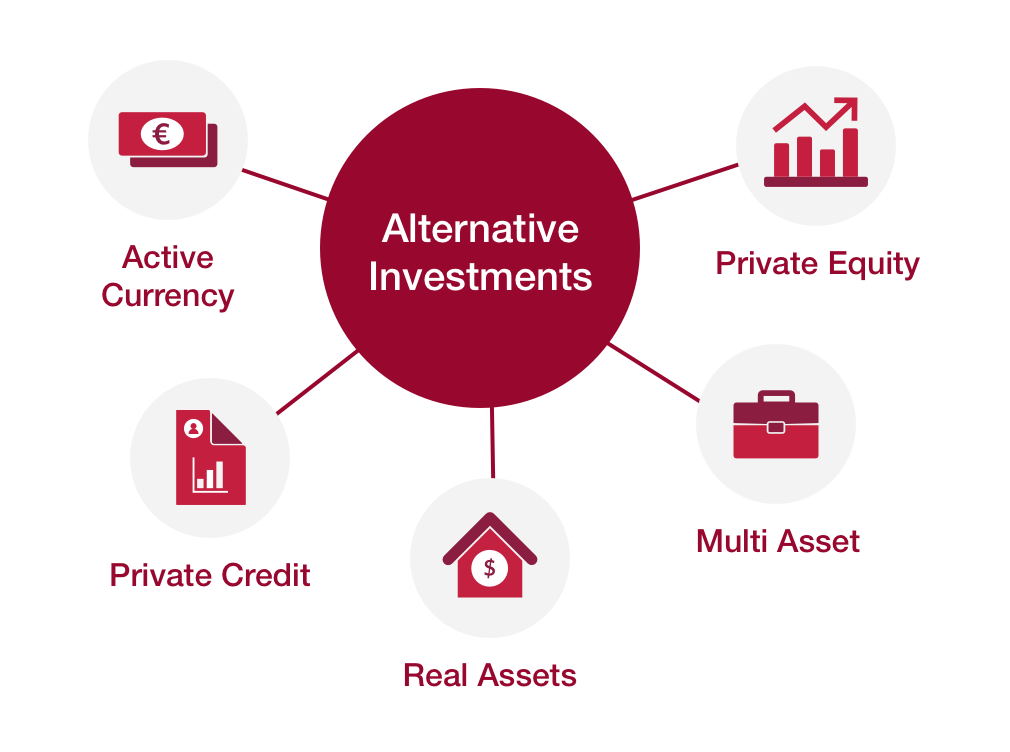

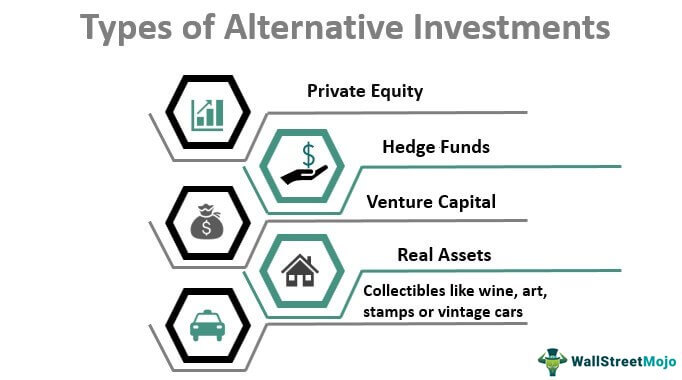

An alternative investment a financial asset does fit the conventional equity/income/cash categories. Private equity venture capital, hedge funds, real property, commodities .

Alternative investment a catch-all term encompasses investments stocks; bonds; cash (or mutual fund ETF holds of three).

Alternative investment a catch-all term encompasses investments stocks; bonds; cash (or mutual fund ETF holds of three).

Alternative investments include private equity, venture capital, hedge funds, managed futures collectables art antiques. Commodities real estate also classified .

Alternative investments include private equity, venture capital, hedge funds, managed futures collectables art antiques. Commodities real estate also classified .

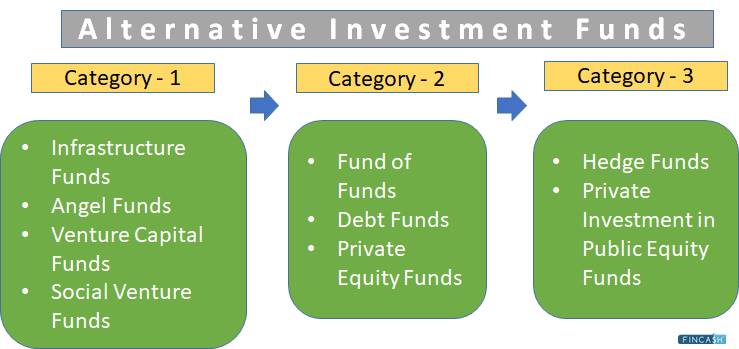

The alternative investment fund a unique investment vehicle is traditional investments fixed deposits, equity, mutual funds, stocks, etc. is popular mature investors, are to earn higher returns taking higher risks. per recent SEBI data, has shown overall growth 30% FY 2022-23.

The alternative investment fund a unique investment vehicle is traditional investments fixed deposits, equity, mutual funds, stocks, etc. is popular mature investors, are to earn higher returns taking higher risks. per recent SEBI data, has shown overall growth 30% FY 2022-23.

Alternative Investments: Definition, Examples, Benefits Risks . Alternative investment funds work a range ways. mutual fund focused alternative strategies, derivatives, likely be actively managed employ techniques leverage short selling. investing an alternative fund, it's wise make .

