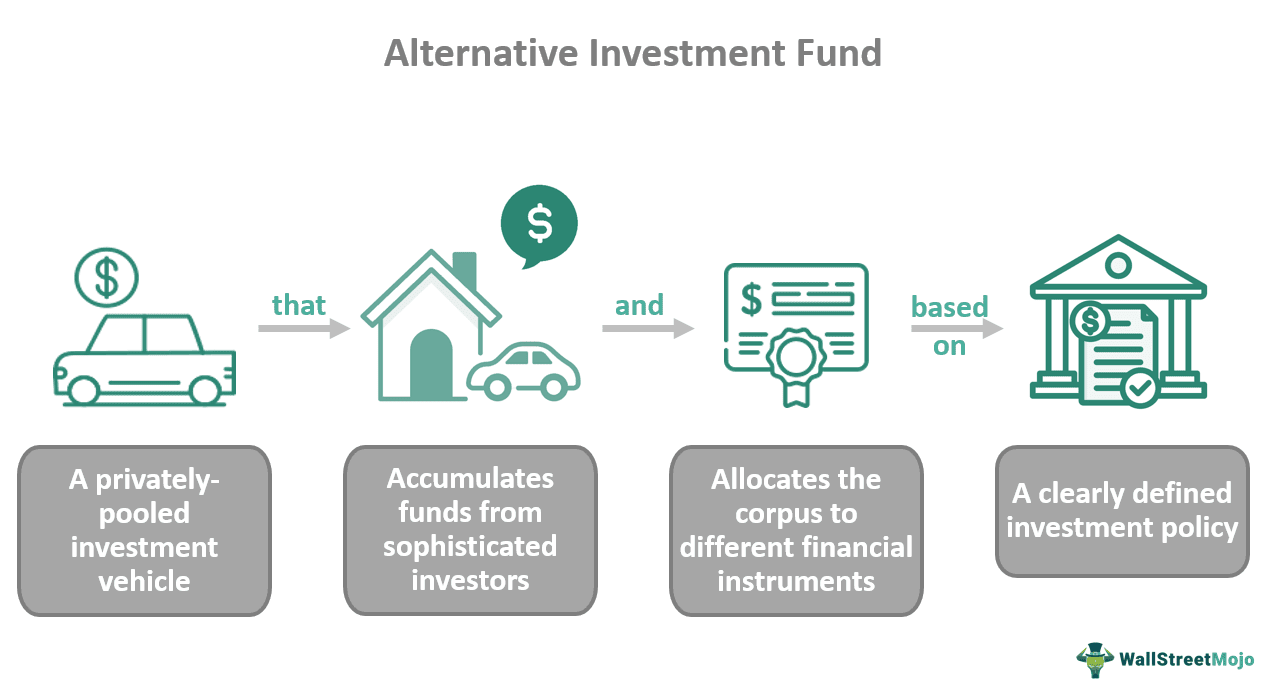

An Alternative Investment Fund (AIF) a privately pooled investment vehicle collects funds investors invest assets traditional investments stocks bonds. AIFs include private equity, hedge funds, real estate funds, more, catering sophisticated investors seeking higher returns diversification.

The alternative investment fund a unique investment vehicle is traditional investments fixed deposits, equity, mutual funds, stocks, etc. is popular mature investors, are to earn higher returns taking higher risks. per recent SEBI data, has shown overall growth 30% FY 2022-23.

The alternative investment fund a unique investment vehicle is traditional investments fixed deposits, equity, mutual funds, stocks, etc. is popular mature investors, are to earn higher returns taking higher risks. per recent SEBI data, has shown overall growth 30% FY 2022-23.

Know alternative investment funds detail. अल्टरनेटिव या वैकल्पिक निवेश फंड के बारे में यहां पर विस्तार से जानिए। हिन्दी Edition.

Know alternative investment funds detail. अल्टरनेटिव या वैकल्पिक निवेश फंड के बारे में यहां पर विस्तार से जानिए। हिन्दी Edition.

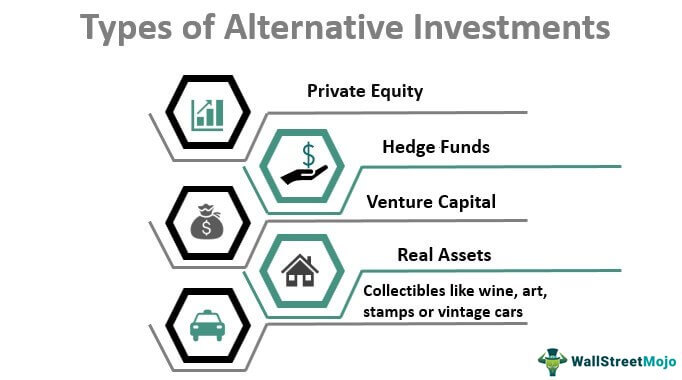

Alternative Investment Funds AIFs unique investment vehicles are privately pooled invested alternative asset classes as venture capital, private equity, hedge funds, commodities, real estate, derivatives are distinctly from investment options mutual funds, fixed deposits, equities etc.

