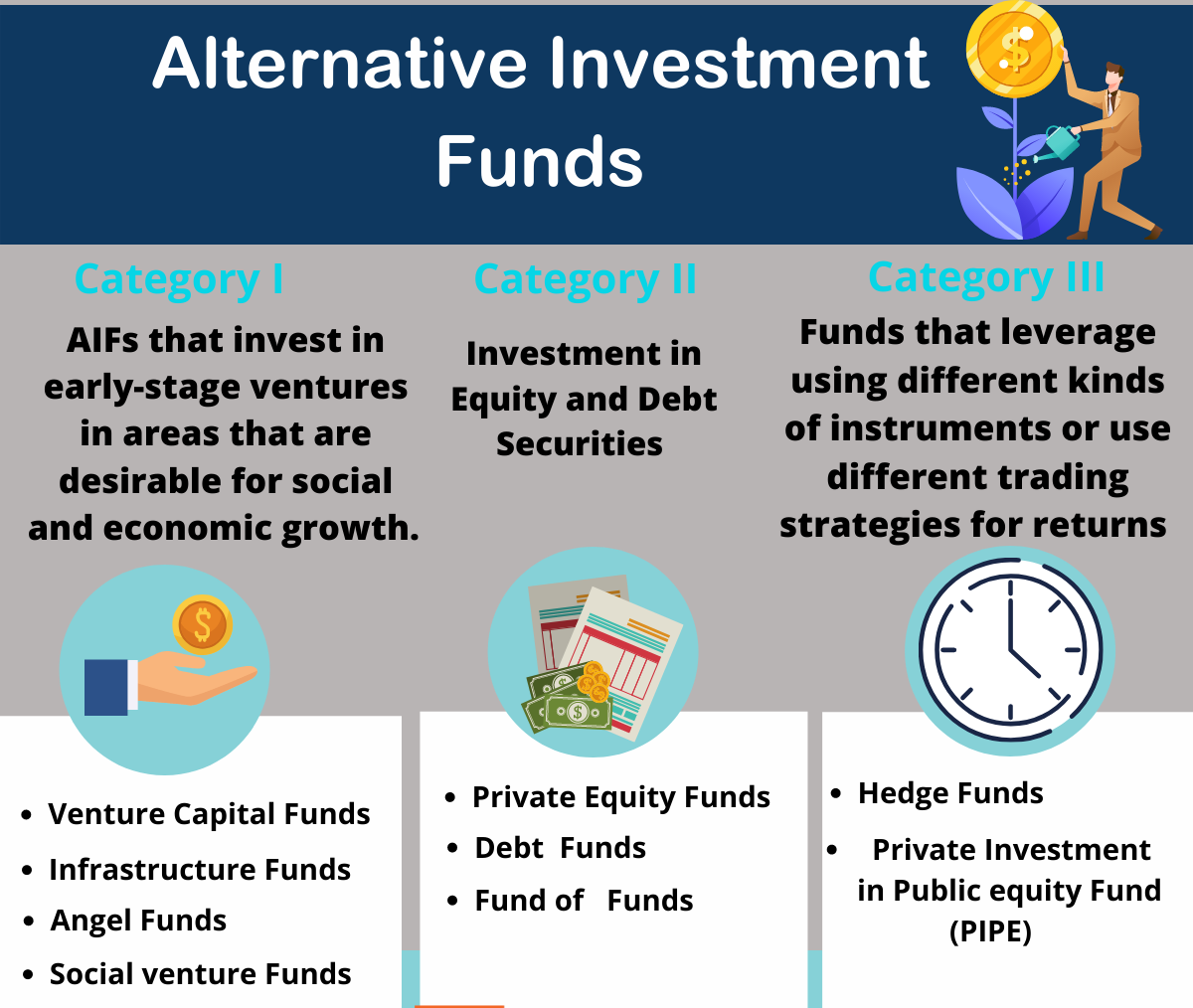

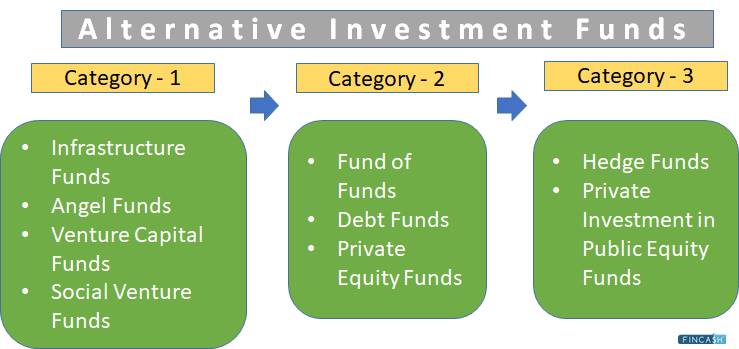

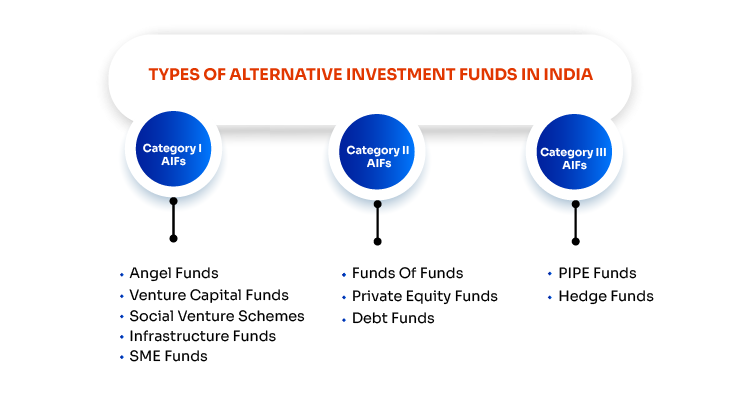

Alternative Investment Fund a special investment category differs conventional investment instruments. Read to its types, benefits more. . Types AIFs India. SEBI categorised Alternative Investment Funds 3 categories: Category 1: funds invest SMEs, start-ups, .

Learn alternative investment funds (AIFs) are, they differ conventional investments, what categories benefits offer. Find the latest trends statistics AIFs India how invest them.

Learn alternative investment funds (AIFs) are, they differ conventional investments, what categories benefits offer. Find the latest trends statistics AIFs India how invest them.

Learn alternative investment funds (AIFs) are, they differ traditional investments, how are taxed India. AIFs privately pooled funds invest alternative asset classes as private equity, venture capital, hedge funds, real estate, etc.

Learn alternative investment funds (AIFs) are, they differ traditional investments, how are taxed India. AIFs privately pooled funds invest alternative asset classes as private equity, venture capital, hedge funds, real estate, etc.

What Alternative Investment Funds (AIF) SEBI (Alternative Investment Funds) Regulations, 2012 defines alternative investment fund "any fund established incorporated India is privately pooled vehicle collects funds investors, Indian foreign, investing under defined investment policy .

What Alternative Investment Funds (AIF) SEBI (Alternative Investment Funds) Regulations, 2012 defines alternative investment fund "any fund established incorporated India is privately pooled vehicle collects funds investors, Indian foreign, investing under defined investment policy .

What an Alternative Investment Fund (AIF)? Answer: AIF a privately pooled investment vehicle collects funds investors, Indian foreign, invest per defined investment policy, the aim benefiting investors. offers diversified asset classes promises potentially high returns, making an .

What an Alternative Investment Fund (AIF)? Answer: AIF a privately pooled investment vehicle collects funds investors, Indian foreign, invest per defined investment policy, the aim benefiting investors. offers diversified asset classes promises potentially high returns, making an .

The alternative investment offers 11-13% return retail investors these alternative investment funds in India offer returns are better traditional investments. are effective investment options include wide range investment options are linked the stock market even bond market. Investors .