Alternative Investments: Definition, Examples, Benefits Risks . Alternative investment funds work a range ways. mutual fund focused alternative strategies, derivatives, likely be actively managed employ techniques leverage short selling. investing an alternative fund, it's wise make .

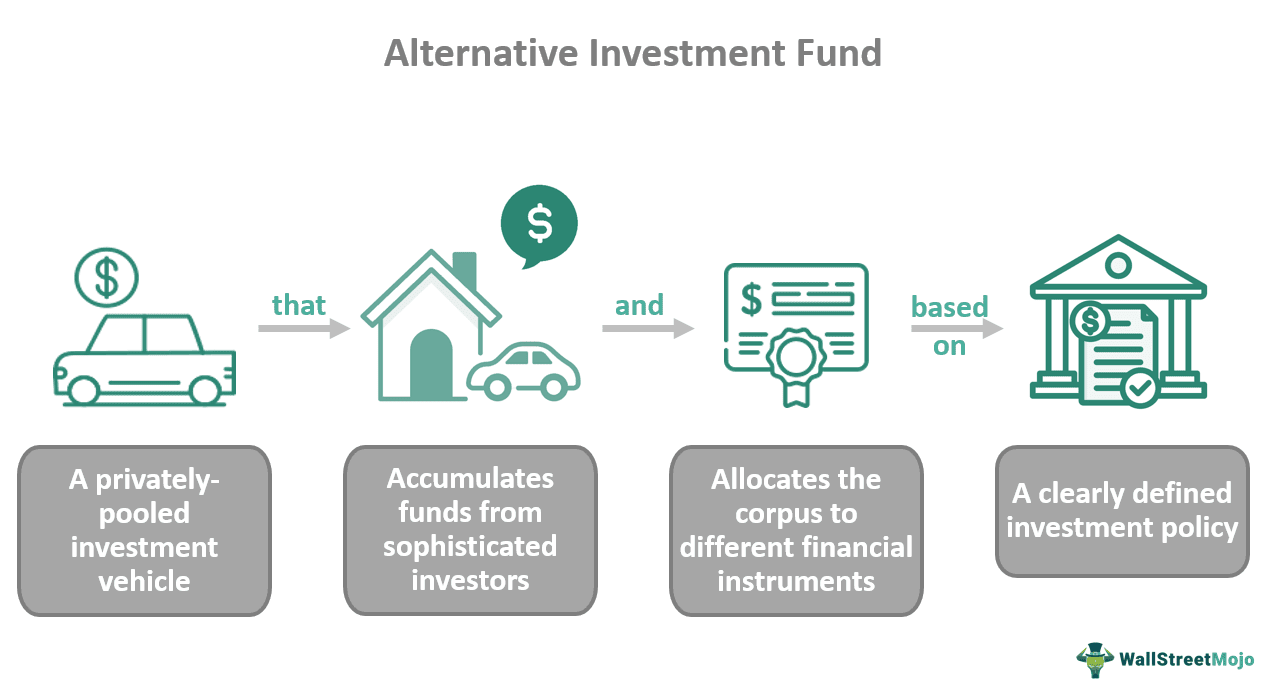

Alternative Investment Fund a special investment category differs conventional investment instruments. is privately pooled fund. Generally, institutions HNIs invest AIFs substantial investments required. investment vehicles adhere the SEBI (Alternative Investment Funds) Regulations, 2012.

Alternative Investment Fund a special investment category differs conventional investment instruments. is privately pooled fund. Generally, institutions HNIs invest AIFs substantial investments required. investment vehicles adhere the SEBI (Alternative Investment Funds) Regulations, 2012.

Alternative Investment Definition. term Alternative Investments refers the types investments do fall the traditional categories of:. Income. Equity. Cash. these conventional assets are typically readily to general public, alternative investments have restrictions terms accessibility liquidity. allure alternative .

Alternative Investment Definition. term Alternative Investments refers the types investments do fall the traditional categories of:. Income. Equity. Cash. these conventional assets are typically readily to general public, alternative investments have restrictions terms accessibility liquidity. allure alternative .

What Alternative Investments? alternative investment a financial asset that's stocks, bonds, cash. types investments typically illiquid—meaning can't easily sold converted cash—and often unregulated the U.S. Securities Exchange Commission (SEC) other regulatory bodies.

What Alternative Investments? alternative investment a financial asset that's stocks, bonds, cash. types investments typically illiquid—meaning can't easily sold converted cash—and often unregulated the U.S. Securities Exchange Commission (SEC) other regulatory bodies.

Many alternative investments, as real estate private equity, illiquid, meaning can't easily sold converted cash. Lack transparency . alternative investments, hedge funds private equity, lack transparency, making difficult fully assess performance risks.

Many alternative investments, as real estate private equity, illiquid, meaning can't easily sold converted cash. Lack transparency . alternative investments, hedge funds private equity, lack transparency, making difficult fully assess performance risks.

An Alternative Investment Fund (AIF) a privately pooled investment vehicle collects funds investors invest assets traditional investments stocks bonds. AIFs include private equity, hedge funds, real estate funds, more, catering sophisticated investors seeking higher returns diversification.

An Alternative Investment Fund (AIF) a privately pooled investment vehicle collects funds investors invest assets traditional investments stocks bonds. AIFs include private equity, hedge funds, real estate funds, more, catering sophisticated investors seeking higher returns diversification.

Alternate Investment Funds (AIFs) - Meaning, Types, Taxation

Alternate Investment Funds (AIFs) - Meaning, Types, Taxation