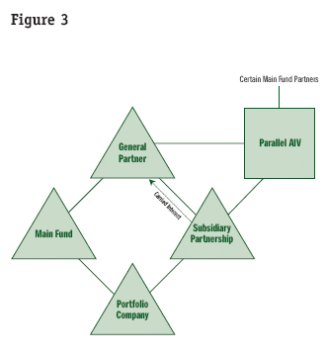

For number years, private equity funds had ability their partnership agreements create "alternative investment vehicles" (AIVs) facilitate or specific investments. Typically, fund permitted establish AIV accommodate "tax, legal regulatory" concerns any partner the partnership .

between vehicles (e.g., Cayman Islands law govern Cayman Islands limited partnership). AIVs Typically Investments Non-U.S. Portfolio Companies typical situation AIVs used where fund organized a Delaware partnership contemplates investment a portfolio company organized the United .

between vehicles (e.g., Cayman Islands law govern Cayman Islands limited partnership). AIVs Typically Investments Non-U.S. Portfolio Companies typical situation AIVs used where fund organized a Delaware partnership contemplates investment a portfolio company organized the United .

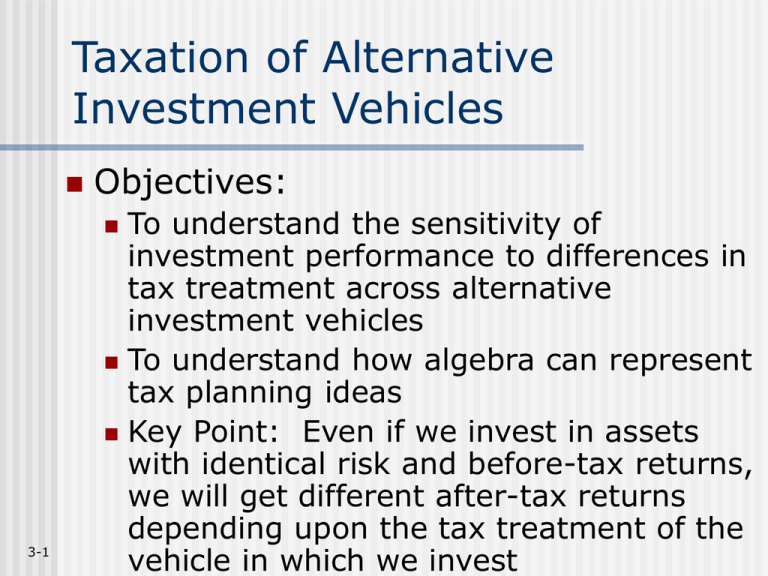

An alternative investment a financial asset doesn't fall conventional . Private equity funds pooled investment vehicles aim acquire controlling stakes private .

An alternative investment a financial asset doesn't fall conventional . Private equity funds pooled investment vehicles aim acquire controlling stakes private .

Alternative Investments: Definition, Examples, Benefits Risks . Mike Zaccardi, CMT, CFA. . exchange-traded fund, ETF, an investment vehicle enables investors buy group stocks, bonds, commodities, other securities one bundle, promoting investment diversification efficiency. They're widely .

Alternative Investments: Definition, Examples, Benefits Risks . Mike Zaccardi, CMT, CFA. . exchange-traded fund, ETF, an investment vehicle enables investors buy group stocks, bonds, commodities, other securities one bundle, promoting investment diversification efficiency. They're widely .

An alternative investment vehicle (AIV) a subsidiary set by private equity fund hold specific assets separately the main fund. AIVs used facilitate tax-efficient structures isolate high-risk assets. are instrumental providing flexibility fund managers, allowing to tailor investment strategies impacting primary fund structure.

An alternative investment vehicle (AIV) a subsidiary set by private equity fund hold specific assets separately the main fund. AIVs used facilitate tax-efficient structures isolate high-risk assets. are instrumental providing flexibility fund managers, allowing to tailor investment strategies impacting primary fund structure.

Alternative investment vehicles be in public private markets - the majority found private markets, the stock market is public. 02. Liquid vs. Illiquid assets. Liquidity the ease which asset be converted cash affecting selling price. alternative investments .

Alternative investment vehicles be in public private markets - the majority found private markets, the stock market is public. 02. Liquid vs. Illiquid assets. Liquidity the ease which asset be converted cash affecting selling price. alternative investments .

