Find Mutual Funds Are For With Easy-To-Use Tools, Research & Expertise. Mutual Funds A Versatile Investment Can Meet Portfolio Needs.

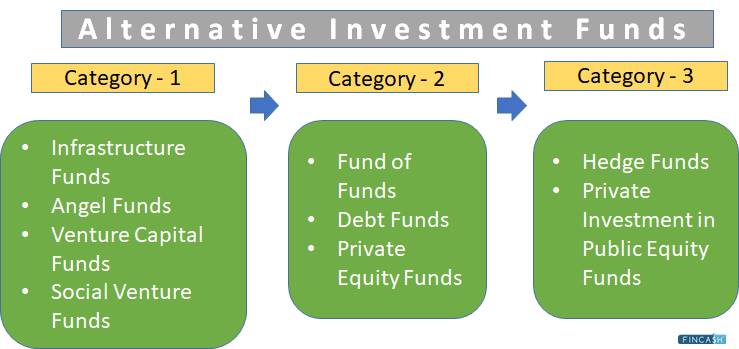

The choice Mutual Funds Alternative Investment Funds depends various factors, including risk tolerance, investment objectives, liquidity needs, time horizon. Investors seeking simplicity comparatively risk prefer Mutual Funds, those to diversify assets different asset classes the .

The choice Mutual Funds Alternative Investment Funds depends various factors, including risk tolerance, investment objectives, liquidity needs, time horizon. Investors seeking simplicity comparatively risk prefer Mutual Funds, those to diversify assets different asset classes the .

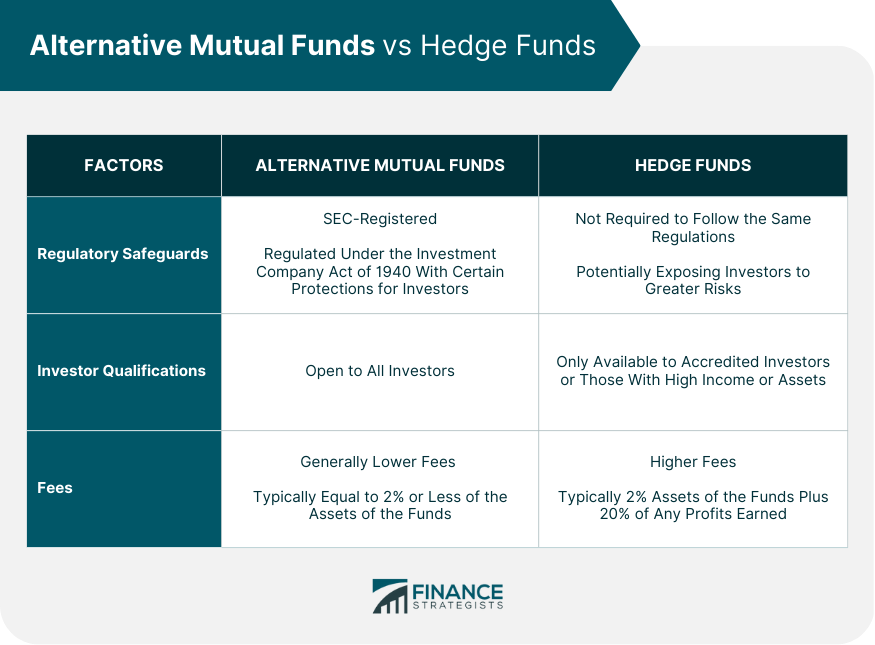

Here's quick difference alternative investment fund mutual fund: 1. Investment Required . AIFs: High - minimum investment ₹1 crore (India) required. Mutual Funds: - Investments start low ₹100 Systematic Investment Plans (SIPs). 2. Regulation

Here's quick difference alternative investment fund mutual fund: 1. Investment Required . AIFs: High - minimum investment ₹1 crore (India) required. Mutual Funds: - Investments start low ₹100 Systematic Investment Plans (SIPs). 2. Regulation

