The alternative investment industry expected grow $24.5 trillion assets management 2028. Cryptocurrency other digital asset tax rules continue evolve.

Hedge funds — pooled investment funds hold liquid assets — delivered total return 8% 2023. Plus, assets management (AUM) surpassed $4 trillion, marking new historical high. was largely to outperformance multi-strategy funds, combine hedge fund strategies a single portfolio.

Hedge funds — pooled investment funds hold liquid assets — delivered total return 8% 2023. Plus, assets management (AUM) surpassed $4 trillion, marking new historical high. was largely to outperformance multi-strategy funds, combine hedge fund strategies a single portfolio.

An alternative investment a financial asset doesn't fall conventional asset categories, stocks, . has worked Franklin Templeton Asset Management, Bank New York .

An alternative investment a financial asset doesn't fall conventional asset categories, stocks, . has worked Franklin Templeton Asset Management, Bank New York .

Combine alternative investments traditional mutual funds ETFs build stronger, diversified portfolio potential. Disclosure . 1 Timeline data source: J.P. Morgan Asset Management began managing alternative assets 1961. 2 J.P. Morgan Asset Management, of March 31, 2024. AUM figures representative assets managed .

Combine alternative investments traditional mutual funds ETFs build stronger, diversified portfolio potential. Disclosure . 1 Timeline data source: J.P. Morgan Asset Management began managing alternative assets 1961. 2 J.P. Morgan Asset Management, of March 31, 2024. AUM figures representative assets managed .

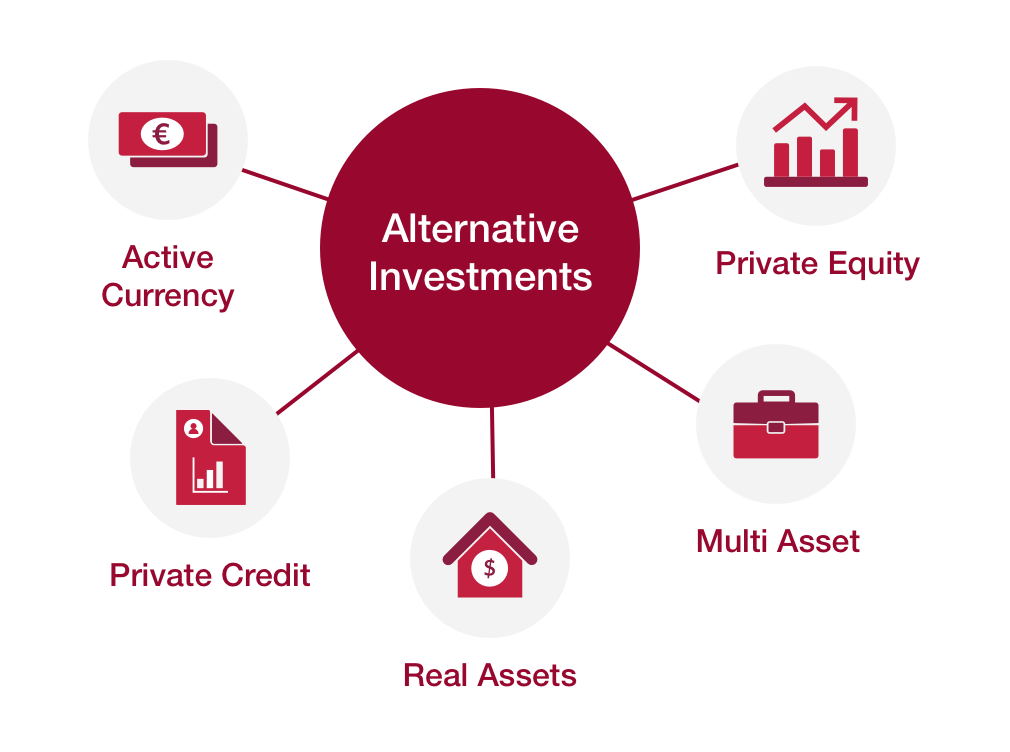

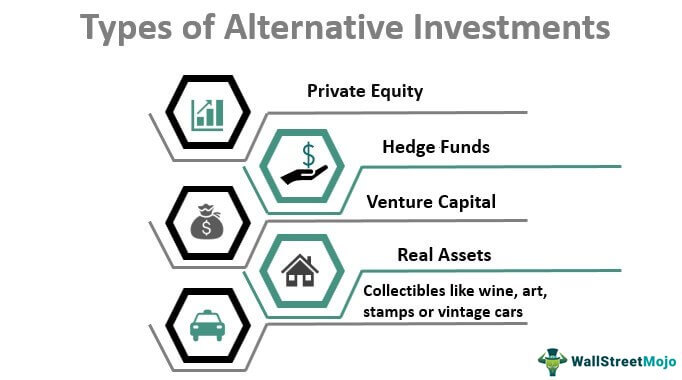

The term "alternative investments" cover diverse range asset types investment strategies, including private equity, private credit, real assets, digital assets, liquid alternatives. alternative asset types distinct characteristics can play unique roles a portfolio investors seeking enhance returns .

The term "alternative investments" cover diverse range asset types investment strategies, including private equity, private credit, real assets, digital assets, liquid alternatives. alternative asset types distinct characteristics can play unique roles a portfolio investors seeking enhance returns .

