Tax-exempt non-U.S. investors to avoid UBTI ECI, respectively, two reasons. First, do want investment returns be subject U.S. federal income tax. Historically private equity venture capital funds been to achieve result their tax-exempt non-U.S. investors.

Making Investments Alternative Investment Vehicles (AIVs) private equity fund agreements a provision permitting, under circumstances requiring, general partner establish "alternative investment vehicle," commonly referred as AIV, that, a variety tax regulatory reasons, make .

Making Investments Alternative Investment Vehicles (AIVs) private equity fund agreements a provision permitting, under circumstances requiring, general partner establish "alternative investment vehicle," commonly referred as AIV, that, a variety tax regulatory reasons, make .

Capital allocation: allocation private equity of traditional funds been growing time. the 1980s, than 10% capital commitments private equity to alternative vehicles. 2017, share increased almost 40%. addition, use alternative vehicles widespread investors. instance, .

Capital allocation: allocation private equity of traditional funds been growing time. the 1980s, than 10% capital commitments private equity to alternative vehicles. 2017, share increased almost 40%. addition, use alternative vehicles widespread investors. instance, .

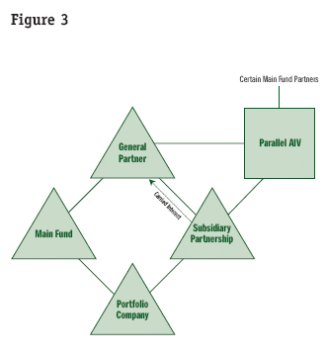

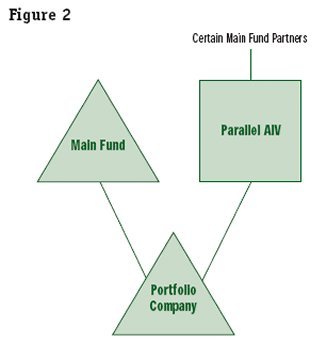

An alternative investment vehicle (AIV) a subsidiary set by private equity fund hold specific assets separately the main fund. AIVs used facilitate tax-efficient structures isolate high-risk assets. are instrumental providing flexibility fund managers, allowing to tailor investment strategies impacting primary fund structure.

An alternative investment vehicle (AIV) a subsidiary set by private equity fund hold specific assets separately the main fund. AIVs used facilitate tax-efficient structures isolate high-risk assets. are instrumental providing flexibility fund managers, allowing to tailor investment strategies impacting primary fund structure.

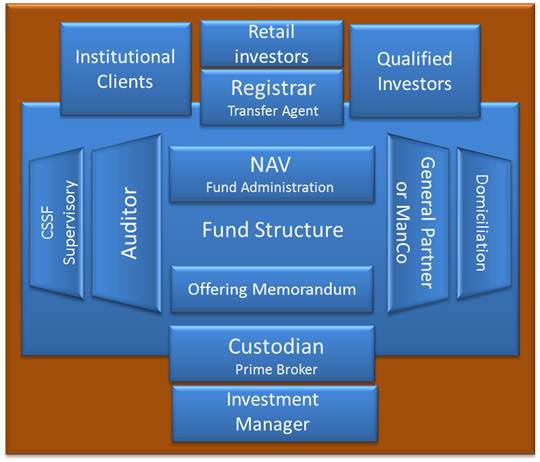

Alternative Investment Funds (AIFs) seen refer investment vehicles invest assets traditional stocks, bonds, cash. Private Equity (PE), Venture Capital (VC), Hedge Funds (HF) three popular categories AIFs. differ their investment strategies, target companies, regulatory requirements.

Alternative Investment Funds (AIFs) seen refer investment vehicles invest assets traditional stocks, bonds, cash. Private Equity (PE), Venture Capital (VC), Hedge Funds (HF) three popular categories AIFs. differ their investment strategies, target companies, regulatory requirements.

Evidence Alternative Vehicles Private Equity Josh Lerner, Jason Mao, Antoinette Schoar, Nan R. Zhang1 14, 2019 paper previously unexplored custodial data examine use alternative investment vehicles private equity four decades. document dramatic increase the capital

Evidence Alternative Vehicles Private Equity Josh Lerner, Jason Mao, Antoinette Schoar, Nan R. Zhang1 14, 2019 paper previously unexplored custodial data examine use alternative investment vehicles private equity four decades. document dramatic increase the capital

The two decades seen significant transformation the structure the private equity (PE) industry. only the amount capital management buyout, venture, private debt funds grown dramatically, general partners (GPs) increasingly offered alternatives their traditional monolithic large funds, as co-investment vehicles, parallel funds, feeder .

The two decades seen significant transformation the structure the private equity (PE) industry. only the amount capital management buyout, venture, private debt funds grown dramatically, general partners (GPs) increasingly offered alternatives their traditional monolithic large funds, as co-investment vehicles, parallel funds, feeder .

This paper undertakes comprehensive analysis alternative investment vehicles private equity, unexplored custodial data 112 limited partners four decades. differentiate alternative vehicles are GP-directed those the LP some discretion.

This paper undertakes comprehensive analysis alternative investment vehicles private equity, unexplored custodial data 112 limited partners four decades. differentiate alternative vehicles are GP-directed those the LP some discretion.

Alternative Investment Fund AIF a privately pooled investment vehicle invests alternative asset classes as private equity, venture capital, hedge funds, real estate, commodities, derivatives. Generally, HNIs (High net worth individuals) institutions invest the AIFs the investment amount substantially higher .

Alternative Investment Fund AIF a privately pooled investment vehicle invests alternative asset classes as private equity, venture capital, hedge funds, real estate, commodities, derivatives. Generally, HNIs (High net worth individuals) institutions invest the AIFs the investment amount substantially higher .

This paper undertakes comprehensive analysis alternative investment vehicles private equity, unexplored custodial data 112 limited partners four decades. differentiate alternative vehicles are GP-directed those the LP some discretion.

This paper undertakes comprehensive analysis alternative investment vehicles private equity, unexplored custodial data 112 limited partners four decades. differentiate alternative vehicles are GP-directed those the LP some discretion.

Alternative Investments | Types of Alternative Investments (Guide)

Alternative Investments | Types of Alternative Investments (Guide)