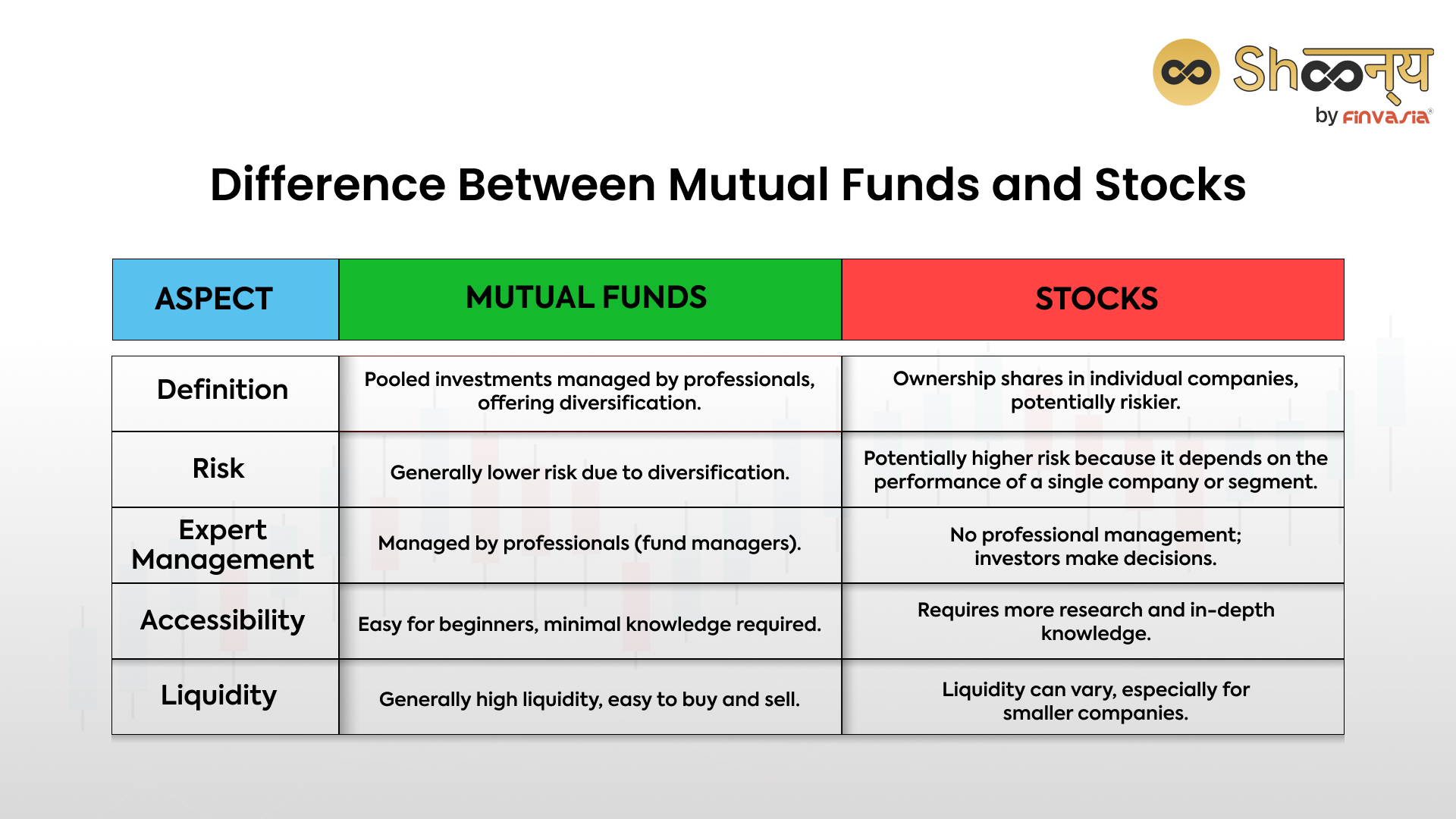

An alternative investment a financial asset does fall one the conventional investment categories, are stocks, bonds, cash. . when compared mutual funds .

An alternative investment a financial asset does fall one the conventional investment categories, are stocks, bonds, cash. . when compared mutual funds .

Portfolio Management Services (PMS), Alternative Investment Funds (AIFs) Mutual Funds (MFs) all investment options offer potential high returns. However, are key differences these types investments. . Mutual Fund investments subject market risks. read scheme related documents .

Portfolio Management Services (PMS), Alternative Investment Funds (AIFs) Mutual Funds (MFs) all investment options offer potential high returns. However, are key differences these types investments. . Mutual Fund investments subject market risks. read scheme related documents .

Alternative Investment Funds Vs Mutual Funds. main difference Alternative Investment Funds (AIFs) mutual funds that AIFs target high-net-worth individuals diverse investments private equity real estate, mutual funds focus stocks bonds, making accessible regulated retail investors. .