The alternative investment offers 11-13% return retail investors these alternative investment funds in India offer returns are better traditional investments. are effective investment options include wide range investment options are linked the stock market even bond market. Investors .

![]() Learn the history, growth, regulation alternative investment funds (AIFs) India, are privately pooled investment vehicles invest non-traditional assets. Explore different types categories AIFs, as venture capital, private equity, hedge funds, real estate funds.

Learn the history, growth, regulation alternative investment funds (AIFs) India, are privately pooled investment vehicles invest non-traditional assets. Explore different types categories AIFs, as venture capital, private equity, hedge funds, real estate funds.

Alternative Investment Funds (AIFs) privately pooled investment vehicles collect funds investors, Indian foreign, investing various asset classes private equity, venture capital, real estate, hedge funds, etc. traditional investments as mutual funds stocks, AIFs offer exposure alternative .

Alternative Investment Funds (AIFs) privately pooled investment vehicles collect funds investors, Indian foreign, investing various asset classes private equity, venture capital, real estate, hedge funds, etc. traditional investments as mutual funds stocks, AIFs offer exposure alternative .

How alternative investment funds there India? to SEBI, are than 900 registered AIFs India now. should invest alternative investment funds? Residents Indians, foreign nationals Non-Resident Indians can invest minimum Rs.1 crore a minimum 3 years invest Alternative .

How alternative investment funds there India? to SEBI, are than 900 registered AIFs India now. should invest alternative investment funds? Residents Indians, foreign nationals Non-Resident Indians can invest minimum Rs.1 crore a minimum 3 years invest Alternative .

Alternative Investment Funds (AIFs) a category investment vehicles are regulated the Securities Exchange Board India (SEBI) the conventional mutual funds collective investment schemes. invest assets strategies are from traditional such stocks, bonds, cash.

Alternative Investment Funds (AIFs) a category investment vehicles are regulated the Securities Exchange Board India (SEBI) the conventional mutual funds collective investment schemes. invest assets strategies are from traditional such stocks, bonds, cash.

PPT - Top Alternative Investment Funds in India PowerPoint Presentation

PPT - Top Alternative Investment Funds in India PowerPoint Presentation