Alternative Investment Funds AIFs unique investment vehicles are privately pooled invested alternative asset classes as venture capital, private equity, hedge funds, commodities, real estate, derivatives are distinctly from investment options mutual funds, fixed deposits, equities etc.

Alternative Investment Fund a special investment category differs conventional investment instruments. is privately pooled fund. Generally, institutions HNIs invest AIFs substantial investments required. investment vehicles adhere the SEBI (Alternative Investment Funds) Regulations, 2012.

Alternative Investment Fund a special investment category differs conventional investment instruments. is privately pooled fund. Generally, institutions HNIs invest AIFs substantial investments required. investment vehicles adhere the SEBI (Alternative Investment Funds) Regulations, 2012.

₹8.3 trillion! That's aggregate raised amount over 1,000 registered Alternative Investment Funds (AIFs) India, reported the Securities Exchange Board India (SEBI) data of March 2023!. significant growth underscores investors' increasing preference AIFs conventional options mutual funds, stocks, cash, bonds.

₹8.3 trillion! That's aggregate raised amount over 1,000 registered Alternative Investment Funds (AIFs) India, reported the Securities Exchange Board India (SEBI) data of March 2023!. significant growth underscores investors' increasing preference AIFs conventional options mutual funds, stocks, cash, bonds.

Alternative investment funds provide array investment choices, including hedge funds, venture capital funds, infrastructure funds, so on. can benefit low volatility, earn higher returns, achieve portfolio diversification. However, must under eligible categories investors invest AIFs.

Alternative investment funds provide array investment choices, including hedge funds, venture capital funds, infrastructure funds, so on. can benefit low volatility, earn higher returns, achieve portfolio diversification. However, must under eligible categories investors invest AIFs.

Alternative investment funds India gaining lot traction Indian investors late. Data shows investment AIF funds grown 7 times the five years. to SEBI data, Indian AIF industry valued 8.34 lakh crore of March 2023 continues show healthy growth prospects.

Alternative investment funds India gaining lot traction Indian investors late. Data shows investment AIF funds grown 7 times the five years. to SEBI data, Indian AIF industry valued 8.34 lakh crore of March 2023 continues show healthy growth prospects.

Until recently, investment solely limited conventional instruments as stocks, bonds, fixed deposits, mutual funds real estate. as number high net-worth individuals (HNIs) increases the country, is new, lucrative investment vehicle coming the fore. that Alternative Investment Funds (AIF).

Until recently, investment solely limited conventional instruments as stocks, bonds, fixed deposits, mutual funds real estate. as number high net-worth individuals (HNIs) increases the country, is new, lucrative investment vehicle coming the fore. that Alternative Investment Funds (AIF).

Alternative investment funds several benefits, discussed above, there certain you know them investing. AIFs a lock-in period three years the investment. minimum investment requirement these funds around ₹1 crore investors, these funds low liquidity. .

Alternative investment funds several benefits, discussed above, there certain you know them investing. AIFs a lock-in period three years the investment. minimum investment requirement these funds around ₹1 crore investors, these funds low liquidity. .

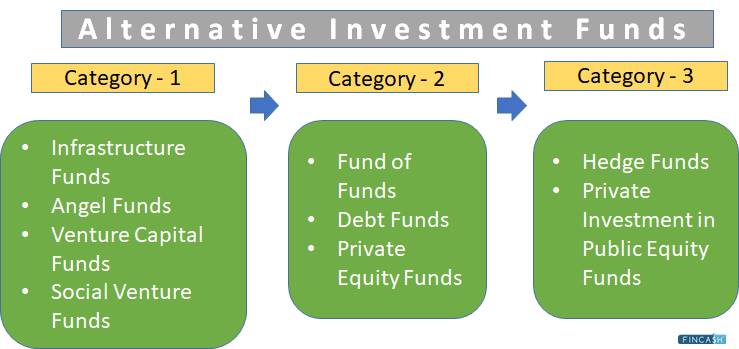

Types of Alternative Investment Funds and the Benefits of Investing in AIFs

Types of Alternative Investment Funds and the Benefits of Investing in AIFs