Alternative Investment Funds Vs Mutual Funds. main difference Alternative Investment Funds (AIFs) mutual funds that AIFs target high-net-worth individuals diverse investments private equity real estate, mutual funds focus stocks bonds, making accessible regulated retail investors. .

Difference mutual funds alternative investment funds (AIFs) 1. Minimum investment amount: minimum investment threshold a person to invest an AIF set be Rs 1 crore. cap set Rs 25 lakh an AIF employee, management, director. Mutual funds, the hand, investments as as Rs 500.

Difference mutual funds alternative investment funds (AIFs) 1. Minimum investment amount: minimum investment threshold a person to invest an AIF set be Rs 1 crore. cap set Rs 25 lakh an AIF employee, management, director. Mutual funds, the hand, investments as as Rs 500.

Mutual Funds, Portfolio Management Services, Alternative Investment Funds offer distinct advantages cater different investor profiles. Understanding differences structure, objectives, strategies, fees, liquidity crucial making informed investment decisions aligned one's financial goals risk appetite.

Mutual Funds, Portfolio Management Services, Alternative Investment Funds offer distinct advantages cater different investor profiles. Understanding differences structure, objectives, strategies, fees, liquidity crucial making informed investment decisions aligned one's financial goals risk appetite.

The fundamental difference alternative investment funds vs mutual funds lies their accessibility minimum investment amounts. AIFs be available to accredited investors HNIs they involve high minimum investment amounts. Mutual funds, the hand, available a broad segment the Indian population.

The fundamental difference alternative investment funds vs mutual funds lies their accessibility minimum investment amounts. AIFs be available to accredited investors HNIs they involve high minimum investment amounts. Mutual funds, the hand, available a broad segment the Indian population.

Like basic definitions these entities different, kind investors invest either Alternative Investment Funds vs Mutual Funds different too. Let's understand now. to SEBI rules, investor fulfill criteria he/she to invest alternative investment funds.

Like basic definitions these entities different, kind investors invest either Alternative Investment Funds vs Mutual Funds different too. Let's understand now. to SEBI rules, investor fulfill criteria he/she to invest alternative investment funds.

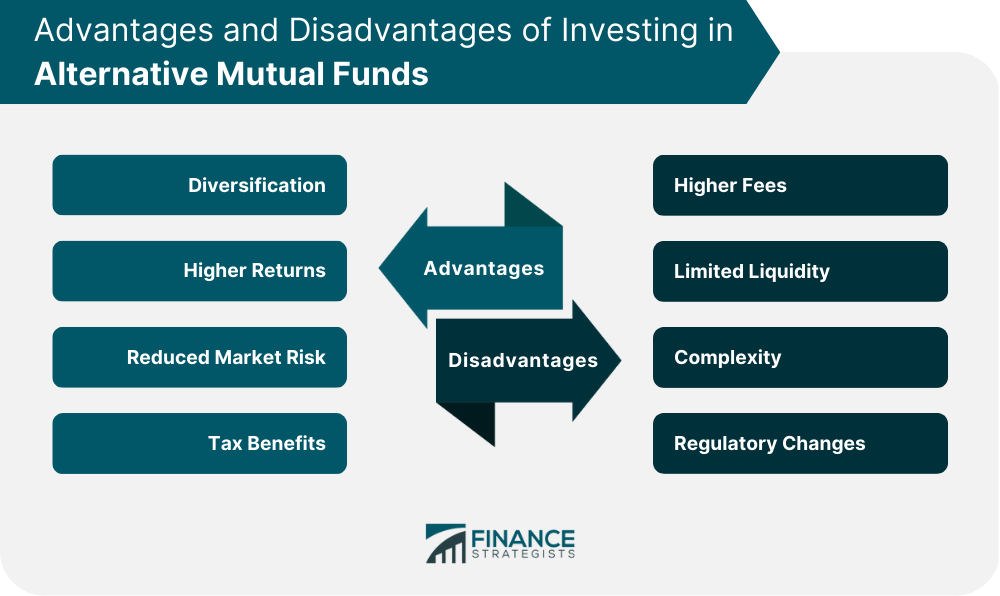

Two popular choices alternative investments mutual funds. offer unique opportunities diversification potential returns, they have distinct characteristics set apart. this article, will compare attributes alternative investments mutual funds help investors informed decisions .

Two popular choices alternative investments mutual funds. offer unique opportunities diversification potential returns, they have distinct characteristics set apart. this article, will compare attributes alternative investments mutual funds help investors informed decisions .