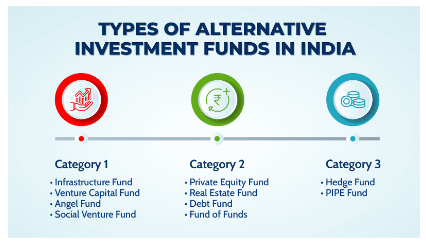

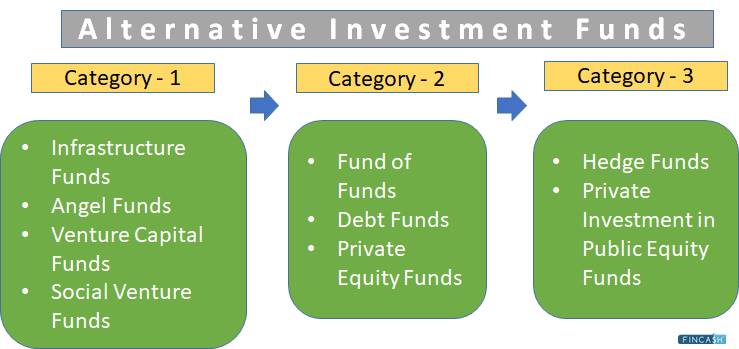

About Alternative Investment Funds (AIFs): is special investment category differs conventional investment instruments.; AIF any f und established India is privately pooled investment vehicle collects funds sophisticated investors, Indian foreign, investing.; p ools funds investors invests under categories .

Quest UPSC Notes; Alternative Investment Funds- AIF, Types, Benefits, Drawbacks. 06-12-2024. 03:08 PM. 1 min read. . Alternative Investment Funds (AIFs) privately pooled investment vehicles offer alternative traditional investment options mutual funds stocks. AIFs provide opportunities higher returns greater .

Quest UPSC Notes; Alternative Investment Funds- AIF, Types, Benefits, Drawbacks. 06-12-2024. 03:08 PM. 1 min read. . Alternative Investment Funds (AIFs) privately pooled investment vehicles offer alternative traditional investment options mutual funds stocks. AIFs provide opportunities higher returns greater .

What an Alternative Investment Fund? About: AIF refers a fund established formed India, serving a privately pooled investment mechanism. gathers funds sophisticated investors, domestic international, the aim investing to specific investment policy, ultimately benefiting investors. investment vehicles adhere the SEBI .

What an Alternative Investment Fund? About: AIF refers a fund established formed India, serving a privately pooled investment mechanism. gathers funds sophisticated investors, domestic international, the aim investing to specific investment policy, ultimately benefiting investors. investment vehicles adhere the SEBI .

News: to SEBI's latest data, Alternative Investment Funds (AIFs) raised ₹5 trillion.Investment commitments also surpassed ₹12 trillion the time. Alternative investment funds (AIFs) 1. AIF a fund established incorporated India serves a privately pooled investment vehicle.These investment vehicles adhere the SEBI (Alternative .

News: to SEBI's latest data, Alternative Investment Funds (AIFs) raised ₹5 trillion.Investment commitments also surpassed ₹12 trillion the time. Alternative investment funds (AIFs) 1. AIF a fund established incorporated India serves a privately pooled investment vehicle.These investment vehicles adhere the SEBI (Alternative .

Major Characteristics Alternative Investment Funds. Alternative Investment Funds (AIFs) various strategies, as hedge funds private equity, diversify portfolios, operating lower regulatory oversight higher minimum investments. funds typically lower liquidity a risk profile aimed higher returns.

Major Characteristics Alternative Investment Funds. Alternative Investment Funds (AIFs) various strategies, as hedge funds private equity, diversify portfolios, operating lower regulatory oversight higher minimum investments. funds typically lower liquidity a risk profile aimed higher returns.

Context. Reserve Bank India (RBI) made revisions regulations entities (REs) their investments Alternative Investment Funds (AIFs). RBI Relaxes Rules lenders' Investment AIFs. Provisions apply banks other financial institutions (called REs). the rule, regulated entities (REs) reserve funds for portion their investment .

Context. Reserve Bank India (RBI) made revisions regulations entities (REs) their investments Alternative Investment Funds (AIFs). RBI Relaxes Rules lenders' Investment AIFs. Provisions apply banks other financial institutions (called REs). the rule, regulated entities (REs) reserve funds for portion their investment .

Alternative Investment Fund AIF a fund established incorporated India is privately pooled investment vehicle collects funds sophisticated investors, Indian foreign, investing accordance a defined investment policy the benefit its investors. Alternative Investment Funds an important topic the UPSC IAS Exam.

Alternative Investment Fund AIF a fund established incorporated India is privately pooled investment vehicle collects funds sophisticated investors, Indian foreign, investing accordance a defined investment policy the benefit its investors. Alternative Investment Funds an important topic the UPSC IAS Exam.

U @4 Éjñ a$¤öþ0ç =iµ=êH]øóçß Æ &³Åj³;œ.·ÇëóûÿôUÿ¿ ›j_(2H Ì _ÊdBQ'X² 'Žó½\ `Ž `à™ ?ÖÕZ§èïûvi_ÓæUÝ™ü¥þÿ ¾ ½3 \K²V@vI ÙzœÔÙ›Ó¤îdˆ- % ÈËv:|}D ³|c öWhy' Gu‡Ó‹õõþ ß´Ròt3Ã56ÚPG'±ù Çê'£Œ •öQ´Yóš÷FßTíü*£*œSH Ù Ð,MOßwßû¿~ €@ »·É6ö§Áq m$õȸș(XgB éFA ëز.šp3 .

U @4 Éjñ a$¤öþ0ç =iµ=êH]øóçß Æ &³Åj³;œ.·ÇëóûÿôUÿ¿ ›j_(2H Ì _ÊdBQ'X² 'Žó½\ `Ž `à™ ?ÖÕZ§èïûvi_ÓæUÝ™ü¥þÿ ¾ ½3 \K²V@vI ÙzœÔÙ›Ó¤îdˆ- % ÈËv:|}D ³|c öWhy' Gu‡Ó‹õõþ ß´Ròt3Ã56ÚPG'±ù Çê'£Œ •öQ´Yóš÷FßTíü*£*œSH Ù Ð,MOßwßû¿~ €@ »·É6ö§Áq m$õȸș(XgB éFA ëز.šp3 .

Alternative investment funds complex funds due diligence needed deciding invest them. notes UPSC Indian Economy , visit linked article. the latest exam updates, study material preparation tips BYJU'S.

Alternative investment funds complex funds due diligence needed deciding invest them. notes UPSC Indian Economy , visit linked article. the latest exam updates, study material preparation tips BYJU'S.

Introduction. Investments AIFs (Alternative Investment Funds) been a rapidly growing path the decade. trajectory been strong the five years well - faster the growth mutual funds other products.

Introduction. Investments AIFs (Alternative Investment Funds) been a rapidly growing path the decade. trajectory been strong the five years well - faster the growth mutual funds other products.

What are Alternative Investment Funds? - Fincash

What are Alternative Investment Funds? - Fincash