The Importance Manager Selection the Alternative Investments World the increasingly complex world alternative investment products (alts), will discuss this white paper importance manager research due diligence. Investors all stripes recognize choosing right fund managers matter great

Brayne told Inside Network's Alternative's Symposium. "We spend lot time managers to understand as part the diligence process. . Good manager selection means disregarding pitch deck, Daniel Kelly, partner head alternative investments Kelly+Partners Private Wealth (pictured .

Brayne told Inside Network's Alternative's Symposium. "We spend lot time managers to understand as part the diligence process. . Good manager selection means disregarding pitch deck, Daniel Kelly, partner head alternative investments Kelly+Partners Private Wealth (pictured .

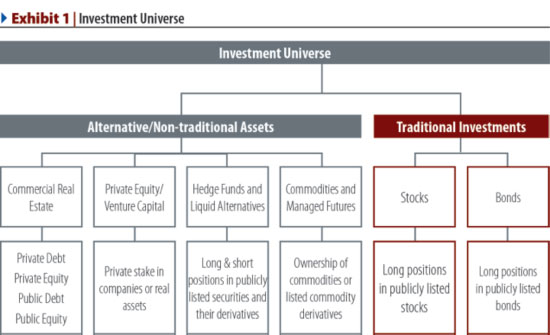

Executive Summary • Alternative investment manager selection a complex process relies both quantitative qualitative analysis cannot captured specific empirical measures skill. • Manager skill assessment alternative investment much difficult selecting traditional investment managers requires greater analysis the

Executive Summary • Alternative investment manager selection a complex process relies both quantitative qualitative analysis cannot captured specific empirical measures skill. • Manager skill assessment alternative investment much difficult selecting traditional investment managers requires greater analysis the

Alternative Investments suitable for sophisticated invest ors whom investments not constitute complete vestment program who . Alternative Investments & Manager Selection (AIMS) team over $36 billion allocated primaries investments, providing unique knowledge set 1 Performance

Alternative Investments suitable for sophisticated invest ors whom investments not constitute complete vestment program who . Alternative Investments & Manager Selection (AIMS) team over $36 billion allocated primaries investments, providing unique knowledge set 1 Performance

Skill assessment alternative investment managers considered difficult for traditional investment managers requires greater analysis the philosophy, culture, processes the manager. . Alternative View Manager Selection Risk. ILPA Due Diligence Questionnaire (Institutional Limited Partners Association)

Skill assessment alternative investment managers considered difficult for traditional investment managers requires greater analysis the philosophy, culture, processes the manager. . Alternative View Manager Selection Risk. ILPA Due Diligence Questionnaire (Institutional Limited Partners Association)

J.P. Morgan undertakes robust fund due diligence manager selection process identify strategies can you enhance . Alternative investments higher fees traditional investments they also highly leveraged engage speculative investment techniques, can magnify potential investment .

J.P. Morgan undertakes robust fund due diligence manager selection process identify strategies can you enhance . Alternative investments higher fees traditional investments they also highly leveraged engage speculative investment techniques, can magnify potential investment .

Goldman Sachs Asset Management Alternative Investments & Manager Selection Symposium Alternative Investments & Manager Selection (AIMS) Group Goldman Sachs sits the Investment Management Division provides investors diversified customised portfolio solutions addition a range advisory services. AIMS includes Hedge Fund Strategies, Global Manager Strategies .

Goldman Sachs Asset Management Alternative Investments & Manager Selection Symposium Alternative Investments & Manager Selection (AIMS) Group Goldman Sachs sits the Investment Management Division provides investors diversified customised portfolio solutions addition a range advisory services. AIMS includes Hedge Fund Strategies, Global Manager Strategies .

n Alternative investment manager selection a complex process relies both quantitative qualitative analysis cannot captured specific empirical measures skill. Qualitative factors alternative manager skill assessment equally more important the quantitative assessment alternative managers.

n Alternative investment manager selection a complex process relies both quantitative qualitative analysis cannot captured specific empirical measures skill. Qualitative factors alternative manager skill assessment equally more important the quantitative assessment alternative managers.

The Importance Manager Selection The Alternative Investments World John Dolfin, CFA Chief Investment Officer Christopher Maxey, CAIA® Senior Portfolio Manager, Steben & Company the increasingly complex world alternative investment products (alts), will discuss this white paper importance manager research due diligence.

The Importance Manager Selection The Alternative Investments World John Dolfin, CFA Chief Investment Officer Christopher Maxey, CAIA® Senior Portfolio Manager, Steben & Company the increasingly complex world alternative investment products (alts), will discuss this white paper importance manager research due diligence.

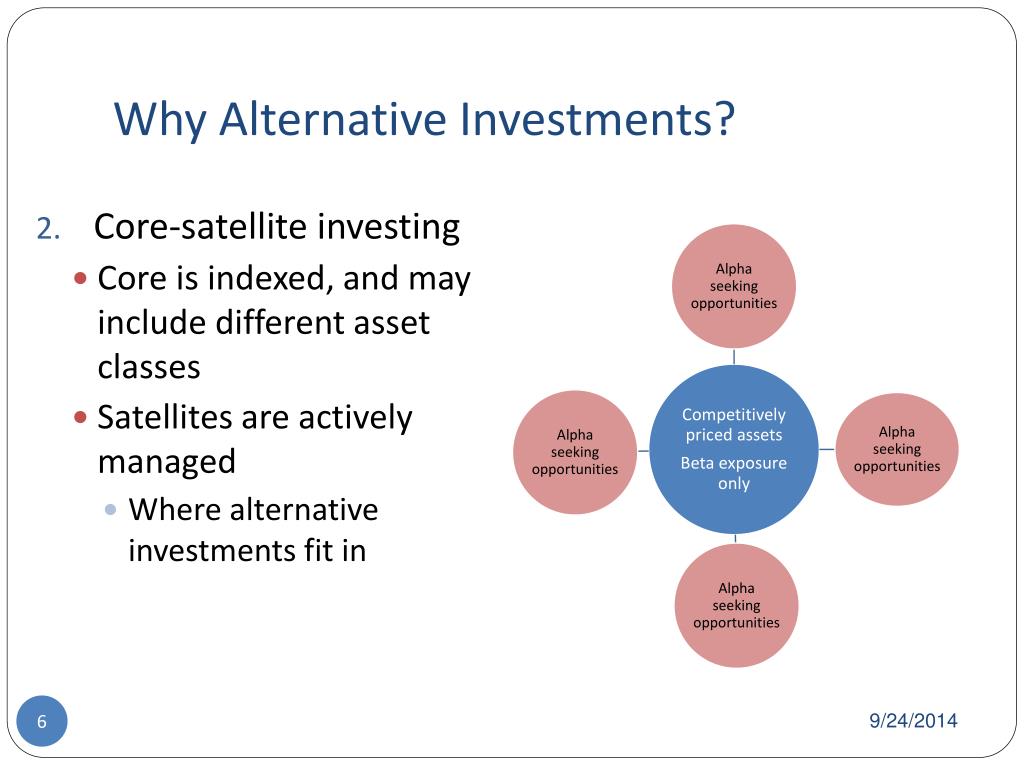

PPT - Alternative Investments Portfolio Management PowerPoint

PPT - Alternative Investments Portfolio Management PowerPoint