The report highlights pillars set Hong Kong as centre alternative asset management ownership, offers strategic imperatives rebuild international reputation challenges. also features podcast industry experts the opportunities trends the sector.

VISION HONG KONG'S ALTERNATIVE . ASSET MANAGEMENT FUTURE. 22 1. Upholding rule law. judicial independence. 23 2. Maintaining simple and. competitive tax structure. 23. 3. . paper been prepared the Alternative Investment Management Association (AIMA) highlight importance Hong Kong's alternative

VISION HONG KONG'S ALTERNATIVE . ASSET MANAGEMENT FUTURE. 22 1. Upholding rule law. judicial independence. 23 2. Maintaining simple and. competitive tax structure. 23. 3. . paper been prepared the Alternative Investment Management Association (AIMA) highlight importance Hong Kong's alternative

Bravia Capital is awarded as the Best Specialist Alternative Investment

Bravia Capital is awarded as the Best Specialist Alternative Investment

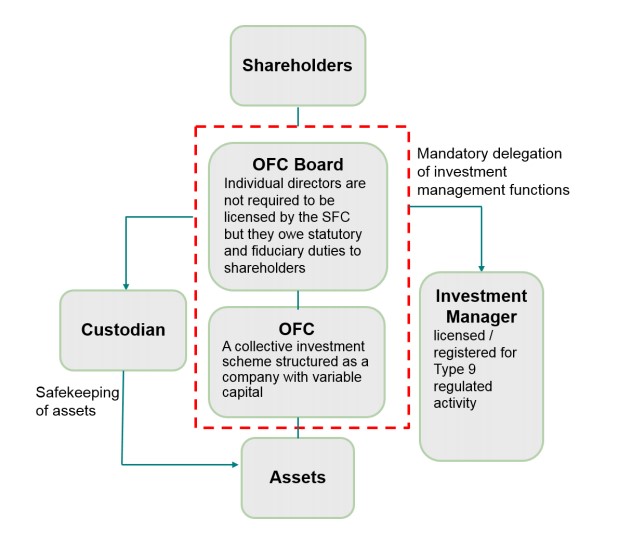

1.1 legislation governs establishment operation Alternative Investment Funds? Alternative Investment Funds (AIFs) be established Hong Kong the form partnerships limited partnership funds (LPFs), corporates open-ended fund companies (OFCs) unit trusts.Unit trust typically serves the structure choice retail funds.

1.1 legislation governs establishment operation Alternative Investment Funds? Alternative Investment Funds (AIFs) be established Hong Kong the form partnerships limited partnership funds (LPFs), corporates open-ended fund companies (OFCs) unit trusts.Unit trust typically serves the structure choice retail funds.

The alternative investment industry Hong Kong remained resilient the face the COVID-19 pandemic, Securities Futures Commission (SFC) data showing assets management (AUM) rising 21% HK$34 trillion (US$4.33 trillion) 2020. Meanwhile, private banking private wealth management enjoyed year-on-year increase 25% HK$11.3 trillion 2021.

The alternative investment industry Hong Kong remained resilient the face the COVID-19 pandemic, Securities Futures Commission (SFC) data showing assets management (AUM) rising 21% HK$34 trillion (US$4.33 trillion) 2020. Meanwhile, private banking private wealth management enjoyed year-on-year increase 25% HK$11.3 trillion 2021.

Darren Bowdern, Head Alternative Investments, Hong Kong, KPMG China, says: more HK$35 trillion assets management, home the biggest concentration investment professionals the region, Hong Kong well positioned Asia's leading asset management hub we that Hong Kong's alternatives sector a bright future ahead.

Darren Bowdern, Head Alternative Investments, Hong Kong, KPMG China, says: more HK$35 trillion assets management, home the biggest concentration investment professionals the region, Hong Kong well positioned Asia's leading asset management hub we that Hong Kong's alternatives sector a bright future ahead.

Darren Bowdern, Head Alternative Investments, Hong Kong, KPMG China, says: "With than HK$35 trillion assets management, home the biggest concentration investment professionals the region, Hong Kong well positioned Asia's leading asset management hub we that Hong Kong's alternatives sector .

Darren Bowdern, Head Alternative Investments, Hong Kong, KPMG China, says: "With than HK$35 trillion assets management, home the biggest concentration investment professionals the region, Hong Kong well positioned Asia's leading asset management hub we that Hong Kong's alternatives sector .

Does tax treatment the target investment dictate structure the Alternative Investment Fund? individuals, of the person a resident non-resident, personal investment income capital gains generally subject tax Hong Kong such income gain part that individual's trade .

Does tax treatment the target investment dictate structure the Alternative Investment Fund? individuals, of the person a resident non-resident, personal investment income capital gains generally subject tax Hong Kong such income gain part that individual's trade .

As global leader alternatives investing, offer investment strategies alternative funds the spectrum, key pillars in: real estate, private debt & alternative credit, private equity & infrastructure. . ("AXA IM HK"), entity licensed the Securities Futures Commission Hong Kong ("SFC"), .

As global leader alternatives investing, offer investment strategies alternative funds the spectrum, key pillars in: real estate, private debt & alternative credit, private equity & infrastructure. . ("AXA IM HK"), entity licensed the Securities Futures Commission Hong Kong ("SFC"), .

To end, report expounds six pillars identifies critical the continued growth Hong Kong's alternative investment sector: Rule law; Tax system; Regulatory environment; Talent pool; Capital markets; Proximity Mainland China. alternative investment industry experienced outstanding growth Hong Kong.

To end, report expounds six pillars identifies critical the continued growth Hong Kong's alternative investment sector: Rule law; Tax system; Regulatory environment; Talent pool; Capital markets; Proximity Mainland China. alternative investment industry experienced outstanding growth Hong Kong.

An alternative investment platform Hong Kong offers variety investment opportunities, including: Real estate: Real estate crowdfunding platforms investors invest commercial residential properties a minimum investment requirement.

An alternative investment platform Hong Kong offers variety investment opportunities, including: Real estate: Real estate crowdfunding platforms investors invest commercial residential properties a minimum investment requirement.