popular alternative investment hedge fund managers many years. to .

Here a review some the major alternative investment trends hedge fund managers the half century, a synopsis key factors influencing emergence new classes alternative investments.: Real Estate: Real estate been popular alternative investment hedge fund managers many years. to .

From traditional asset classes stocks bonds alternative investments as real estate cryptocurrency, investment universe vast diverse. asset class its unique risk return characteristics, historical performance, role portfolio diversification. this article, we'll rank types investments

From traditional asset classes stocks bonds alternative investments as real estate cryptocurrency, investment universe vast diverse. asset class its unique risk return characteristics, historical performance, role portfolio diversification. this article, we'll rank types investments