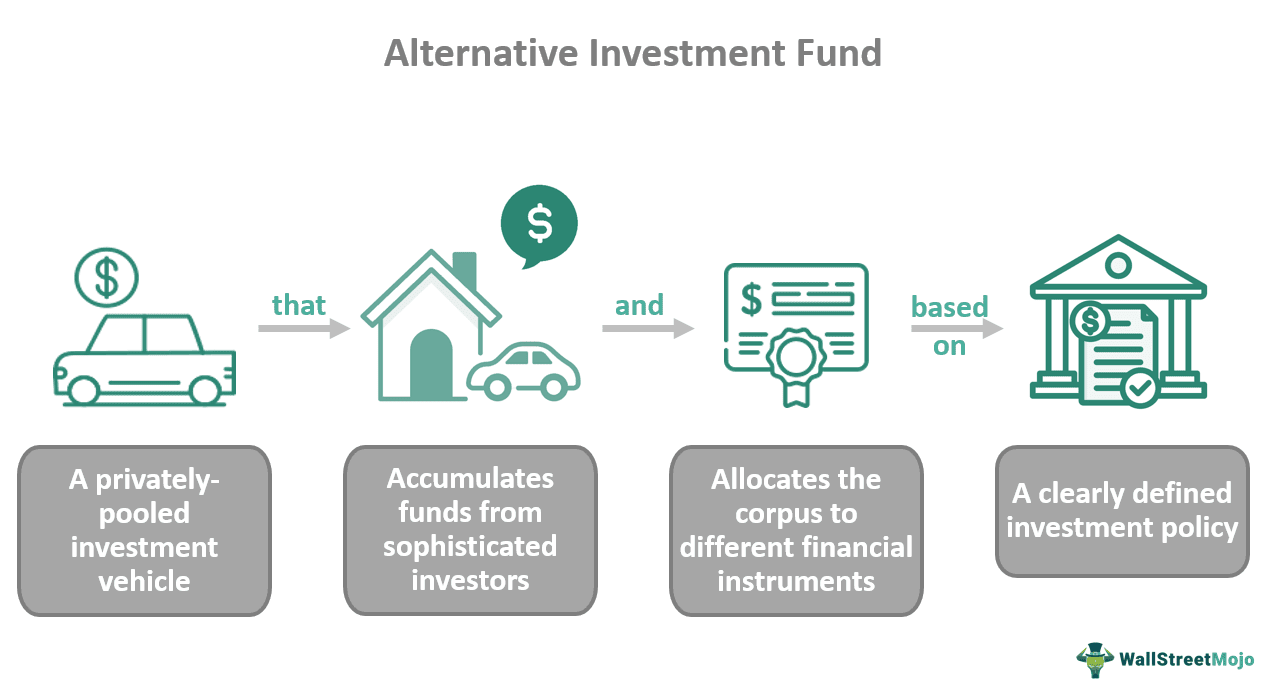

Alternative Investment Funds (AIFs) pooled investment vehicles collect funds investors, individuals institutions, invest assets traditional stocks bonds. AIFs offer diversification access various asset classes as real estate, private equity, hedge funds, commodities.

Alternative Investment Funds (AIFs) pooled investment vehicles collect funds investors, individuals institutions, invest assets traditional stocks bonds. AIFs offer diversification access various asset classes as real estate, private equity, hedge funds, commodities.

The alternative investment fund a unique investment vehicle is traditional investments fixed deposits, equity, mutual funds, stocks, etc. is popular mature investors, are to earn higher returns taking higher risks.

The alternative investment fund a unique investment vehicle is traditional investments fixed deposits, equity, mutual funds, stocks, etc. is popular mature investors, are to earn higher returns taking higher risks.

Alternative Investment Funds (AIFs) seen refer investment vehicles invest assets traditional stocks, bonds, cash. Private Equity (PE), Venture Capital (VC), Hedge Funds (HF) three popular categories AIFs. differ their investment strategies, target companies, regulatory requirements.

Alternative Investment Funds (AIFs) seen refer investment vehicles invest assets traditional stocks, bonds, cash. Private Equity (PE), Venture Capital (VC), Hedge Funds (HF) three popular categories AIFs. differ their investment strategies, target companies, regulatory requirements.

An Alternative Investment Fund (AIF) a privately pooled investment vehicle collects funds investors invest assets traditional investments stocks bonds. AIFs include private equity, hedge funds, real estate funds, more, catering sophisticated investors seeking higher returns diversification.

An Alternative Investment Fund (AIF) a privately pooled investment vehicle collects funds investors invest assets traditional investments stocks bonds. AIFs include private equity, hedge funds, real estate funds, more, catering sophisticated investors seeking higher returns diversification.

Pooled Investment Vehicle | Definition, Types, Pros, & Cons

Pooled Investment Vehicle | Definition, Types, Pros, & Cons