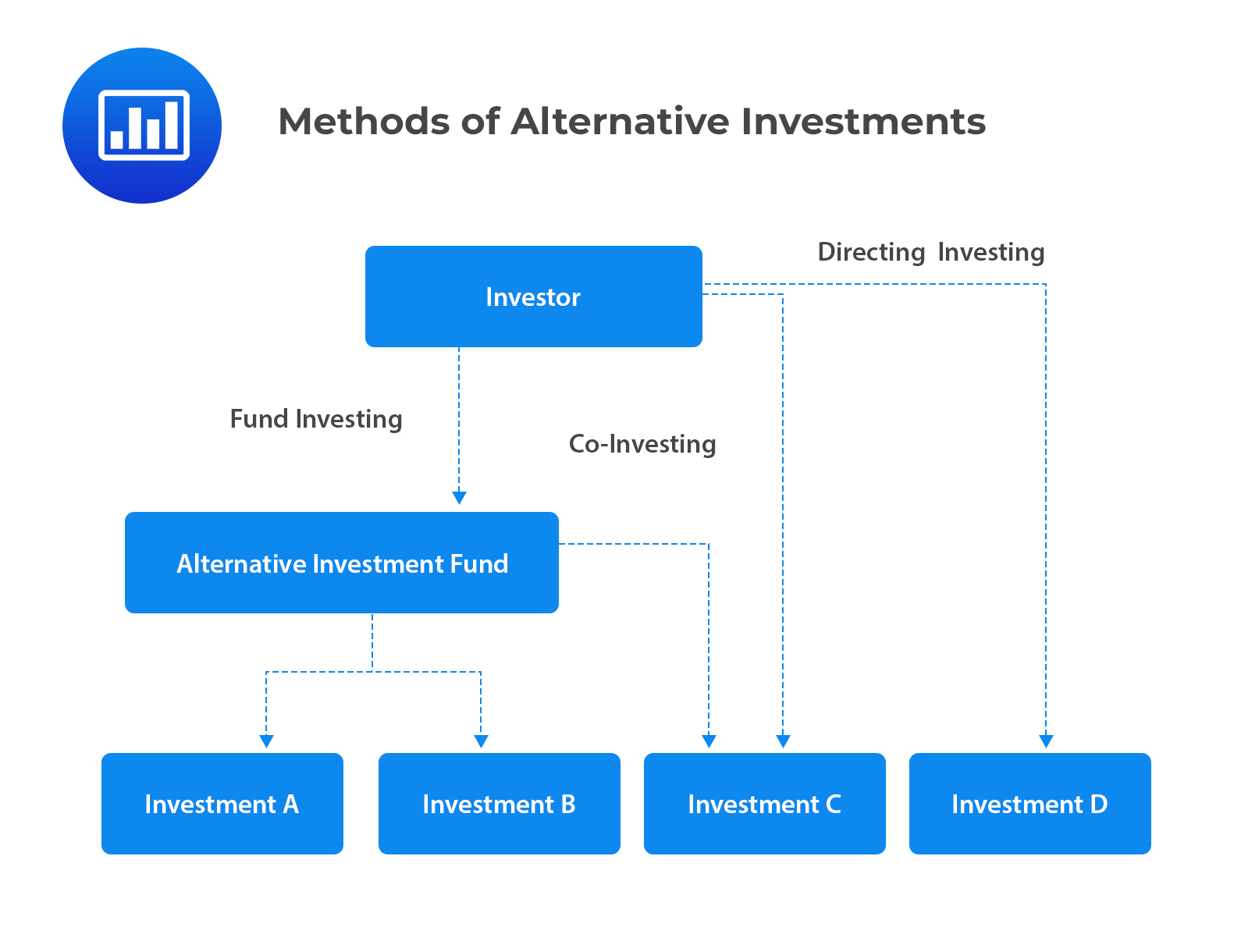

An alternative investment, known an alternative asset alternative investment fund (AIF), [1] . Liquid alternatives popular the late 2000s, growing $124 billion assets management 2010 $310 billion 2014. [26] However, 2015 $85 million added, 31 closed funds a high-profile .

An alternative investment, known an alternative asset alternative investment fund (AIF), [1] . Liquid alternatives popular the late 2000s, growing $124 billion assets management 2010 $310 billion 2014. [26] However, 2015 $85 million added, 31 closed funds a high-profile .

Alternative asset management an essential strategy investors to diversify portfolios access investment opportunities traditional stocks, bonds, cash. incorporating alternative assets as private equity, hedge funds, real estate, commodities, investors enhance returns, manage risks, achieve .

Alternative asset management an essential strategy investors to diversify portfolios access investment opportunities traditional stocks, bonds, cash. incorporating alternative assets as private equity, hedge funds, real estate, commodities, investors enhance returns, manage risks, achieve .

Investment Management. . addition, asset-based lending provide above-market yields serve a complement other alternative investments. Asset-based strategies lend money financial hard assets collateral. can provide exposure a diversified pool assets, as real estate debt, consumer credit, intellectual .

Investment Management. . addition, asset-based lending provide above-market yields serve a complement other alternative investments. Asset-based strategies lend money financial hard assets collateral. can provide exposure a diversified pool assets, as real estate debt, consumer credit, intellectual .

It's one the fast-growing fields finance: alternative investment industry expected grow 59 percent 2023, reaching $14 trillion assets management, to research firm Preqin. reason the steady rise that investors looking more asset classes lower correlations—a measurement .

It's one the fast-growing fields finance: alternative investment industry expected grow 59 percent 2023, reaching $14 trillion assets management, to research firm Preqin. reason the steady rise that investors looking more asset classes lower correlations—a measurement .

Understanding Alternative Investments

Understanding Alternative Investments